Home improvement retailers Home Depot, Inc. (NYSE: HD) and Lowe’s Companies, Inc. (NYSE: LOW) have constantly striven to outperform each other and woo customers in the rapidly changing retail landscape. The scale of Home Depot’s operation is much larger compared to Lowe’s and the former has a bigger maker cap.

Holiday Sales

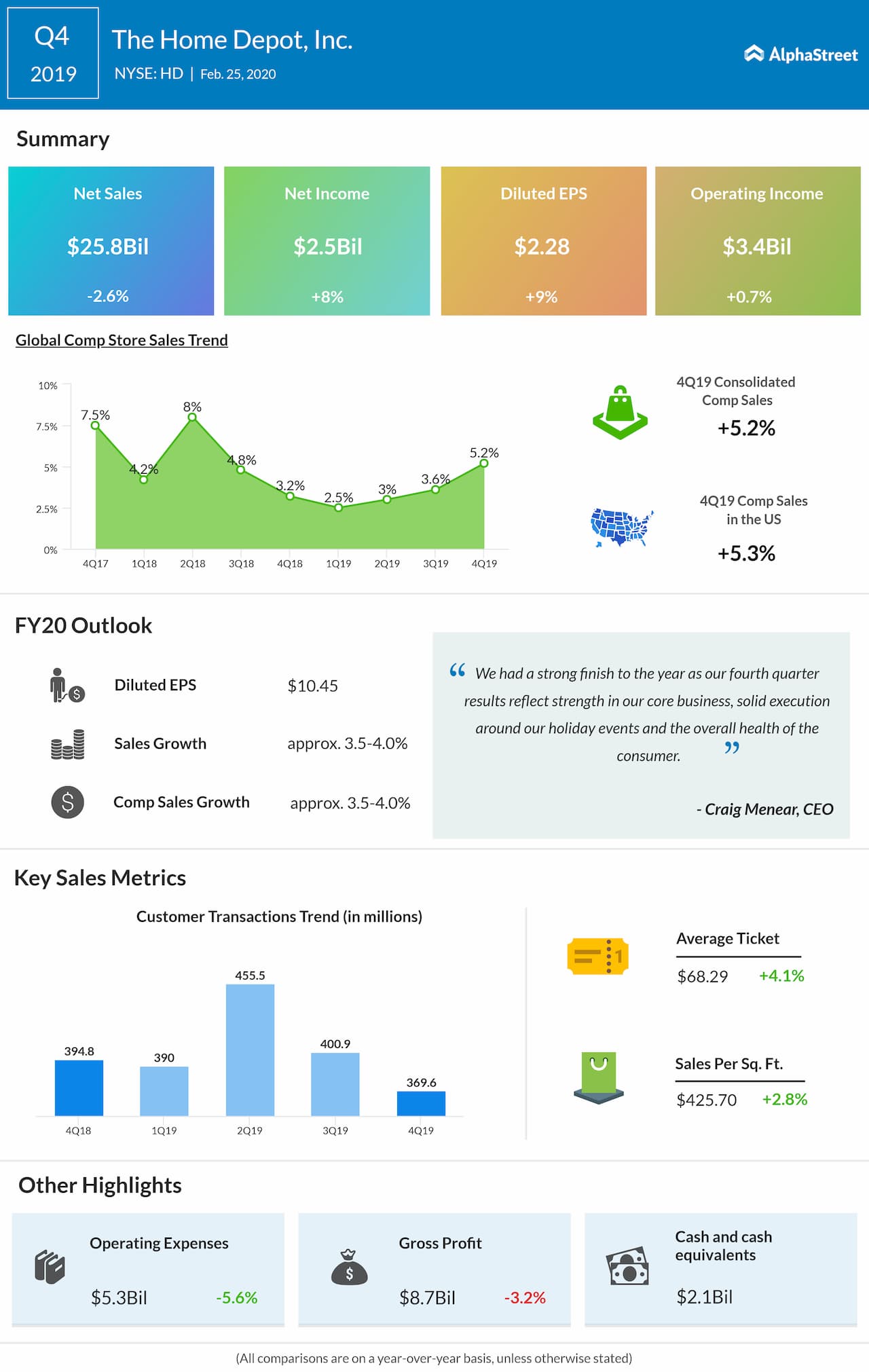

Home Depot had a better holiday season this time than most others in the sector, and registered a marked improvement in comparable store sales in the fourth quarter. Earnings rose to $2.3 per share despite a 2.6% drop in net sales, mainly due to the absence of one-off benefits that contributed to last year’s results.

Lowe’s reported double-digit growth in fourth-quarter earnings, reflecting stable comparable store performance that pushed up revenues by 3% year-over-year. The management attributed the impressive performance to strong sales at physical stores, which is a surprising trend given the general weakness in store traffic across the sector.

It seems Lowe’s efforts to incorporate technology, modernize stores and promote the Pro business are paying off. However, the company needs to revamp its digital platform to drive long-term growth. Home Depot has been taking advantage of Lowe’s weak e-commerce sales, which might come to an end if Lowe’s meets its goal of establishing a full-fledged digital platform.

Positive Comps

The solid comparable store performance has been a morale booster for shareholders of Lowe’s, but that is not enough for the company to achieve its growth targets and keep pace with Home Depot.

Most market-watchers believe Home Depot is a good investment option at the current valuation, which is far below the the long-term average. Also, experts are optimistic about the recovery gathering steam and the stock hitting a new peak in the near future. While analysts also recommend buying Lowe’s, the main reason is that the stock is more affordable.

Resilience

Unlike most Wall Street firms, Home Depot’s shares was able to resist the downward pressure from the recent selloff triggered by the Covid-19 epidemic. After falling from an all-time high in the final week of February, the stock pared most of the losses and bounced back early March. However, it got a fresh jolt as the market turmoil intensified.

Lowe’s shares maintained a steady uptrend in recent years and reached a record high last month, ahead of the earnings release. But the stock has been in a free fall since then, reversing most of last year’s gains.