Last year, the market saw some of leading telecommunications firms developing a penchant for launching their own streaming service. The new trend is part of the transformation the industry is undergoing, blurring the line between telecom and media business. The future of telecom companies might depend on their ability to double up as streaming platforms.

Among the top players, AT&T, Inc. (NYSE: T) achieved some key milestones in 5G deployment, expanding the service to more and more US cities last year. It is an area where the company has a clear edge over rivals, for being the first to launch the new-gen network. For AT&T’s stock, 2019 was a year of revival, when it regained strength ending the volatility that prevailed in the previous years. Its market value rose 27% in the past twelve months.

Stock Movement

An almost similar pattern is visible in the movement of the shares of Verizon Communications (NYSE: VZ). After maintaining a moderate uptrend throughout 2019, the stock dropped 5% this year. Last Month, it slipped to the lowest level in one-and-half years. Currently, the New York-based telecom firm is busy expanding market share for its 5G business. The majority of analysts following AT&T recommend buying the stock, while Verizon has a consensus hold rating.

Related: Verizon Q4 2019 Earnings Conference Call Transcript

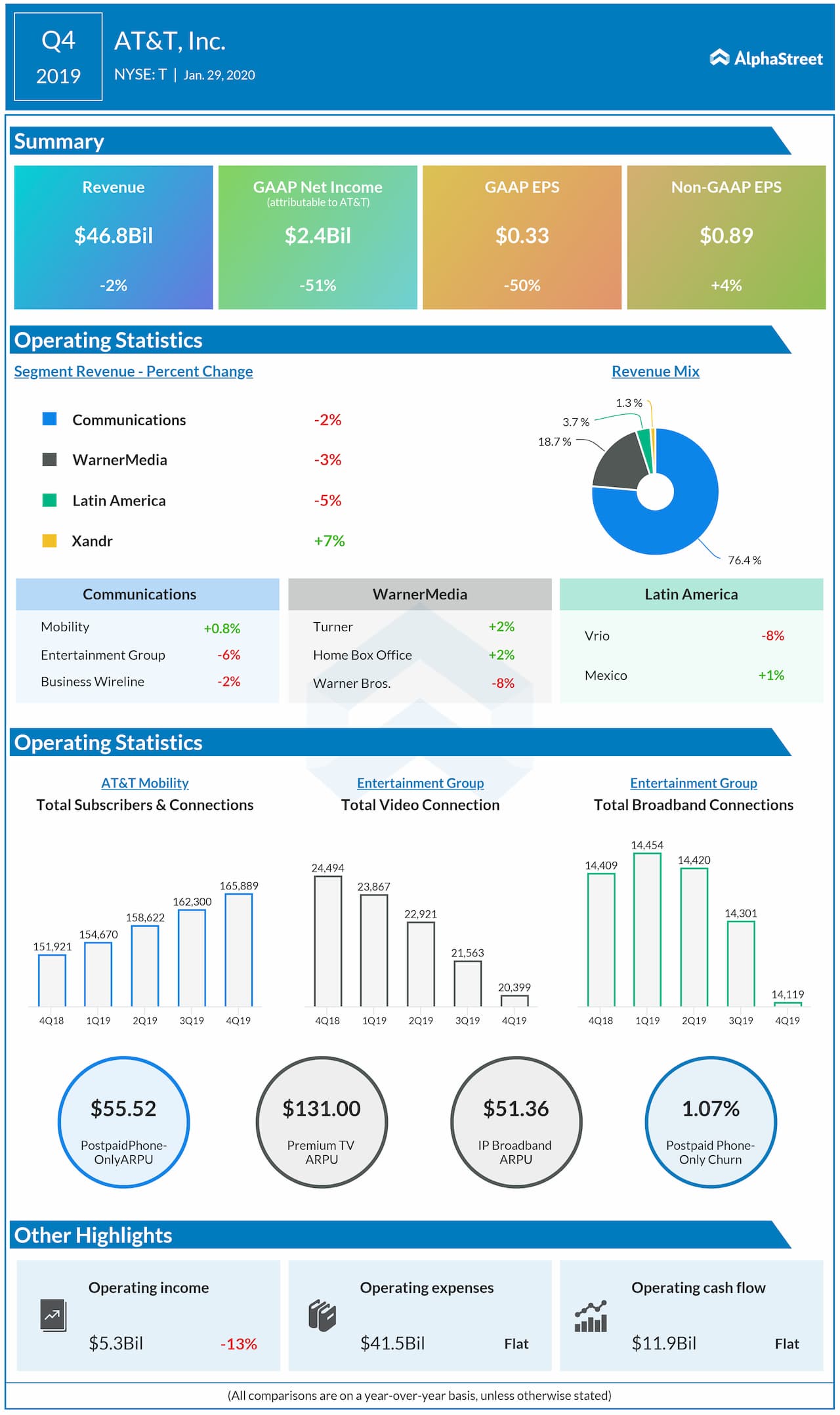

Statistics show that AT&T is better positioned to cash in on the 5G boom than its rivals. Currently, all eyes on the upcoming launch of the much-awaited HBO Max video streaming service, which is expected to help the company overcome the slowdown in its legacy business. In the fourth quarter, the top-line declined and fell short of expectations as revenues of the core Communications business contracted. Earnings, meanwhile, topped the estimates.

HBO Max Launch

With the streaming service set to hit the market in a few weeks, AT&T can expect a spike in the number of customers, who will be accessing the content through its 5G network. That is something others would not be able to offer right now.

While Verizon’s initiatives to offer value-added services were limited to the acquisition of Yahoo and AOL in the past, AT&T expanded its assets though high-value buyouts at a bigger scale, with the largest deal being the purchase of Time Warner two years ago.

The Disney Tie-up

Verizon played it safe by forging a tie-up with the recently launched Disney Plus streaming service, offering the latter’s content over the Verizon network. The strategy helped the company cut on capital spending and prevent its relatively moderate debt from rising.

AT&T’s fundamentals are pretty strong, which justifies the high debt levels, and it has a focused growth strategy. It is crucial that the management executive the plan in an effective manner in the coming years, given the growing competition in the video streaming realm.