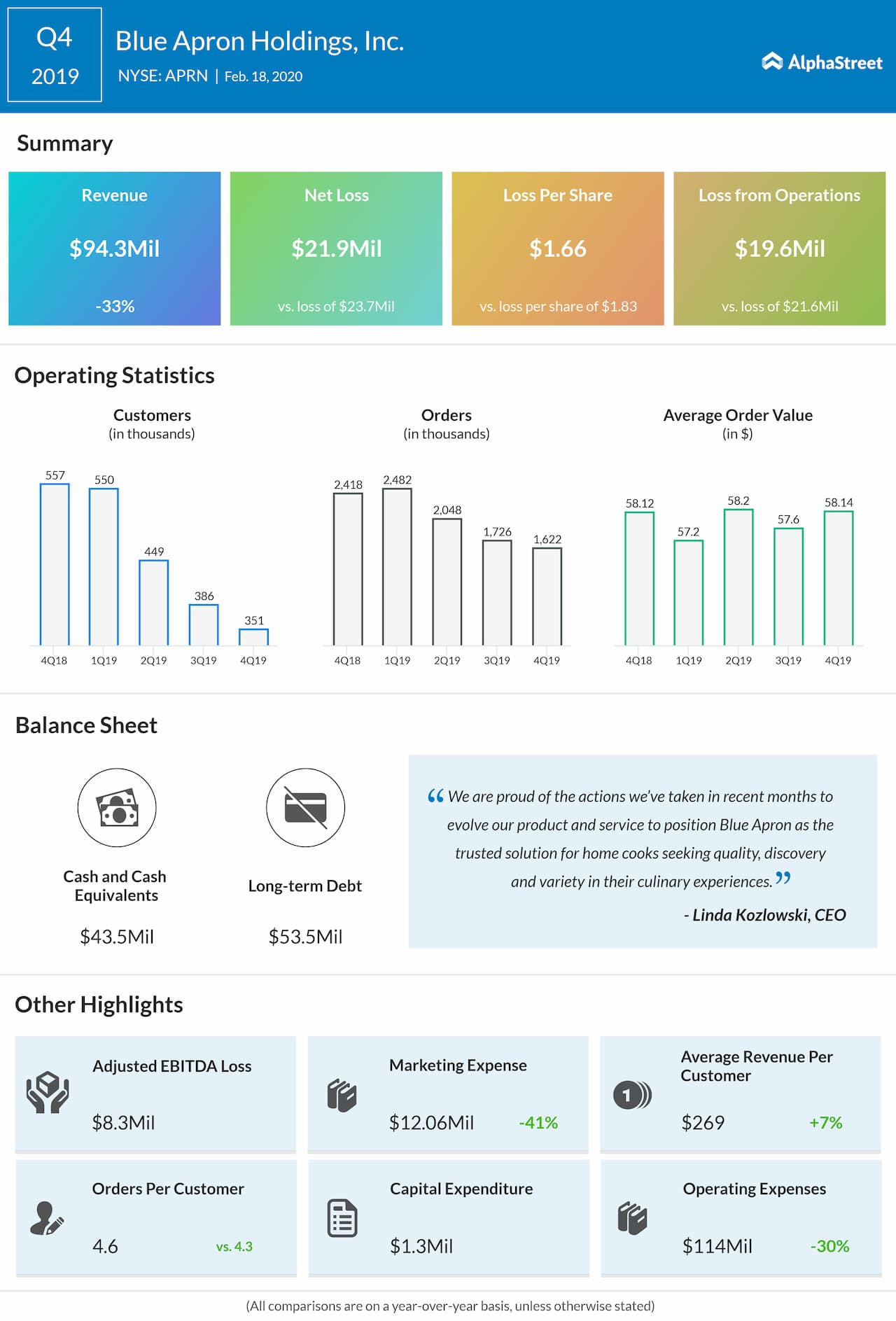

During the quarter, orders dropped 33% while the number of customers decreased 37%. However, the average order value improved to $58.14 from $58.12 last year. Average revenue per customer also improved to $269 from $252 in the year-ago period.

The company announced the planned closure of its Arlington, Texas facility and consolidation of production volume into its New Jersey and California facilities. Blue Apron expects to incur about $1.5 million in cash restructuring charges, including about $0.8 million of employee-related costs and about $0.7 million of other exit costs.

Also, the company expects to incur non-cash asset-related charges in the range of $5-8 million. The majority of the charges will be incurred in the first half of 2020. The company expects this action to generate annual savings in fixed costs of about $8 million beginning in the second quarter of 2020.

Blue Apron’s board is evaluating a broad range of strategic alternatives to maximize shareholder value. This could include a strategic business combination, a capital raise, a transaction that results in private ownership or sale of the company or its assets, or any combination. This along with cost optimization initiatives will provide additional liquidity for supporting the execution of growth strategy and continued investments in the business.