Bullish View

The New York-headquartered credit card company’s second-quarter 2024 earnings report is expected to come on Friday, July 19, at 7:00 am ET. The consensus earnings estimate is $3.23 per share, which is sharply higher than the $2.89/share profit generated a year earlier. Analysts project revenues of $16.59 billion for the June quarter, up 10.2% year-over-year.

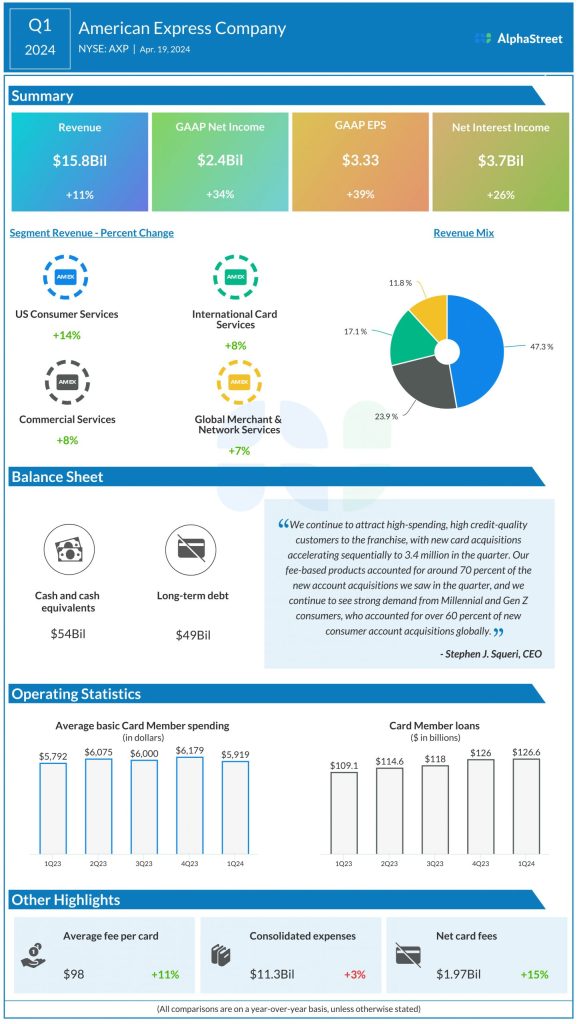

Of late, American Express has seen a steady uptick in customer engagement, reflecting continued investments in the brand, value propositions, marketing, and technology. Recent performance shows that the management’s focus on attracting millennials and Gen-Z customers — who account for about 60% of new consumer account acquisitions globally — is paying off. It is estimated that American Express has a better credit quality than other leading credit card companies and it keeps improving. Moreover, now its cards are more widely accepted than in the past.

“We continue to attract high spending, high credit quality customers to the franchise with new card acquisitions accelerating quarter over quarter, adding 3.4 million new cards in the quarter. Our fee-based products accounted for approximately 70% of the new account acquisitions globally and we continue to see strong demand from Millennial and Gen Z consumers, who accounted for over 60% of the new consumer account acquisitions globally. Finally, our credit metrics continue to be best-in-class,” Amex CEO Steve Squeri said in a recent statement.

Important Numbers

Anticipating the current momentum to extend into the latter half of the year, Amex executives predict a 9-11% growth in full-year revenues and forecast earnings in the range of $12.65 per share to 13.15 per share, which is in line with the guidance issued earlier. The conservative guidance reflects the continuing weakness in spending among small and midsize enterprise customers due to high interest rates.

For the first three months of fiscal 2024, the company reported an 11% year-over-year increase in revenues to $15.8 billion, driven mainly by higher net interest income and increased card member spending. Net income advanced to $2.4 billion or $3.33 per share in Q1 from $1.8 billion or $2.40 per share last year. Both numbers topped expectations, after missing in the preceding quarter. New card acquisitions accelerated sequentially to 3.4 million in the March quarter.

This year, AXP has mostly traded above its long-term average and maintains the momentum ahead of the earnings. On Monday, it opened around $240 and traded higher in the early hours.