Consumer Mood

Right now, cautious consumer spending is the main headwind to sales. Concerned about the high inflation and economic uncertainties, people cancel, or, postpone discretionary purchases. Of late, there has been a decline in the demand for electronic items and home appliances.

Meanwhile, the management has a broad promotional program in place to attract buyers. Recent efforts to ramp up the digital platform are translating into higher online sales which accounted for more than one-third of total sales in the July quarter. Earlier, the company had announced the closure of underperforming stores and extensive store remodeling in certain locations, as part of the efforts to enhance customer experience.

Key Metrics

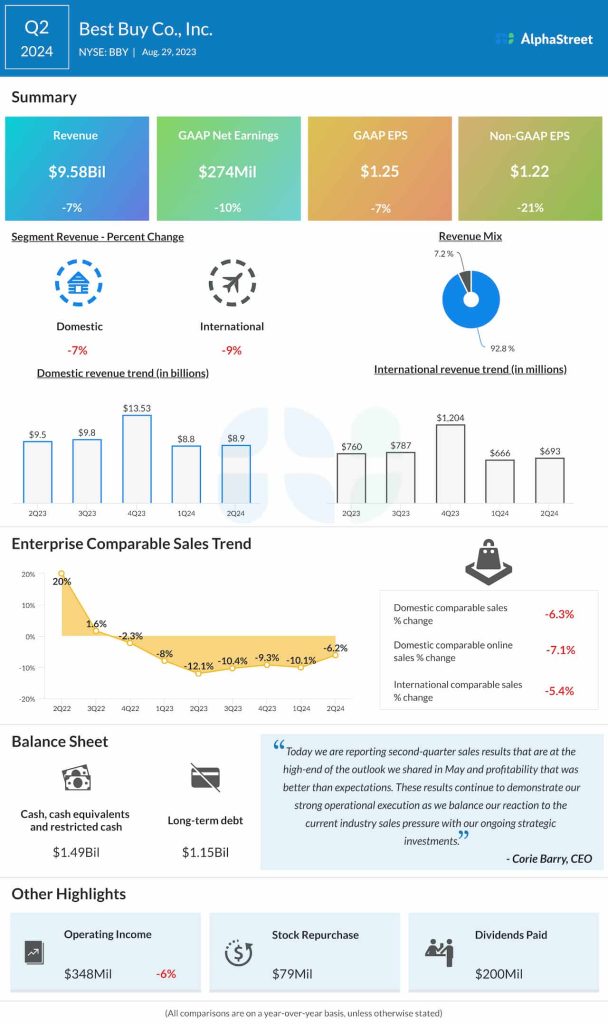

Best Buy’s net profit, adjusted for special items, has beaten Wall Street’s estimates for the fifth time in a row, though the latest number declined in double digits to $1.22 per share. That reflected a 7% decrease in revenues to slightly below $10 billion. Both domestic and international revenues declined, as comparable sales dropped 6.2% from last year. Meanwhile, Q2 gross profit was up110 basis points from last year, thanks to improvements in product margins and the company’s membership program.

Best Buy’s CEO Corie Barry said during the post-earnings interaction with analysts, “Our industry continues to experience lower consumer demand due to the pandemic pull forward of tech purchases and the shift back into services spent outside the home, like travel and entertainment. In addition, of course, persistent inflation has impacted spending decisions for a substantial part of the population. I continue to be incredibly proud of the way our teams are managing the business today and preparing for our future in light of the industry pressure and ongoing uncertain macro conditions.”

Cuts Guidance

Currently, the management expects full-year revenue to be between $43.8 billion and $44.5 billion, compared to the previously forecast estimate in the range of $43.8 billion to $45.2 billion. It also revised comparable sales guidance — expects a decline of 4.5-6% for fiscal 2024, compared to the initial estimate of a 3-6% decrease.

On Wednesday, the stock traded slightly below its 52-week average, after paring a part of the post-earnings gains. It has lost around 5% in the past eight months.