So if nothing drastic happens over the next four years, let’s analyze how the Cupertino-based firm is expected to lead the way the $2 trillion mark.

Stock market run

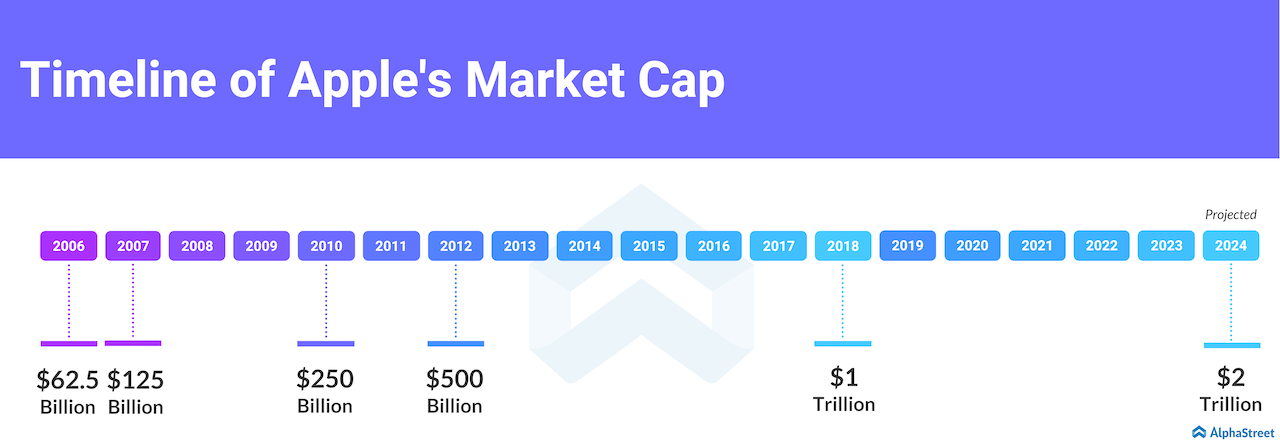

Apple, which went public in 1980, hit $100 billion in market cap only 27 years later. Ironically, this was also the year the first iPhone was launched. Thanks to the immense popularity gained by the avant-garde gadget, it took only five more years for the valuation to hit $500 billion.

The next half a trillion came within a

short span of six years. Currently, the stock is trading at a valuation close

to $1.5 trillion, marching past market concerns surrounding the global pandemic

and the US-China trade war.

Keeping in view that Apple doubled its first $500 billion market cap in just five years and tripled in another two years, hitting $2 trillion appears an easy target based on historical performance in the market.

[irp posts=”59851″]

Only if things were that simple. As we know,

historical performance is only an indicator and not a pattern to be adhered to.

Services to play a key role

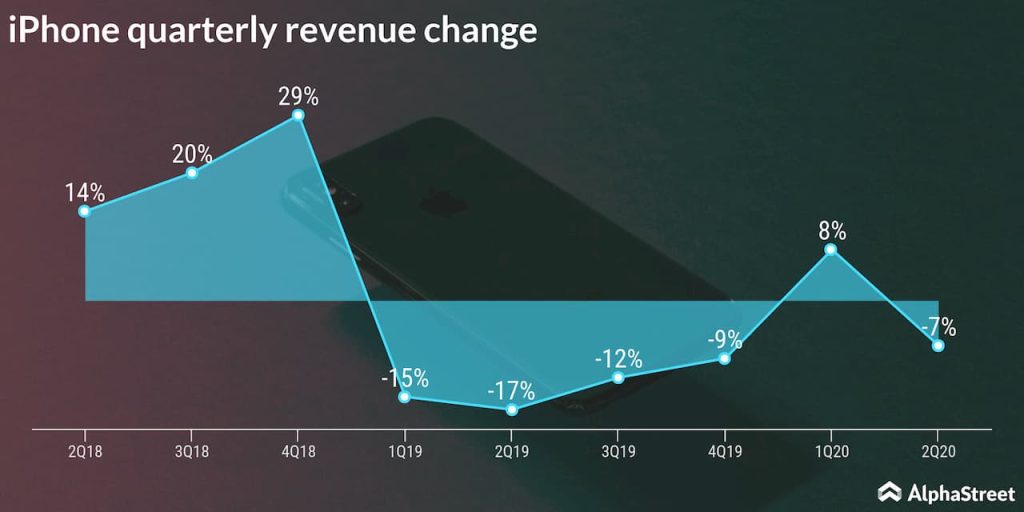

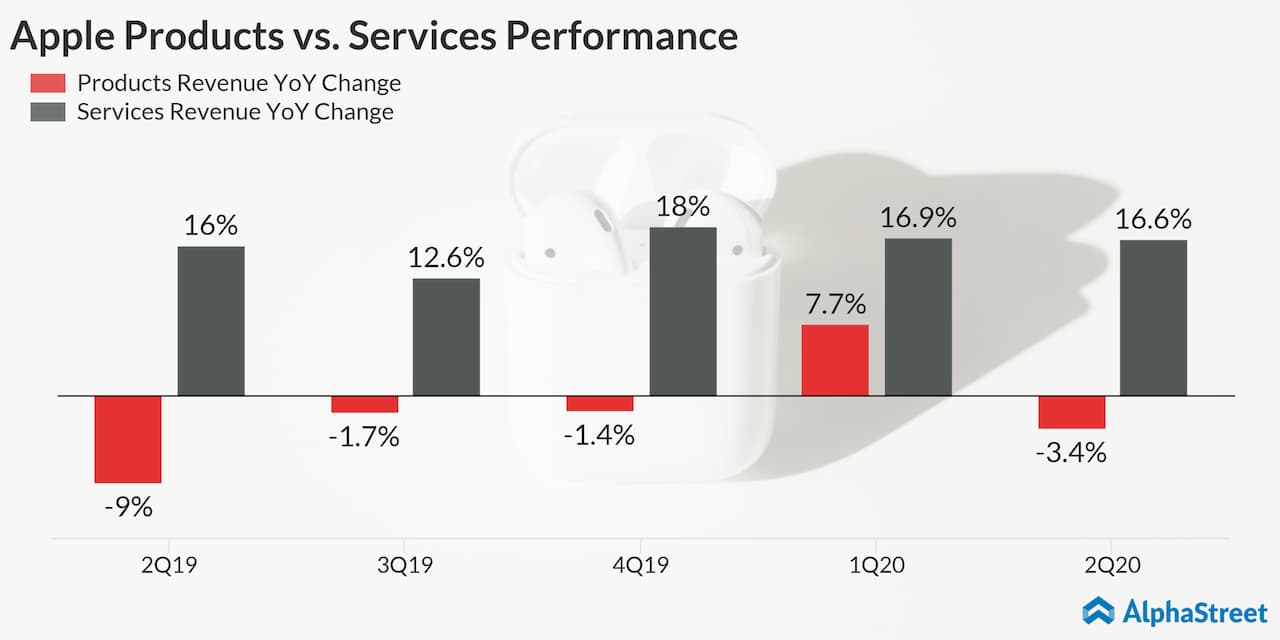

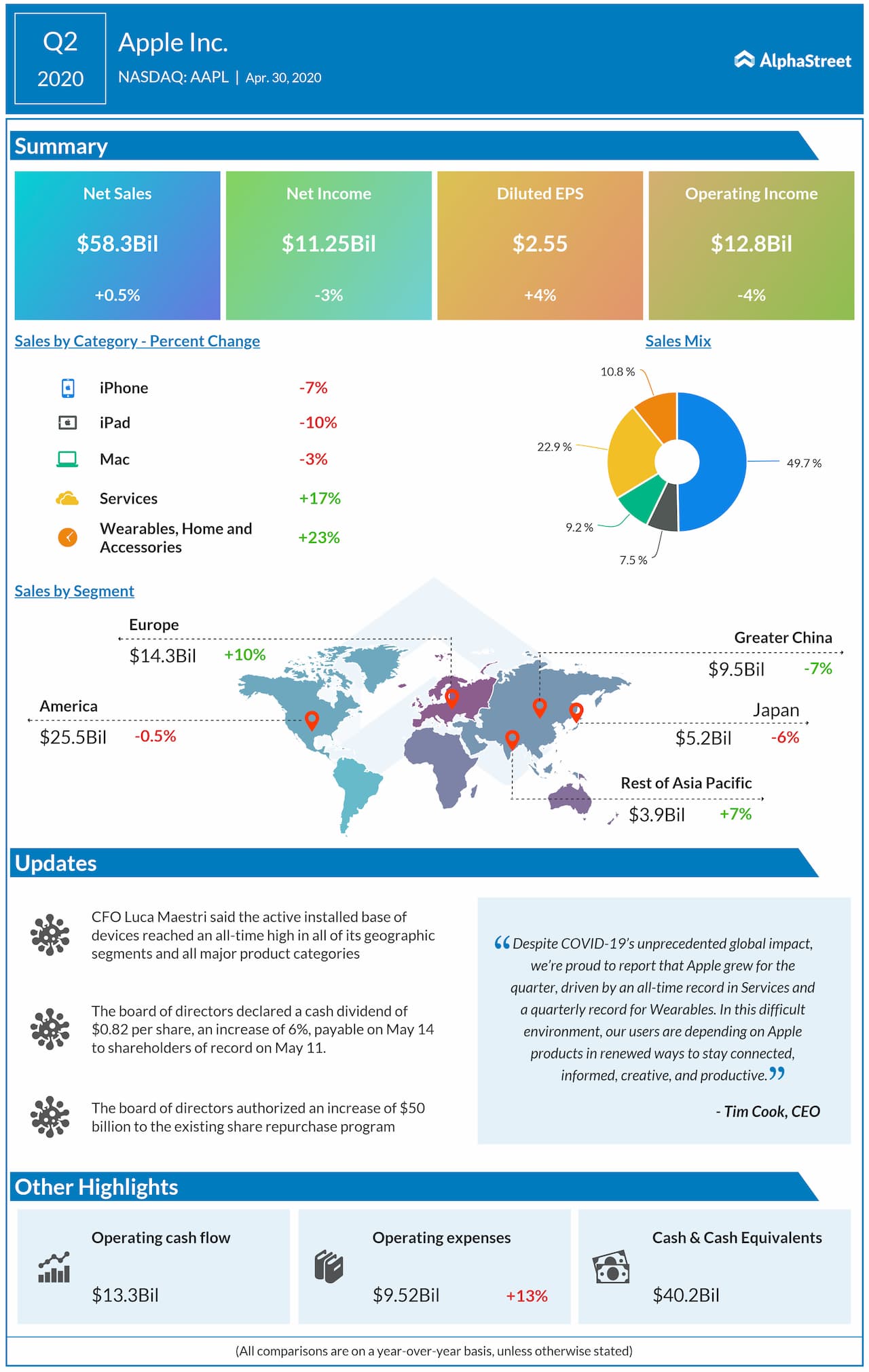

Of late, we have seen Apple’s services segment offsetting some of the weakness seen on iPhone sales. The Services unit will play a key role in Apple’s journey to $2 trillion as it increases its revenue contribution to approximately $100 billion. Wearables, which has been gaining more acceptance among consumers over the past few years, is expected to continue posting double-digit growths to around $60 billion by 2024.

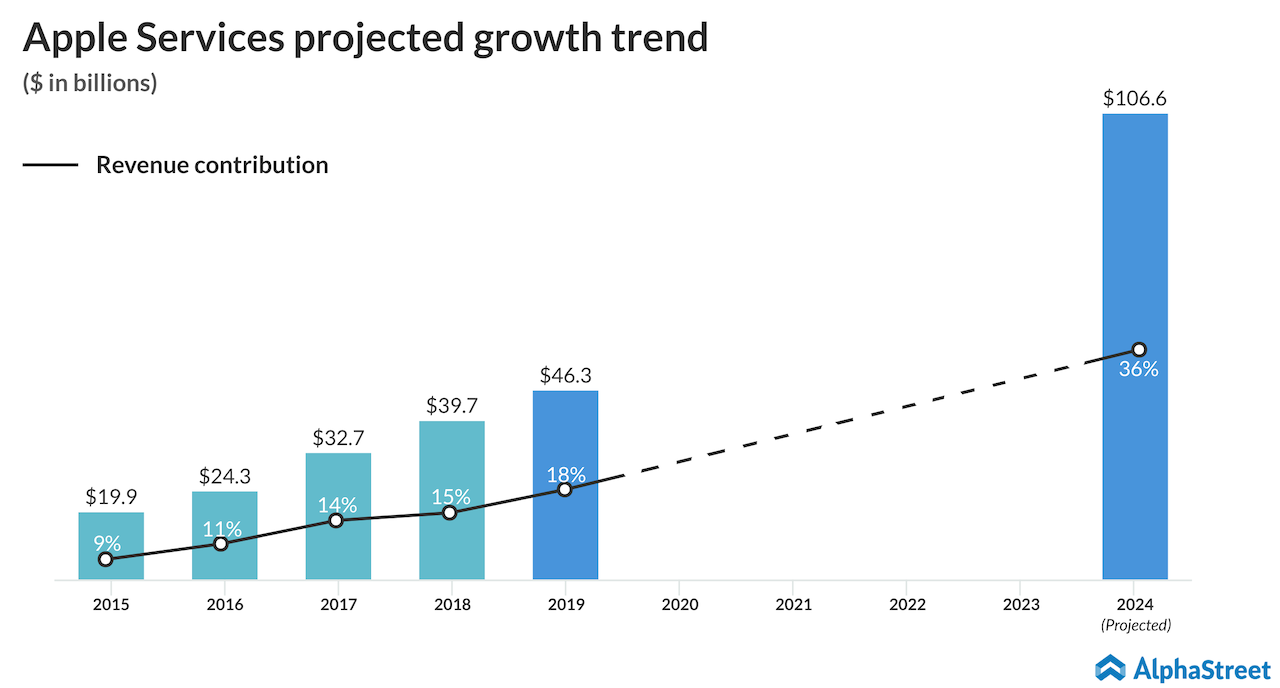

Let’s now break down the Services revenue trend to understand the approximation of $100 billion by 2024.

From fiscal 2015 to 2019, revenue from this business – which includes iCloud, Apple Music, App Store, Apple Arcade, etc – has grown at an average of 23%. At the end of fiscal 2019, the company had registered revenues of $46.3 billion. So if it continues to achieve the current rate of annual growth, that would take it to $106.6 billion at the end of fiscal 2024.

[irp posts=”62564″]

Apple has been transforming itself into a services platform over the past few years, increasing its revenue dependence on the high-margin Services segment. While it accounted for less than 10% of total revenues in fiscal 2015, the uptrend over the years suggests Services could contribute at least a third of Apple’s overall revenues by 2024.

And as Daryanani noted, a fast-growing services segment would help expand the overall gross margins of the firm, in turn, EPS. Robust stock buybacks could further fuel the EPS growth, possibly translating to stock price inflation.

Others in the race

Other members of the elite “Trillion dollar club” are also racing to the $2 trillion mark.

While Jefferies analyst Brent Thill believes Amazon could breach this mark by as early as 2023, Philip Winslow of Wells Fargo Securities bets on Microsoft to achieve the feat by around the same time.

[irp posts=”62384″]

__

For more insights into Apple Inc, read the latest earnings call transcript here.