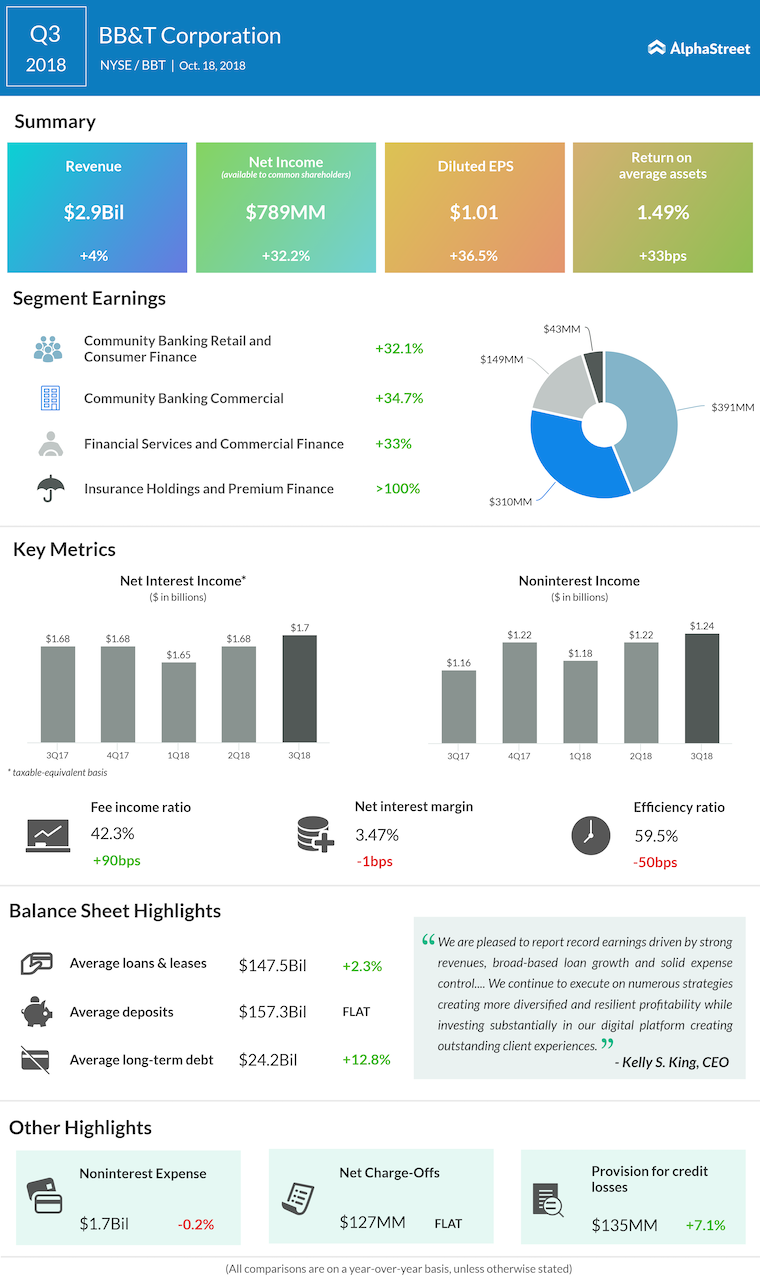

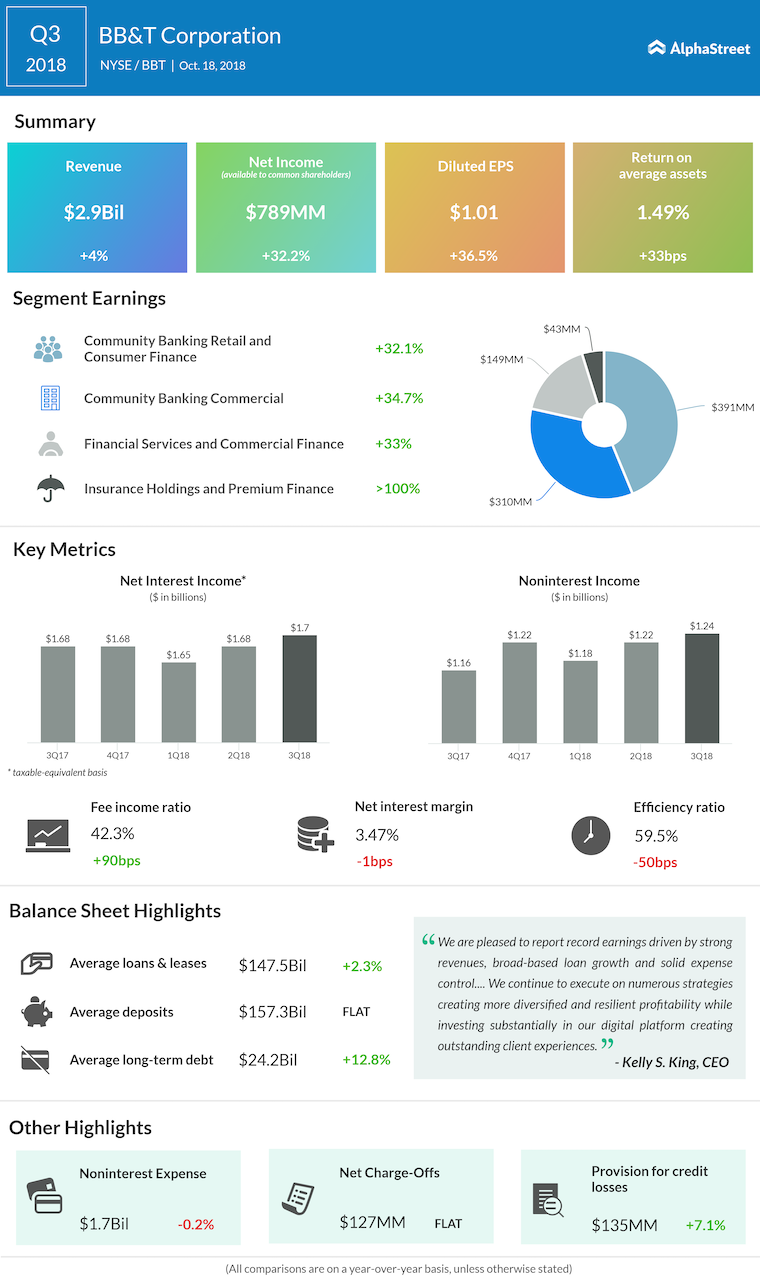

BB&T Corp (BBT) posted Q3 adjusted profit per share of $1.01 and revenue of $2.95 billion, which beat consensus views. Analysts had predicted the banking firm to post earnings of $1 per share. GAAP earnings increased to $789 million, or $1.01 per share, versus $597 million, or $0.74 per share, in the prior-year period. Higher revenue and lower expenses helped the company report a better-than-expected profit.

Excluding pre-tax merger-related and restructuring charges of $18 million, BB&T posted earnings of $1.03 per share. Revenue increased $99 million annually to $2.95 billion. GAAP noninterest expense decreased 0.2% to $1.742 billion for the quarter ended September 30, 2018.

Excluding pre-tax merger-related and restructuring charges of $18 million, BB&T posted earnings of $1.03 per share. Revenue increased $99 million annually to $2.95 billion. GAAP noninterest expense decreased 0.2% to $1.742 billion for the quarter ended September 30, 2018.

The company benefited from the corporate tax rate reduction in January. This was evidenced by the fact that the company’s third quarter provision for income taxes stood at $210 million, compared with $202 million in the second quarter and $294 million in the third quarter of 2017.

“We are pleased to report record earnings driven by strong revenues, broad-based loan growth and solid expense control,” said CEO Kelly King. He added, “Revenue exceeded $2.9 billion as we achieved records in both net interest income and noninterest income.”

Net interest income increased $26 million year-over-year, driven by loan growth of 5.8%. Noninterest income growth of $73 million in the recently ended quarter was led by insurance income, which benefited from the Regions Insurance acquisition as well as organic growth.

Blackstone thrives on equity growth; Q3 results beat estimates

For Q4, BB&T forecasted noninterest income to be up 2-4% and expenses to be up 1-3% compared to the fourth quarter of the prior year.

Shares of the Winston-Salem, North Carolina-based bank holding company closed Wednesday’s trading session up 1.32% at $47.71 and continued the positive momentum on Thursday’s morning session. Since the beginning of 2018, the stock had dropped 4% and it had gained 3% in the past 52-week period.