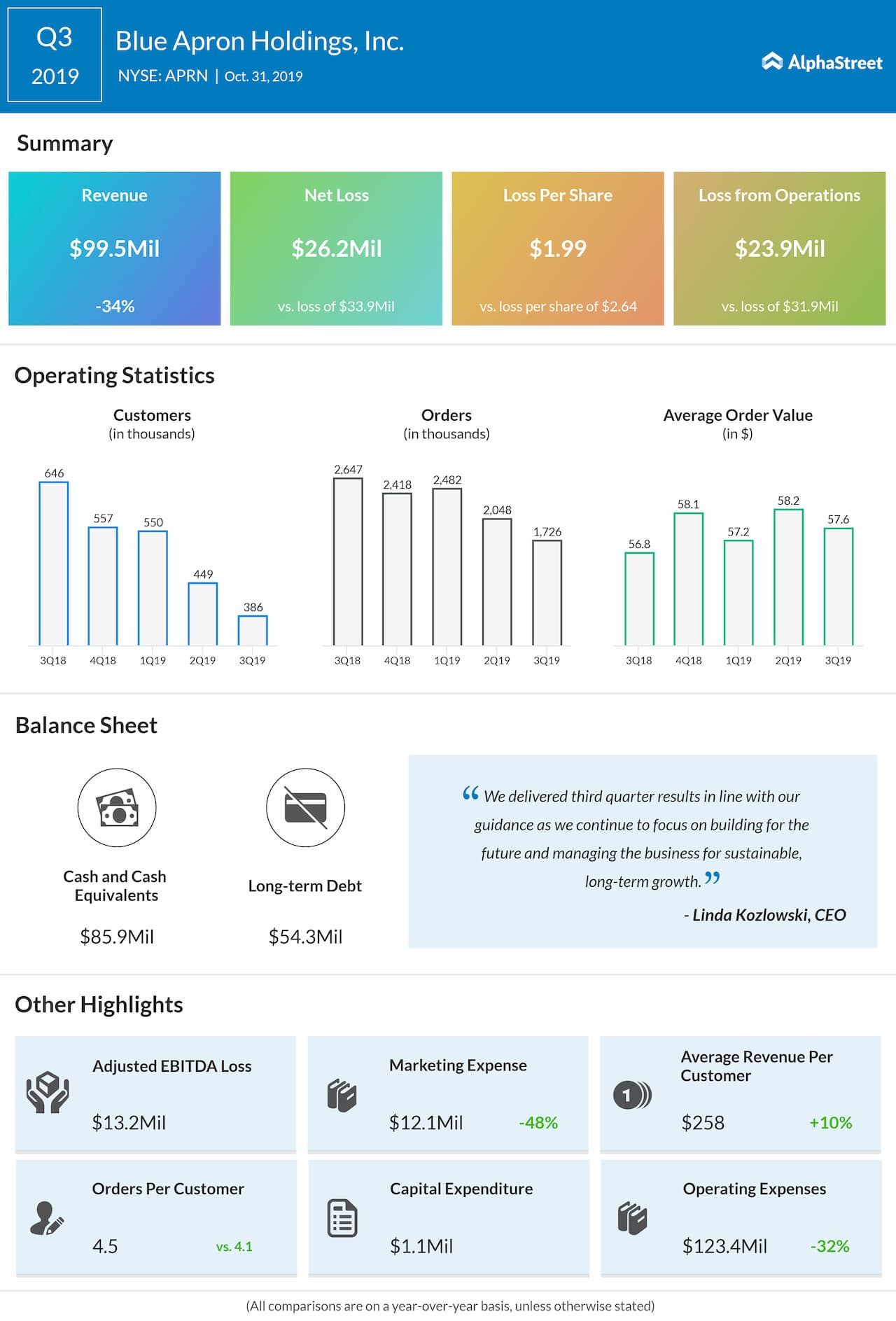

Net loss was $26.2 million, or $1.99 per share, compared to $33.9 million, or $2.64 per share, last year.

CEO Linda Findley Kozlowski said, “We’re pleased to see the continued strengthening of our customer base with year-over-year improvements in certain key customer metrics in the third quarter. We continue to believe that the potential for Blue Apron remains significant and that with the execution of our strategy, we will achieve our 2020 growth targets.”

During the quarter, orders dropped 34% while the number of customers decreased 40%. However, the average order value improved to $57.60 from $56.79 last year. Average revenue per customer also improved to $258 from $233 in the year-ago period.

Adjusted EBITDA improved $5.6 million year-over-year to a loss of $13.2 million in the third quarter, versus a loss of $18.8 million in the prior-year period, reflecting the company’s continued focus on expense management and operational efficiencies.

Marketing expense, as a percentage of net revenue, was 12.2%, compared to 15.4% in the prior-year period. This decrease was due to the company’s strategy to focus on the most efficient marketing channels and customers with high affinity.

Capital expenditures totaled $1.1 million for the quarter. Cash and cash equivalents was $85.9 million as of September 30, 2019.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.