Shares of Home Depot (NYSE: HD) stayed red on Wednesday. The stock has gained 17% over the past three months. The company delivered fourth quarter 2023 earnings results that declined on a year-over-year basis but surpassed expectations. It also provided a cautious outlook for fiscal year 2024 as it expects to continue facing pressures to its business during the period.

Quarterly numbers

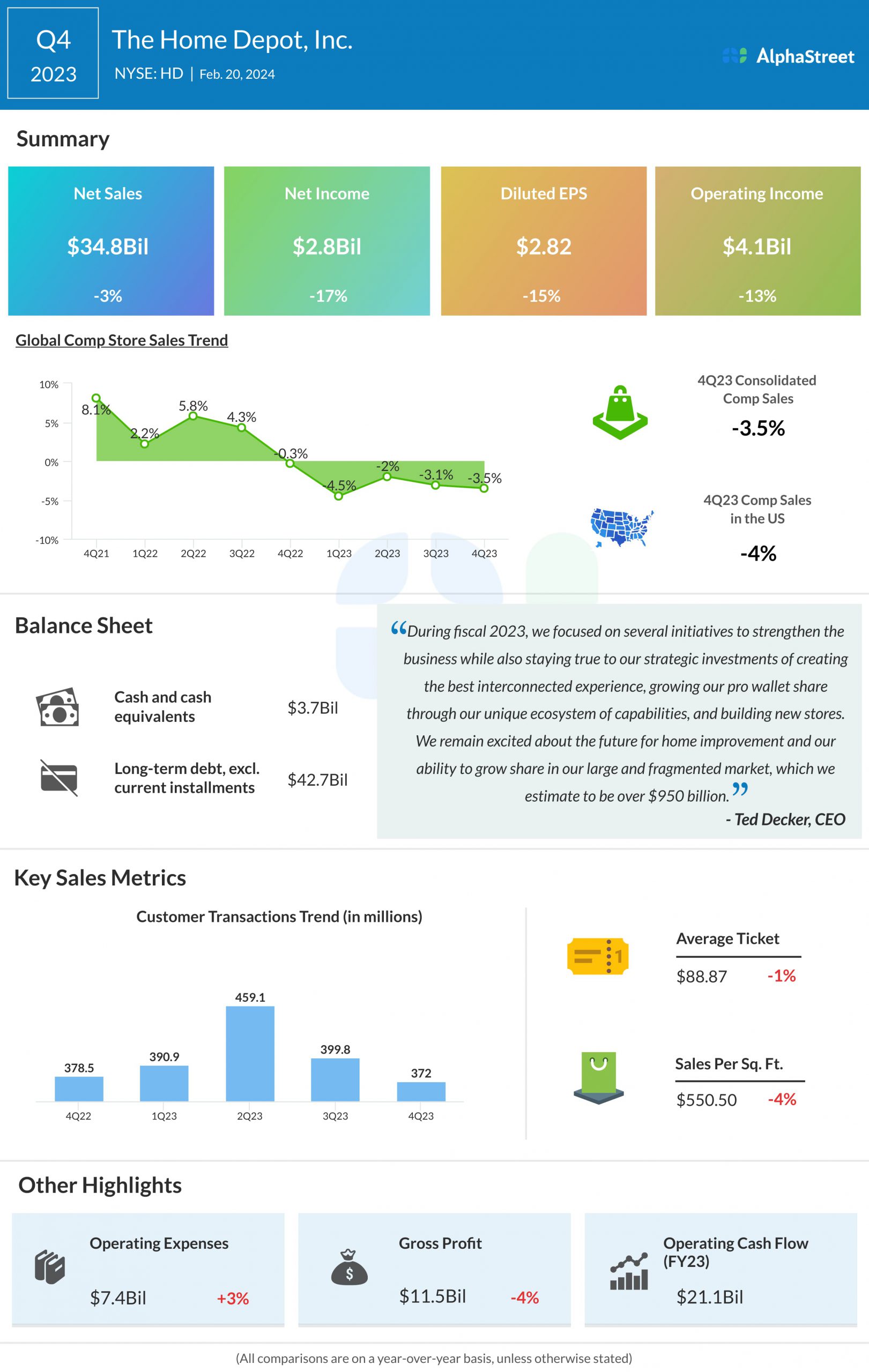

Sales for the fourth quarter of 2023 decreased nearly 3% year-over-year to $34.8 billion. Comparable sales fell 3.5% and comparable sales in the US dropped 4%. Net earnings decreased nearly 17% to $2.8 billion while EPS was down around 15% to $2.82. Despite the year-over-year declines, the top and bottom line numbers exceeded projections.

Business performance

As stated on its quarterly call, Home Depot continued to see softness in big-ticket, discretionary purchases during the fourth quarter, a trend that was visible throughout the year. Customers continued to take on smaller projects while putting off larger ones. Big-ticket comp transactions, or those over $1,000, were down 6.9% year-over-year in Q4. The company experienced softness in big-ticket, discretionary categories like flooring, cabinets and countertops.

Comp transactions decreased 2.1% in the fourth quarter. Comp average ticket decreased 1.3%, hurt by deflation in lumber and copper wire.

The performance of the Pro and DIY customer segments was relatively in line with one another during the fourth quarter. The company said that although Pro backlogs appear to be lower than a year ago, they have remained stable and elevated relative to historical norms.

Store fleet

On its call, Home Depot said it plans to open 80 new stores over the next five years. The company currently has over 2,300 stores throughout North America. In FY2023, it opened eight new stores in the US and five in Mexico. The store openings in the US were focused mainly on relieving pressure from existing stores that had high volume, and filling voids in areas with high growth potential. In FY2024, the company plans to open approx. 12 new stores.

Outlook

During FY2023, Home Depot faced challenges such as a drop in existing home sales, comp pressure from lumber deflation and fed funds rate hikes, which are not likely to reoccur in FY2024. Despite signs that the economy is normalizing, the company still expects to face headwinds in the home improvement market in the coming fiscal year.

Home Depot expects personal consumption growth to decelerate in 2024 compared to 2023. Higher interest rates at the beginning of the year are likely to weigh on demand for larger projects. The effects from the pull-forward of demand during the pandemic as well as project deferrals could also impact demand in 2024.

The home improvement retailer expects to see continued moderation in 2024 but with less pressure to comp sales as compared to 2023. The company expects total sales to grow approx. 1% and comparable sales to decline approx. 1% in FY2024. Total sales will benefit from a 53rd week, which is estimated to contribute approx. $2.3 billion in sales. EPS is expected to grow approx. 1%, with the 53rd week contributing approx. $0.30.