Analysts expect Amazon to continue its solid performance backed by strong fundamentals and industry trends. The company has been outperforming its peers in the retail sector and is seeing revenue growth and margin expansion.

The Amazon Web Services (AWS) division, which is more profitable than the company’s retail business, is a strong contributor to top-line growth and margin expansion. Amazon’s margins are also seeing a boost from its advertising operations, which is a new source of revenue and a high-margin business.

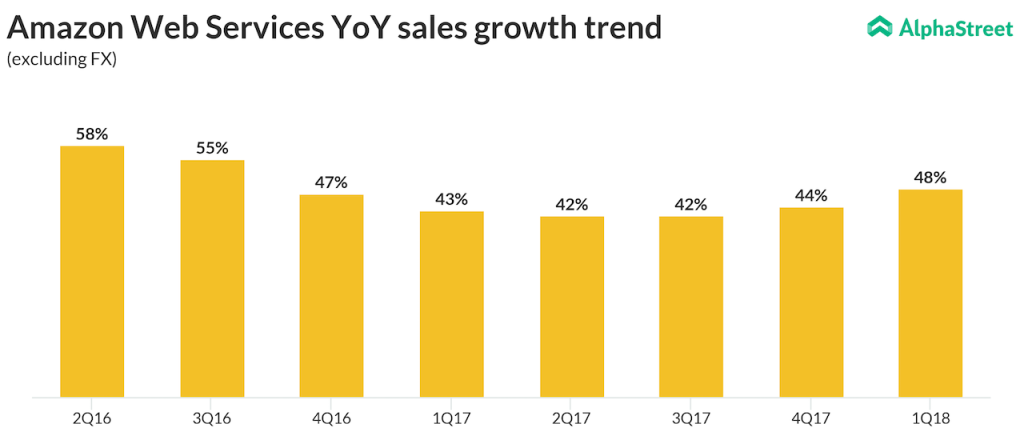

Last quarter, AWS posted a year-over-year sales growth of 49%. Several leading companies including Verizon, Oath and Ryanair have selected AWS as their cloud provider. Last week, AWS was chosen to provide the vast majority of cloud infrastructure for 21st Century Fox (FOX). Amazon enjoys a leading position in the cloud services space and increasing the number of its data centers worldwide will help its expansion in the global cloud market.

However, over the past few quarters, AWS has not been able to increase its market share compared to Alphabet’s (GOOGL) Google Cloud and Microsoft’s (MSFT) Azure. Despite this slowdown, continuous improvement in offerings and investments in infrastructure are helping AWS grow. For the second quarter, AWS is expected to post strong results helped by strategic partnerships and a strong customer base. Analysts estimate AWS revenues to be close to $6 billion for the recently ended quarter.

Analysts do not expect to see a huge increase in revenues for the second quarter as there was no boost from seasonal trends such as the back-to-school period or the holiday season. With Prime Day sales took place in July, the second quarter won’t see any benefits from that event either. However, it would be worthwhile to keep an eye on any updates about the company’s preparations for its peak sales periods during the second half of the year.

Amazon made its entry into the pharmacy business with the acquisition of PillPack last month. Any updates on this transaction will be something to watch out for in the earnings call.

Related: Analysis: The ripple effect of Amazon popping up PillPack

Despite its challenges, Amazon is expected to increase its share of ecommerce sales going forward and continue its solid performance for this quarter too. There is continued optimism in the market around this stock.

Amazon stock has climbed 55% so far this year with a 6% increase over the past one month alone. After Prime Day, the stock price reached an all-time high of $1860, briefly giving the company a market value of over $900 billion, and putting it just behind Apple (AAPL) in the trillion-dollar race.

Related: Move over, Apple! Amazon might be the first trillion-dollar company