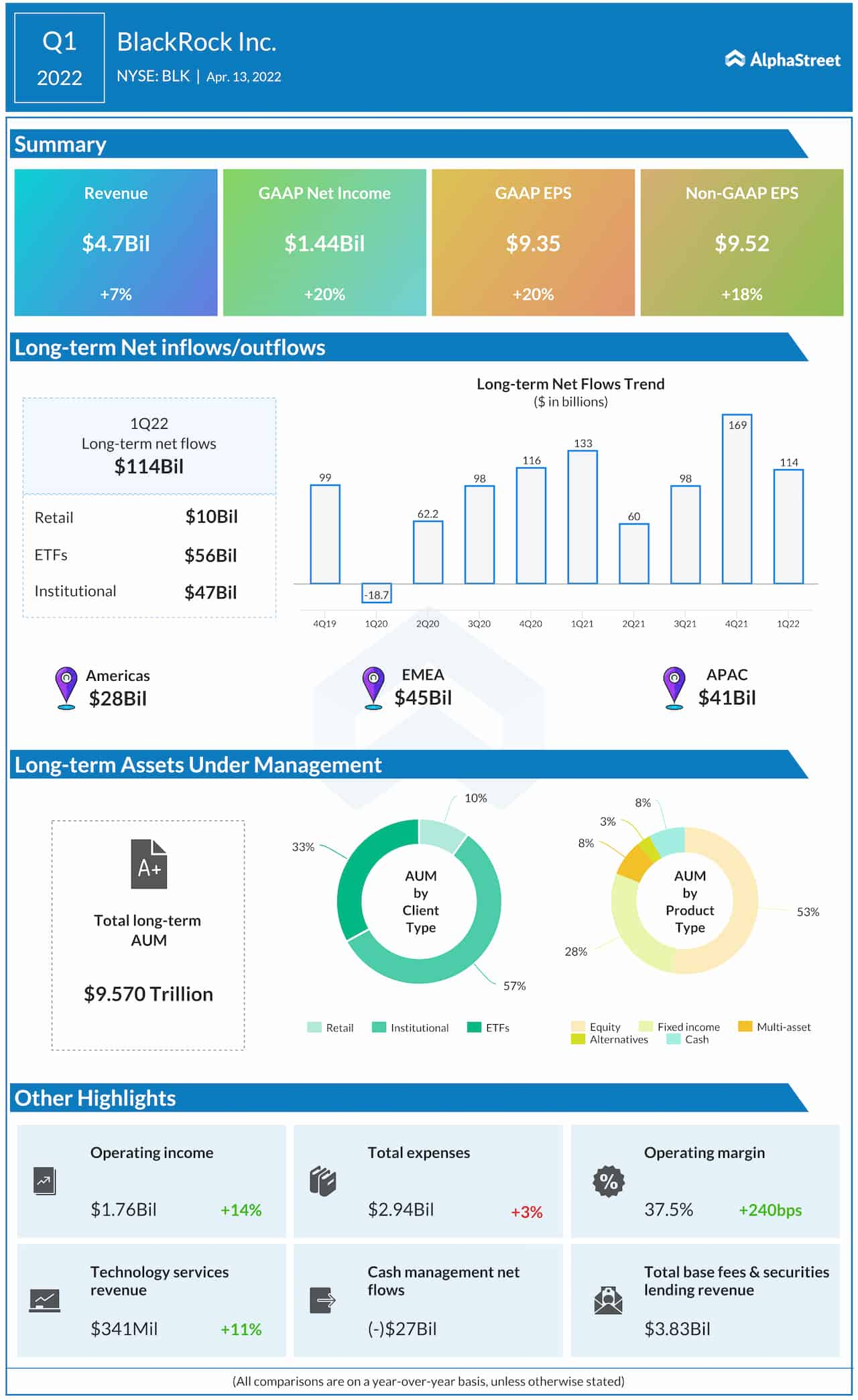

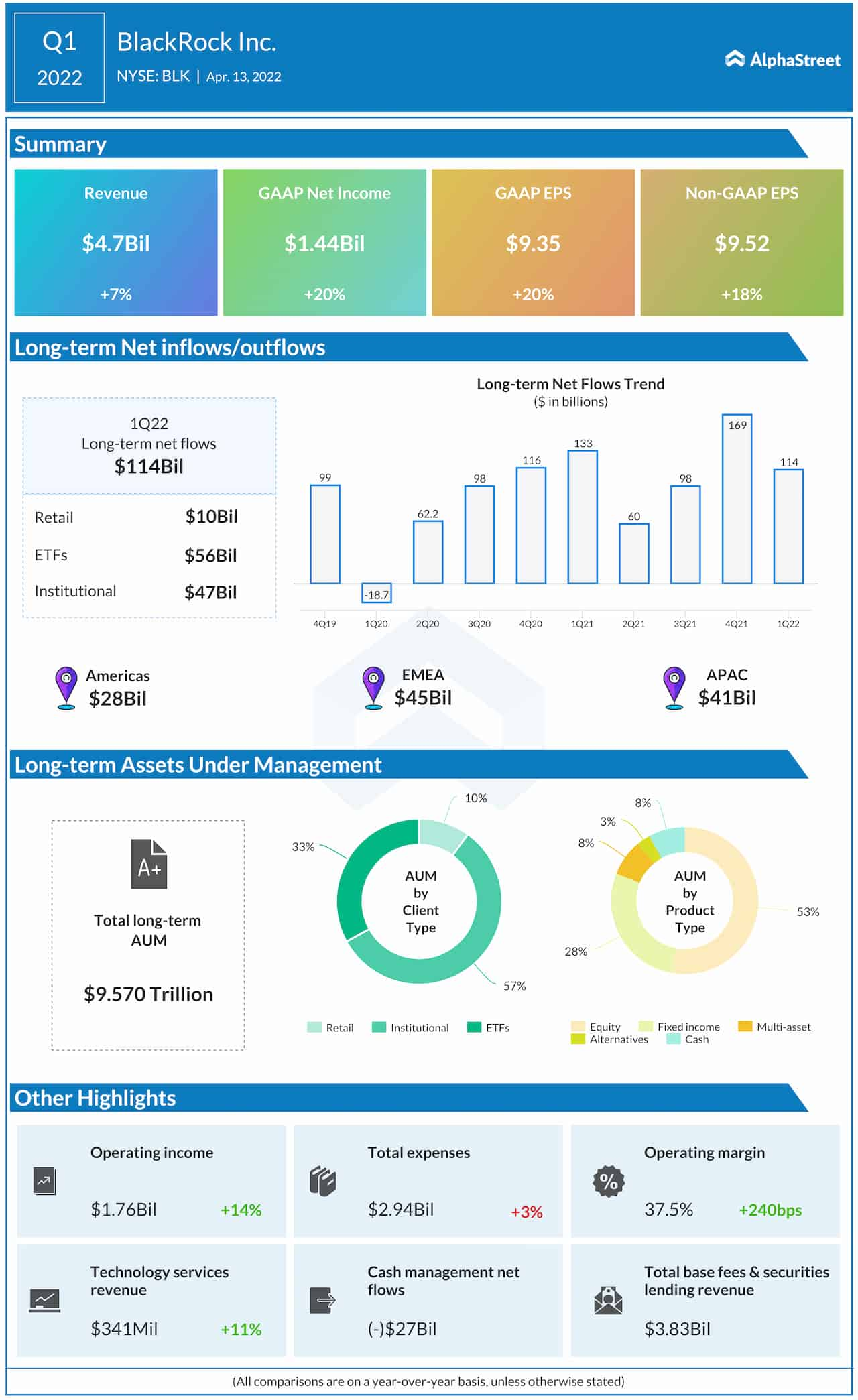

Asset management company BlackRock, Inc. (NYSE: BLK) reported an increase in first-quarter profit, aided by a 7% growth in revenues. Earnings also beat the consensus estimates, while the top line fell short of expectations.

At $4.7 billion, first-quarter revenue was up 7% year-over-year. Experts were looking for faster growth. The top line benefitted from strong organic growth and a double-digit increase in technology services revenue, which was partially offset by lower performance fees.

Net income, excluding special items, was $9.52 per share, compared to $8.04 per share in the comparable period of last year. Unadjusted net income rose to $1.44 billion or $9.35 per share in the most recent quarter from $1.20 billion or $7.77 per share in the prior-year quarter. Total assets under management increased 6% to $9.57 trillion, while quarterly net inflows came in at $86.4 billion.

“As the world continues to face geopolitical and economic uncertainty, our investments over the years to build BlackRock’s all-weather platform position us well to advise our clients and help them pursue their long-term financial goals,” said Laurence Fink, chairman, and CEO of BlackRock.

Check this space to read management/analysts’ comments on BlackRock’s Q1 2022 results

Shares of BlackRock traded higher in the early minutes of Wednesday’s regular session following the earnings release, after closing the previous session lower.