Three phases of Products business

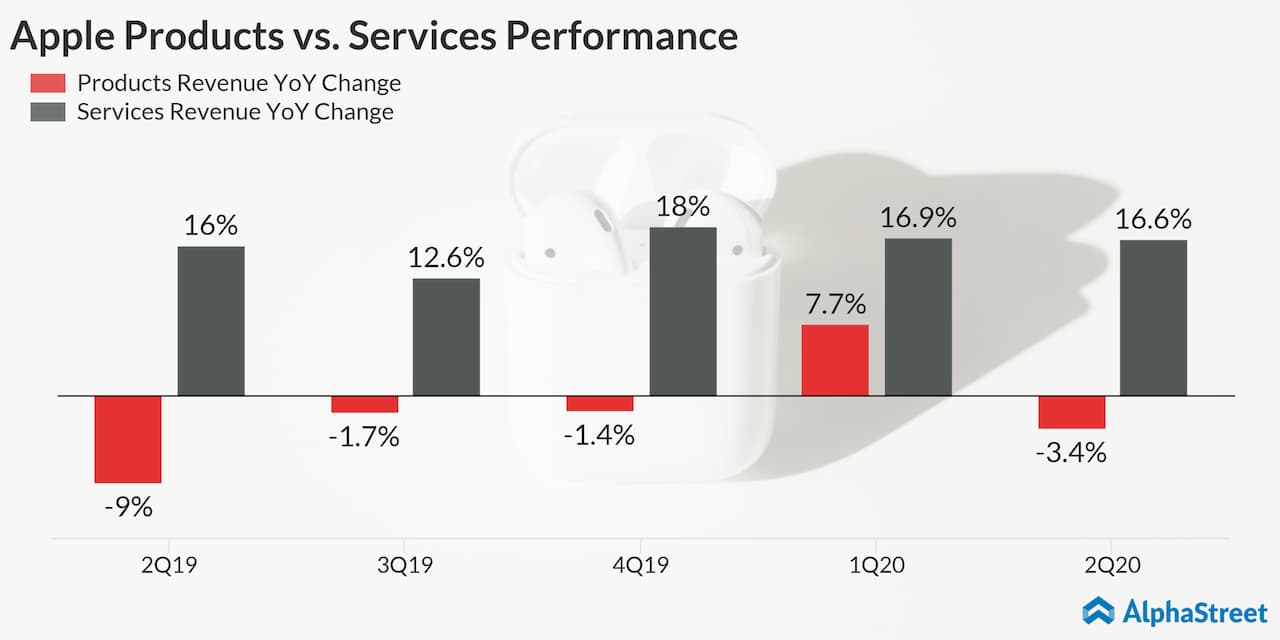

Apple said that based on the performance during the first five weeks of the quarter, the company believed that it was heading toward meeting the high end of second quarter expectations. In the next five weeks of the quarter, as COVID-19 started impacting China, the iPhone supply was temporarily affected, as well as demand for Apple products within China. This caused the company to withdrew its revenue guidance in February. At that point, demand for Apple’s products outside of China was still strong and was in line with the expectations. During the last three weeks of the quarter, as the virus spread globally and social distancing measures were put in place worldwide, including the closure of all Apple retail stores outside of Greater China on March 13 and many channel partner points of sales around the world, demand declined for iPhones and Wearables.

[irp posts=”59085″]

COVID-19 impact

During February 2020, following the initial outbreak of the virus in China, Apple experienced disruptions to its manufacturing, supply chain and logistical services provided by outsourcing partners, resulting in temporary iPhone supply shortages that affected sales worldwide. As Apple retail stores and channel partner points of sale were closed in China, sales got adversely affected in the region.

The virus spread further around the world as the quarter progressed, and social distancing measures and stay-at-home orders were introduced in many countries. Apple experienced a weakened demand for its products and services outside of China during the last three weeks of the March quarter. The COVID-19 pandemic has continued to adversely impact demand for certain Apple products and services through April 2020.

Some positives

The pandemic has resulted in the process of deploying major orders of iPads to school systems. Since early March, there was an increase in demand for its Pro Apps from students, enthusiasts and creative professionals. App Store revenue grew by strong double digits in the quarter, thanks to robust customer demand for in-app purchases and subscriptions. Apple Music and cloud services, both set all-time revenue records, and Apple Care set a March quarter record. Paid subscriptions for all three of these services were up in strong double digits. The number of paid accounts increased double digits in all of the geographic segments.

[irp posts=”59601″]

Apple has over 515 million paid subscriptions across the services on its platform. Apple targets to reach its increased target of 600 million paid subscriptions before the end of the calendar 2020. Wearables, Home and Accessories established a new March quarter record, with revenue of $6.3 billion, up 23% year-over-year, with strong double-digit performance across all five geographic segments. Wearables business is now the size of a Fortune 140 company. Apple Watch continues to extend its reach as over 75% of the customers purchasing Apple Watch around the world during the quarter, were new to the product.

Share buyback and M&A strategy

The company stated that the share repurchase authorization of $50 billion is in addition to over $40 billion that is still remaining from the past authorization. The total available or outstanding in terms of authorization is over $90 billion. When asked about the M&A opportunities CFO Luca Maestri said:

Nothing has changed on our approach for M&A. We’ve been quite active over the last several years. We purchase companies on a very regular basis. We’re always looking for ways to accelerate our product road maps or fill gaps in our portfolio, both on the hardware side, on the software side, on the Services side.

Outlook

Given the lack of visibility and certainty in the near term, the Cupertino-based firm didn’t issue guidance for the third quarter. However, the company stated that its Service business will have headwinds in the upcoming quarter. The closure of retail stores and partners’ point of sale, as well as the reduced level of customer traffic, are expected to affect Apple Care. The weakness in the economy and the uncertainty on when businesses are expected to impact advertising in the App Store and Apple News.

Read Apple Q2 2020 earnings call transcript

Apple stock, which reached its 52-week high ($327.85) at the end of January, dropped 1.61% on Friday.