AutoZone Inc. (NYSE: AZO) reported a 0.3% decline in earnings for the first quarter of 2020 due to an increased effective tax rate resulting from a reduced benefit from stock options exercised. However, the results exceeded analysts’ expectations.

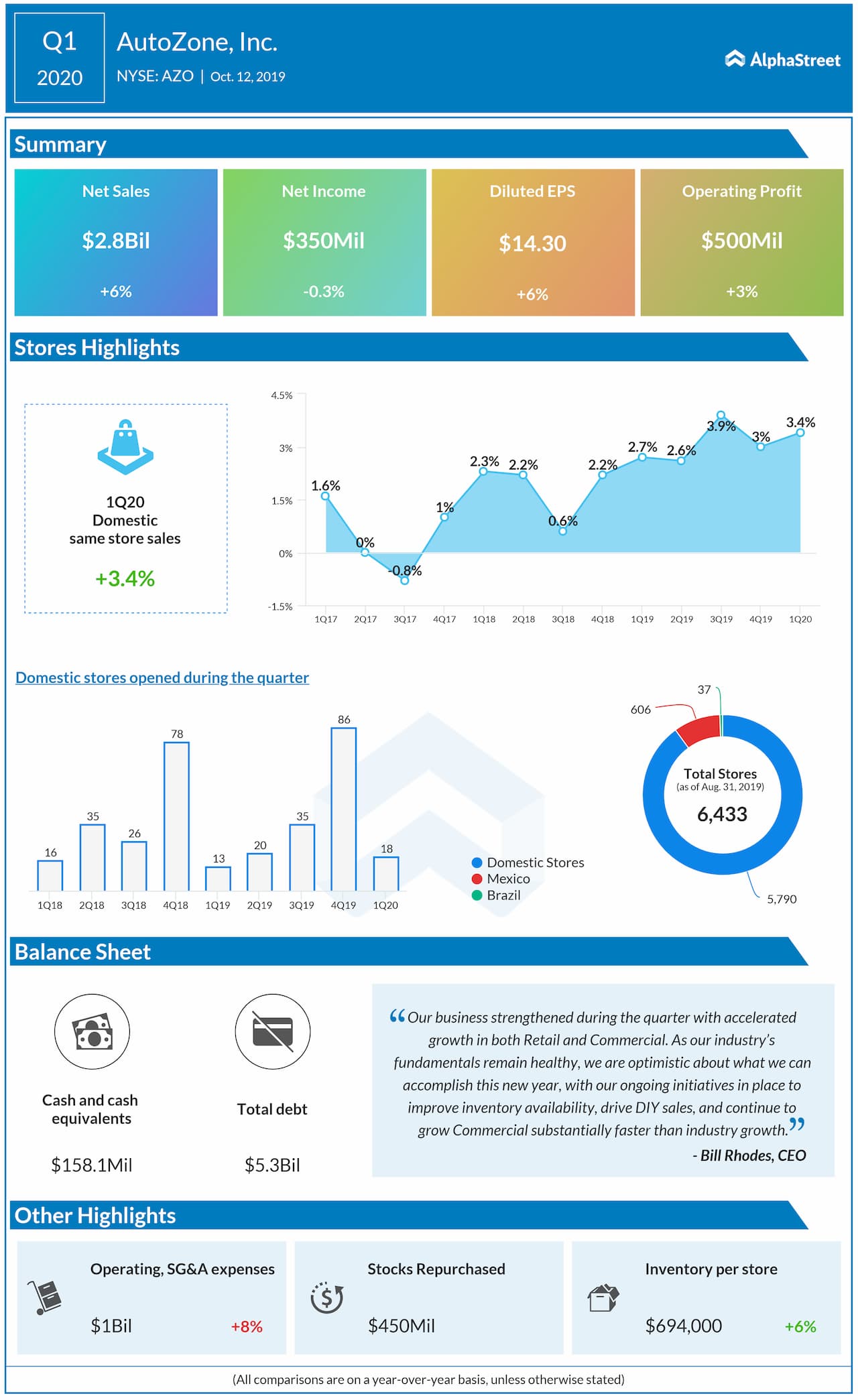

Net income declined by 0.3% to $350.3 million while earnings increased by 6.2% to $14.30 per share on a benefit from stock options. Revenue for the quarter grew by 6% to $2.79 billion, on strong domestic store sales.

Since the fourth quarter of 2018, AutoZone has consistently reported solid domestic store sales, riding on improved product placement. Domestic same-store stores, or sales for stores open at least one year, increased by 3.4% in Q1.

The inventory increased by 9.1% driven by new stores and increased product placement. Inventory per store was $694,000, up from $658,000 last year and $674,000 last quarter. Net inventory, defined as merchandise inventories minus accounts payable, on a per-store basis, was a negative $71,000 versus negative $59,000 last year and negative $85,000 last quarter.

For the first quarter, operating expenses, as a percentage of sales, rose to 35.8% from 35.2% a year ago, with deleverage primarily driven by domestic store payroll and benefits. The company had cash and cash equivalents as of November 23, 2019, of $158.1 million while the total debt stood at $5.29 billion and an accumulated deficit of $1.78 billion.

During the quarter, AutoZone opened 18 new stores in the US, two in Mexico and two in Brazil. As of November 23, 2019, the company had 5,790 stores in the US, 606 stores in Mexico, and 37 stores in Brazil for a total store count of 6,433.