What to Look for

Analysts’ consensus

earnings estimate for the second quarter is $0.29 per share, down

from $0.36 per share recorded in the same period of last year. The

revenue guidance of $2.75 billion represents a 6% year-over-year

decrease.

There is no quick fix for the main problems facing the company – lack of innovation that deprives customers of a pleasant shopping experience both in stores and on the digital platform. Without ramping up the existing infrastructure, the company might not be able to retain customers.

Q1 Outcome

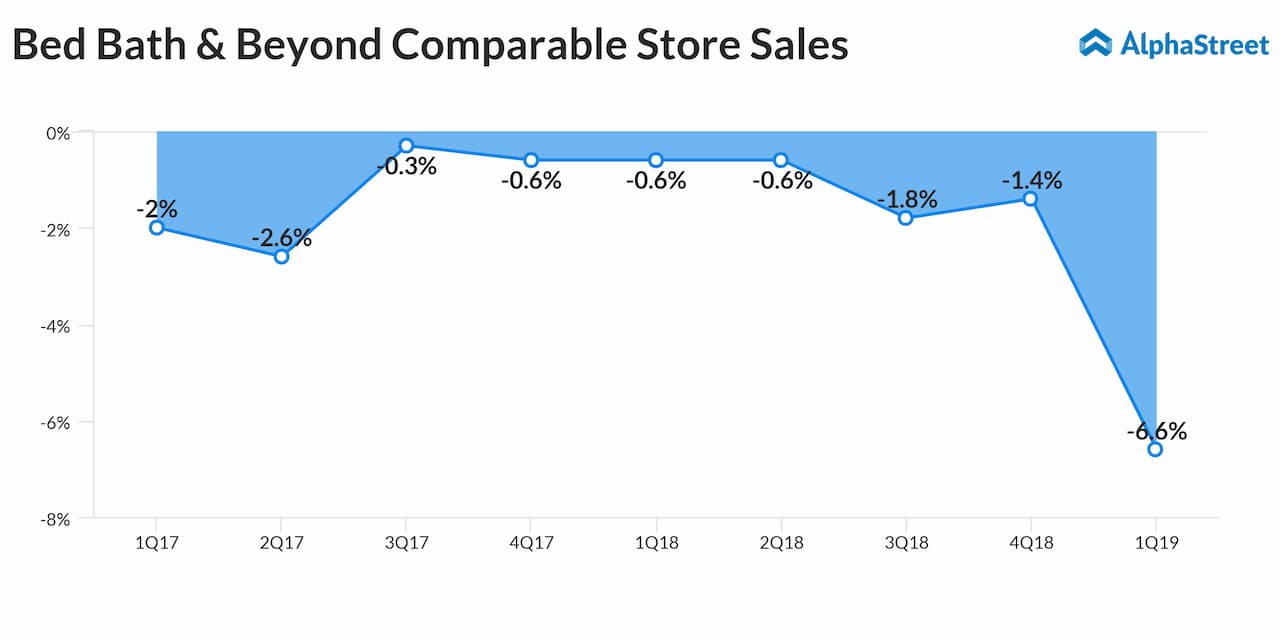

The retailer’s performance in the June-quarter was one of the worst in its history. Total sales dropped to $2.6 billion, hurt by a 7% contraction in comparable-store sales. Consequently, adjusted earnings plunged 68% annually to $0.12 per share. In all of the trailing four quarters, the top-line fell short of the market’s expectations.

Peer Performance

Among others in the home furnishing sector, The Home Depot (HD) reported a 4% growth in earnings to $3.17 per share for its most recent quarter, when revenues rose to about $30 billion.

Bed Bath & Beyond has remained one of the worst-performing Wall Street stocks, losing about 87% in the past four years. The losing streak intensified after the dismal first-quarter results. The stock closed the last session below the $10-mark.