Record Fine

There has been caution among investors while dealing with Citigroup’s stock, primarily due to uncertainties in the global market including economic volatility and trade-related tensions. It needs to be noted that Citigroup’s presence in the overseas market is much bigger than most of its peers, making it vulnerable to fluctuations in regional economies.

Restructuring

That highlights the need to ramp up the U.S retail banking business and streamline operations. Having overhauled its investment banking unit and capital market business already, Citigroup is better positioned to face the market challenges. The estimated pickup in revenue and profit in the coming quarters, as a result of the reorganization, should bring cheer to shareholders. Market experts recommend strong buy for the stock with a target of about $88, which represents a 17% upside from the last closing price.

Mixed Quarter

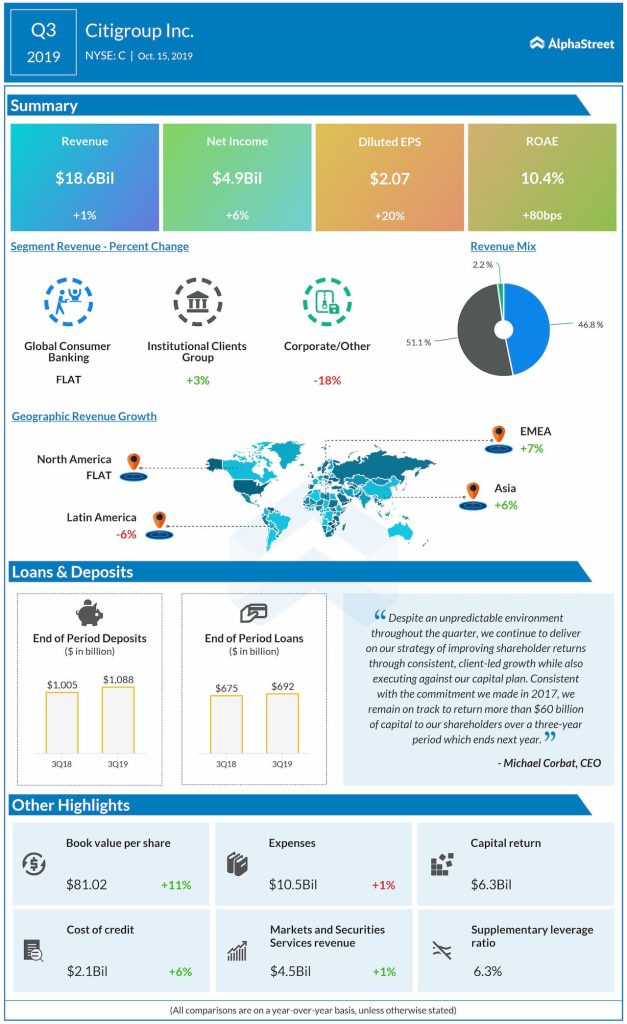

The market’s response to the bank’s third-quarter results was not very encouraging – despite the results surpassing the forecast – mainly due to the muted top-line performance. Revenues edged up 1% annually to $18.6 billion and earnings moved up 20% to $2.07 per share. While unveiling the numbers, the management outlined its capital return program, under which around $60 billion will be given to shareholders over a three-year period that ends next year.

Citigroup’s stock has moved up 35% this year, after slipping to a new low towards the end of last year. Currently, it is trading close to the multi-year highs seen at the beginning of 2018.