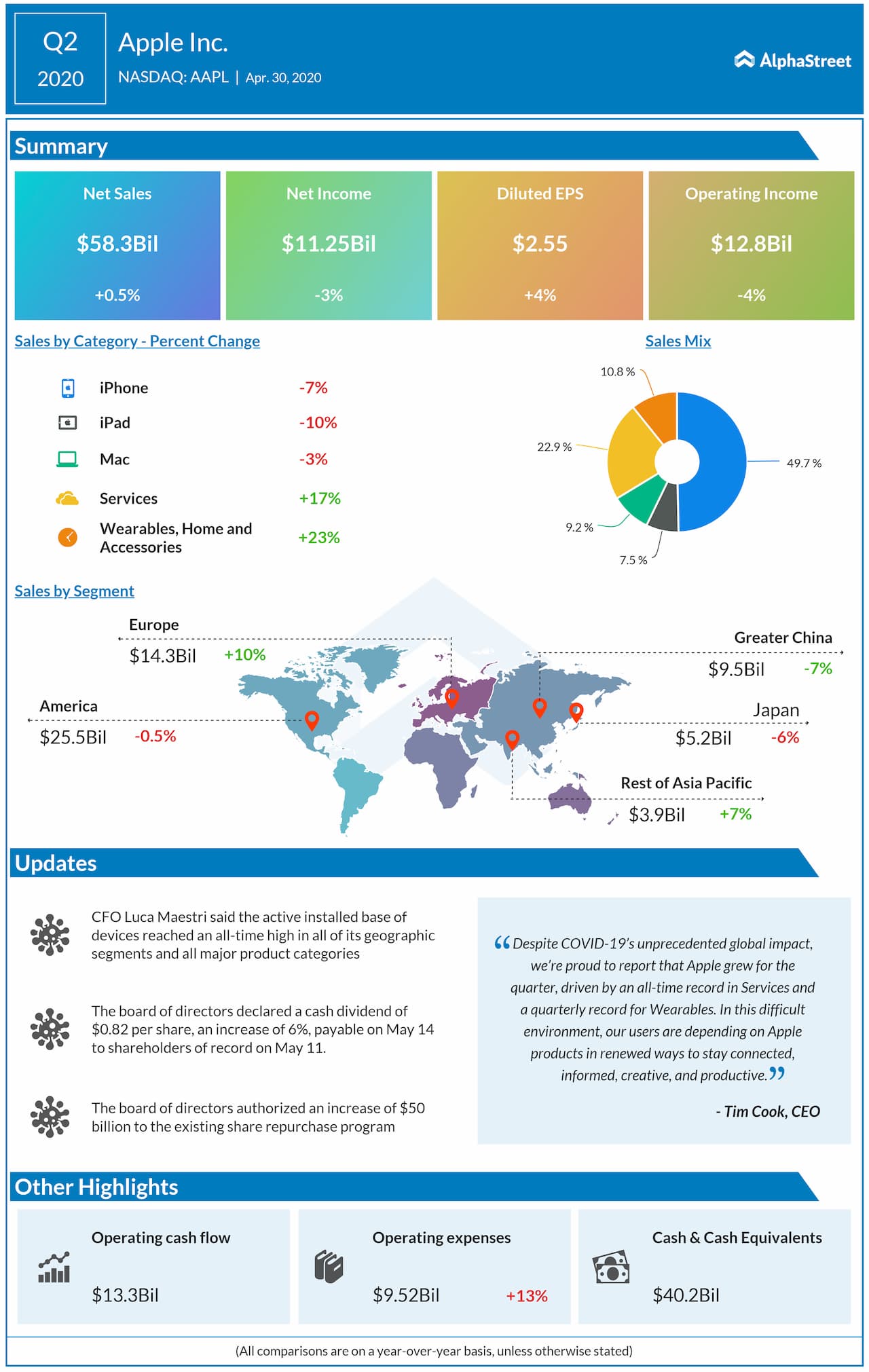

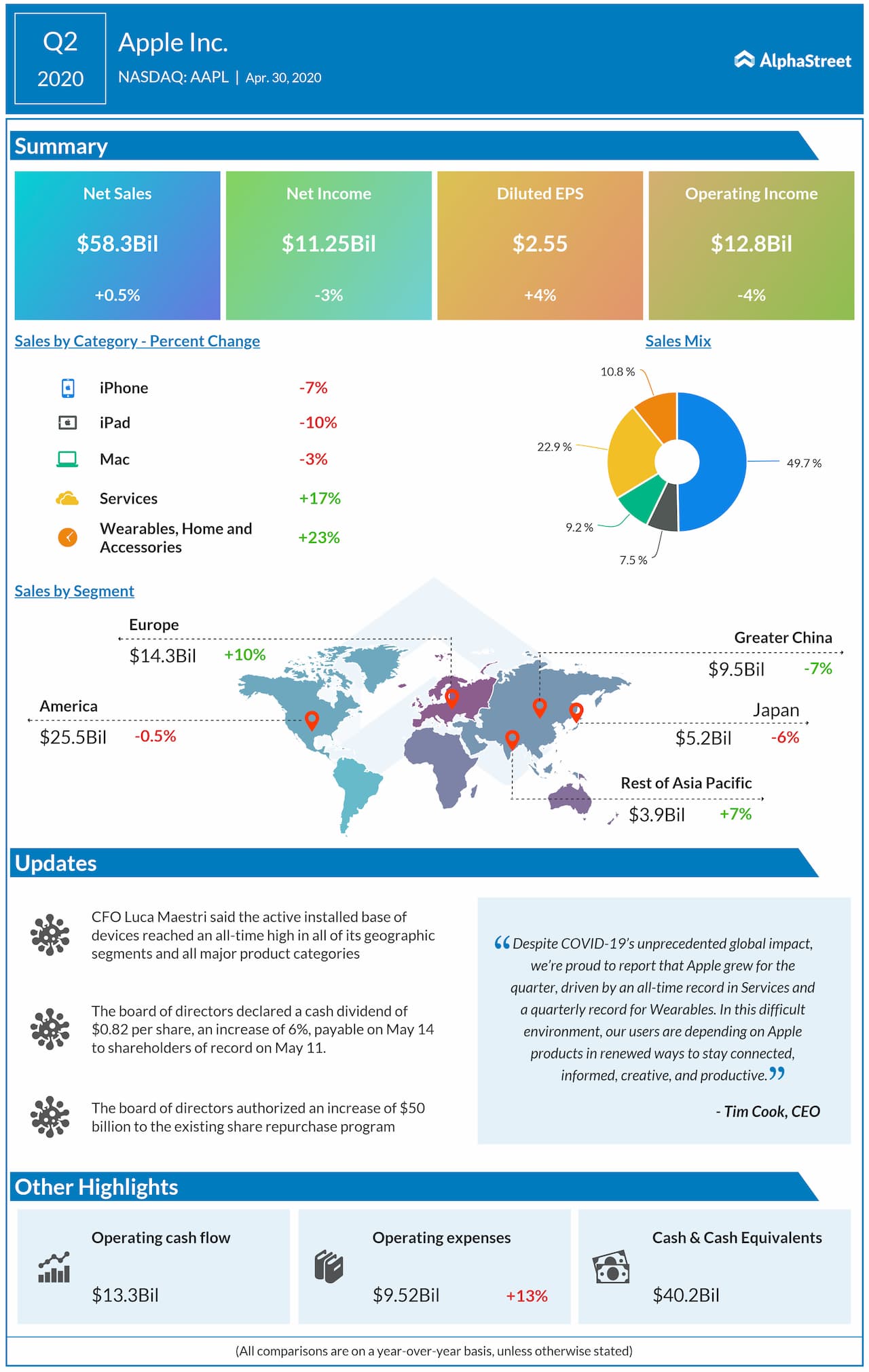

Apple Inc. (NASDAQ: AAPL) reported its financial results for the quarter ended March 31, 2020, on Thursday. Despite the COVID-19 pandemic’s unprecedented global impact, the results exceeded analysts’ expectations.

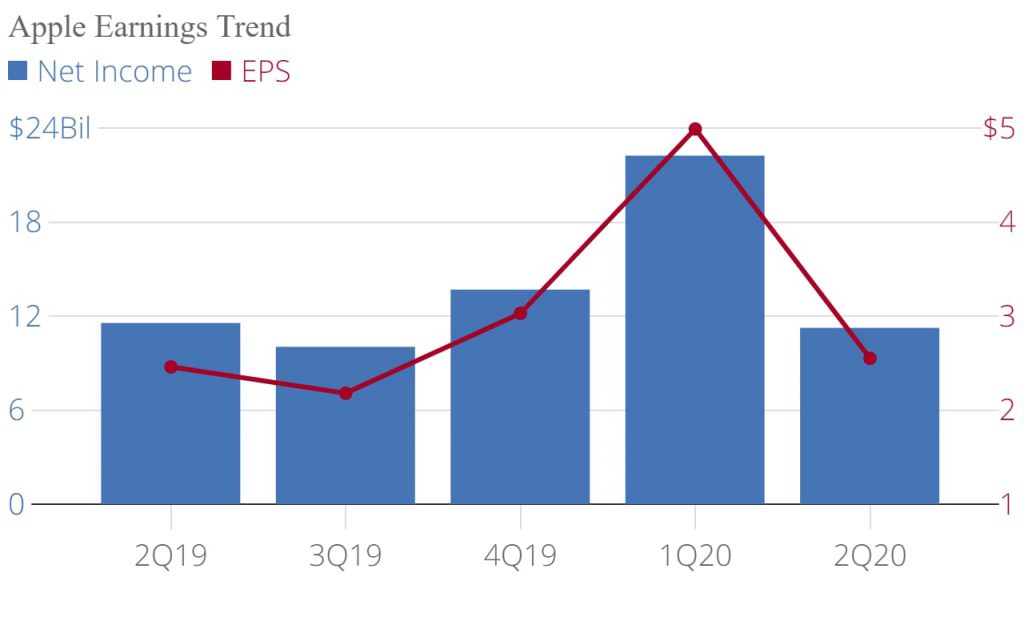

Apple posted a 3% decline in earnings for the second quarter of 2020 due to the impact of the COVID-19 pandemic. However, the top-line rose by 1%. International sales accounted for 62% of the quarter’s revenue.

Apple’s board of directors has declared a cash dividend of $0.82 per share of its common stock, an increase of 6%. The dividend is payable on May 14, 2020, to shareholders of record as of the close of business on May 11, 2020. The board has also authorized an increase of $50 billion to the existing share repurchase program.

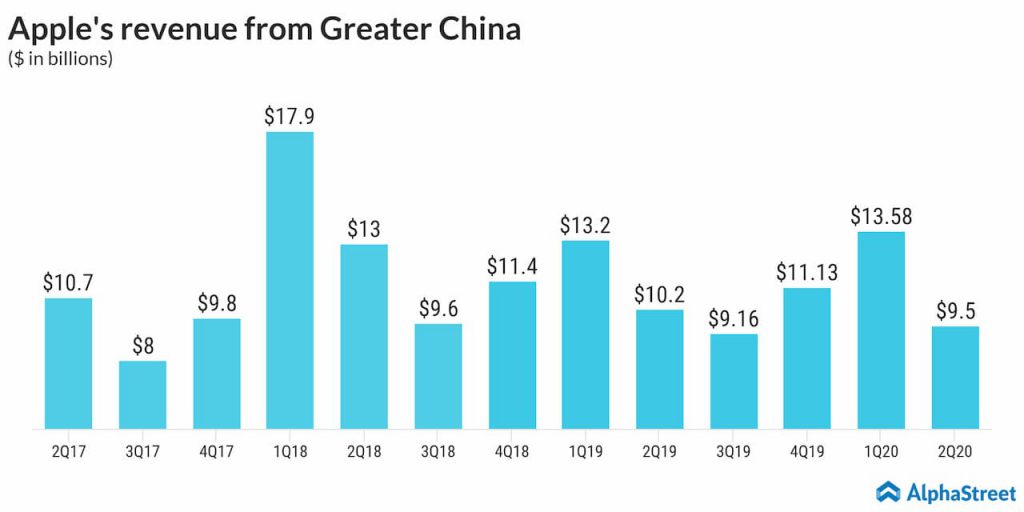

The company’s retail stores have been closed since early March outside of Greater China amidst the stores reopening in China.

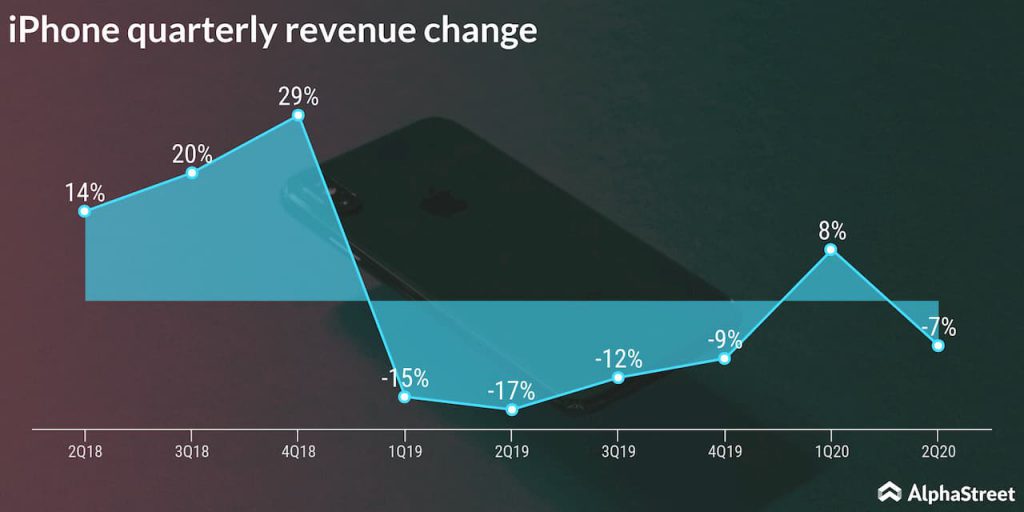

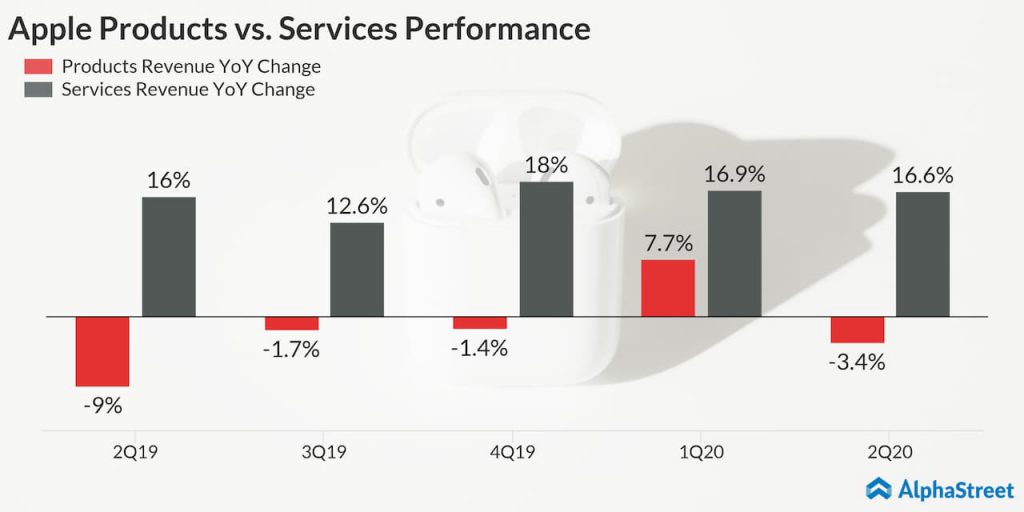

Apple’s products business is remaining under tremendous pressure in the past five quarters. Hardware sales were down across the board with the exception of wearables. However, the services business hits a record high during the second quarter.

Following the earnings release, the stock is down 1.55% in the after-hours trading. Investors were positive about the company’s future as Apple promises buyback and increased dividend.

Past Performance

Apple Q1 2020 Earnings Results

AAPL Q4 2019 Earnings Performance