“

Analog Devices, Inc. (NASDAQ: ADI) reported its financial results for the quarter ended May 2, 2020, on Wednesday before the market opens. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates. Analog Devices posted a 27% dip in earnings for the second quarter of 2020 due to lower revenue. The company […]

· May 20, 2020

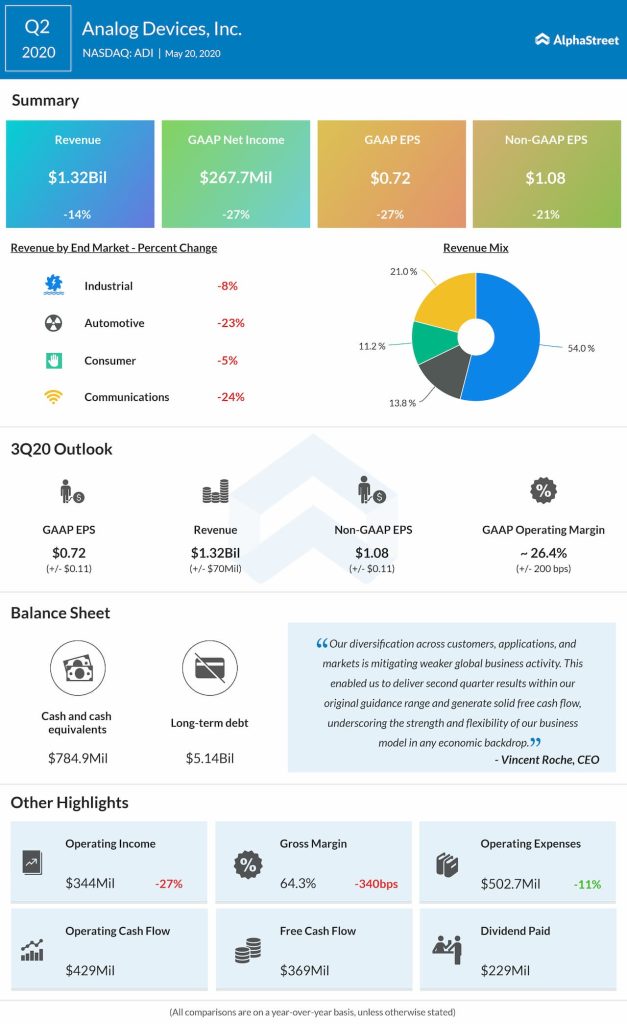

Analog Devices, Inc. (NASDAQ: ADI) reported its financial results for the quarter ended May 2, 2020, on Wednesday before the market opens. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates.

Analog Devices posted a 27% dip in earnings for the second quarter of 2020 due to lower revenue. The company has moved with speed and agility to pivot supply chain and meet customer demand, expediting production and shipments of essential products, including solutions used in medical equipment in the fight against COVID-19.