In the second quarter, companies with higher exposure to investment banking and trading did a better job offsetting weakness in the consumer division.

Winners

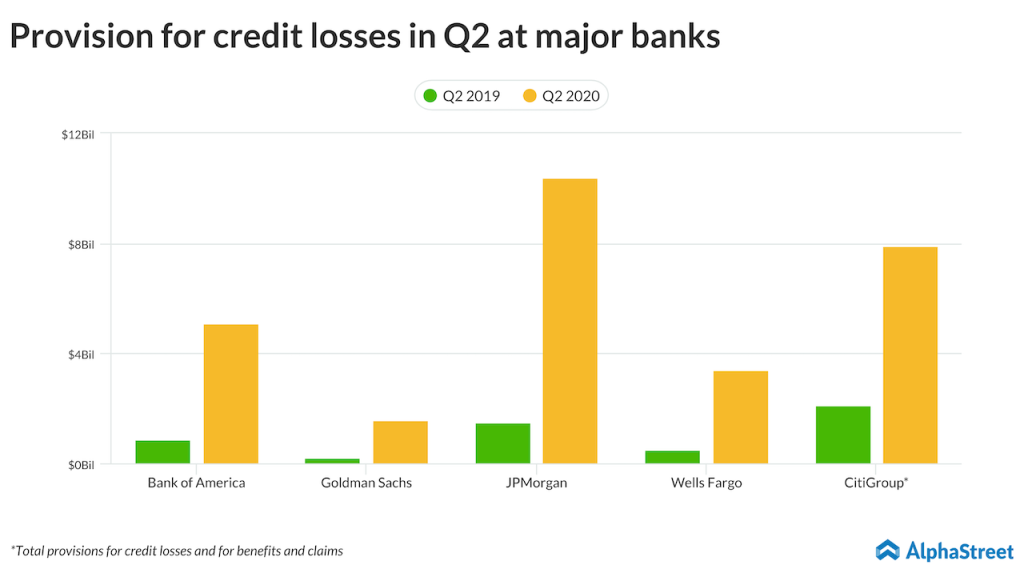

The economic weakness had impacted all banks alike in Q4. If you look at the amount of money kept aside for credit losses and bad debts, an enormous year-over-year spike is ubiquitous. In fact, Goldman Sachs (NYSE: GS) and JPMorgan Chase (NYSE: JPM) were among the big banks that saw the largest percentage increase in provision for credit losses.

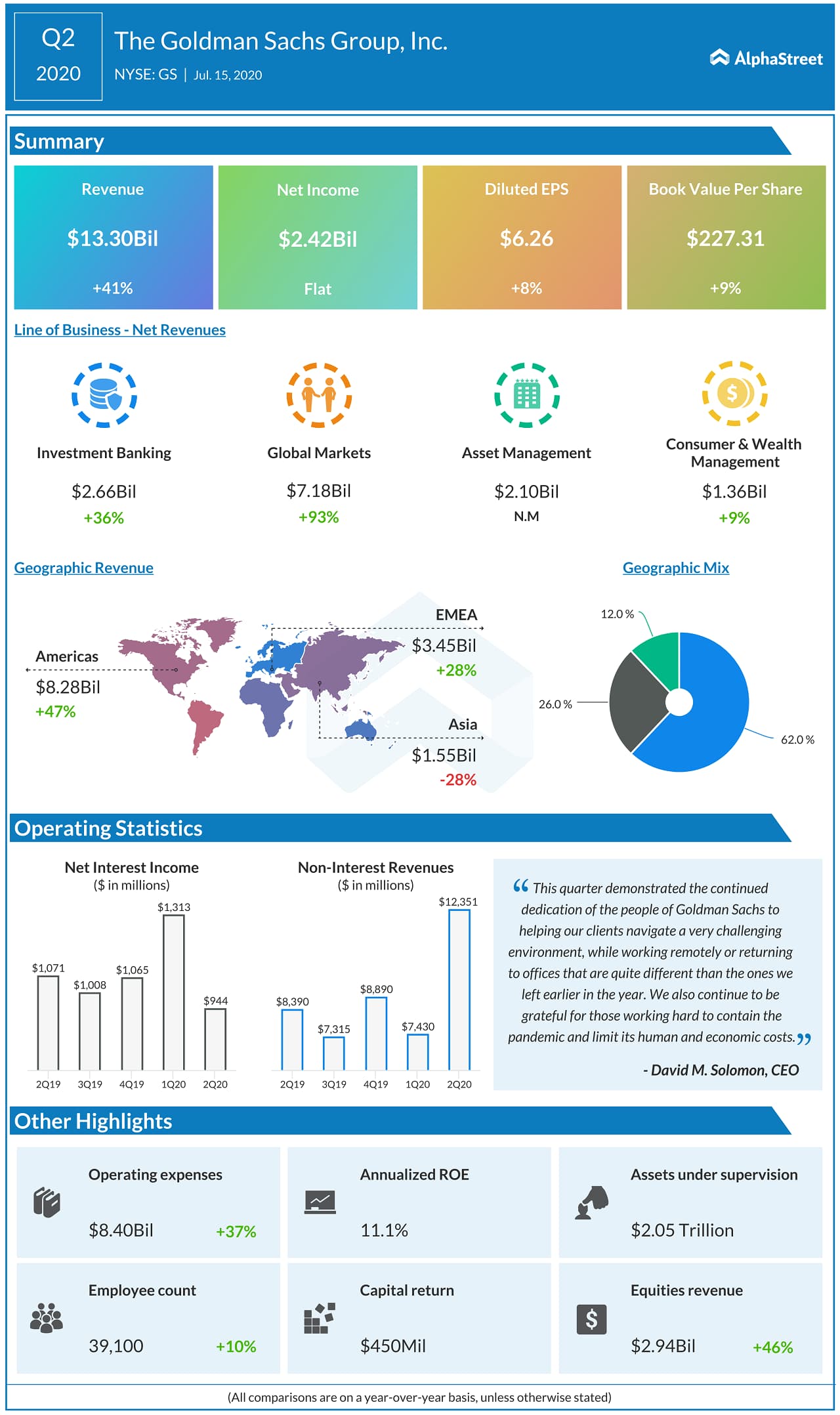

In both banks, this amount rose approximately seven times compared to the second quarter of 2019. Yet, they also came out with strong results on the back of strong trading and investment banking, driven by the pandemic fear. While JPMorgan’s Corporate and Investment Bank unit grew 85%, Goldman Sachs’ Global Markets division grew 93% in Q2.

The increase in trading revenues was powered primarily by the bond market, which was buoyed by the Federal Reserve’s decision to support credit markets as wells the increased volatility seen across different classes of assets. Notably, JPMorgan’s fixed-income trading grew 99% in Q2, compared to just 38% in equity.

Also read: Weak bank earnings send bearish signal

Citigroup (NYSE: C) is another example. Despite the consumer banking segment accounting for close 40% of its overall revenues, solid results from the Institutional Clients Group (which includes corporate investment banking and trading services) helped it surpasses Street expectations in the second quarter. Morgan Stanley (NYSE: MS) was also a strong player during the quarter, due to record trading revenues.

Disappointments

Consumer banks, or banks with high exposure to consumer banking, including Bank of America (NYSE: BAC), Wells Fargo (NYSE: WFC), PNC Financial (NYSE: PNC) and Regional Financial Corporation (NYSE: RF) succumbed to the potential bad debts. Inadequate diversity has cost these banks the ability to cushion the effects of a quick economic downturn like the one we witnessed this year.

A low interest rate environment and people’s general aversion towards credit cards over fears of defaulting payments have hurt the consumer banking units in these banks.

Also read: JPMorgan Q2 2020 Earnings Call Transcript

Wells Fargo, where net interest margin plunged 57 basis points year-over-year, was probably the worst hit by the pandemic. The lack of visibility with regards to its future profitability also forced regulators to push for a dividend cut.

US Bancorp (NYSE: USB), meanwhile, was somewhat of an expectation in Q2. Despite being a consumer bank, it surpassed wall street projections for the quarter, riding on a comparatively strong net interest income performance. However, flat revenue growth for the quarter reflects the vulnerability of the bank to COVID-like situations in the future.

At the end of the day, the quarter has become another example of how diversification can become helpful during market downturns. It pays to have a deep understanding of the banks’ business at the time of investing. We have also seen how the trading business plays god during panic situations.

_____

Looking for management/ analysts comments on Q2 results? Check out this space for the latest earnings call transcripts