Estimates

Conagra Brands’ stock had a weak start to 2025 and has lost 8% since the beginning of the year. After slipping to a five-year low recently, the shares have been trading sideways. The average stock price for the last 52 weeks is $28.83, which is up 12% compared to the last closing price.

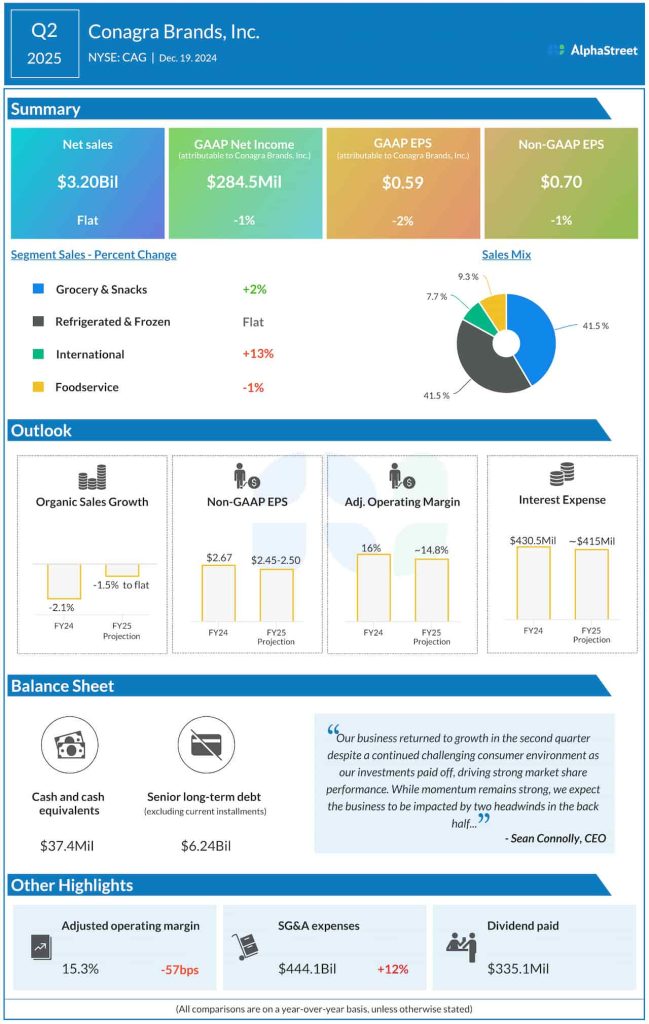

Flat Sales

In the second quarter, sales remained broadly unchanged year-over-year at $3.20 billion, while adjusted earnings edged down by 1% to $0.70 per share. A modest increase in grocery and snack sales was offset by weakness in other business segments. Organic net sales rose 0.3% during the quarter. Net income, on an unadjusted basis, was $284.5 million or $0.59 per share in the second quarter, compared to $286.2 million or $0.60 per share in Q2 2024. Meanwhile, both sales and profit beat estimates, after missing in the prior quarter.

From Conagra Brands’ Q2 2025 earnings call:

“While we’re happy with our top-line performance through Q2, we do expect two factors to pressure the second half of the year: inflation and FX. On inflation, last quarter we told you we expected it to peak in Q2 and then fall in the second half, driven in part by lower costs on proteins. Our latest forecast projects that relief on protein costs will be delayed until after the end of the fiscal year. But to be clear, we do still expect these costs to fall as animal supply strengthens. We also expect some deflation on crop-based inputs as fiscal 26 unfolds. Given this updated outlook, we are not locking in commodity prices at the peak.”

Outlook

The Conagra Brands leadership recently revised its fiscal 2025 financial guidance, forecasting a 2% year-over-year decrease in organic sales, compared to the previous outlook of down 1.5% to flat. The company lowered its full-year adjusted EPS guidance to $2.35 from $2.45-$2.50 estimated earlier. The revised guidance for FY25 adjusted operating margin is approximately 14.4%, which marks a reduction from the earlier forecast of around 48%. While reaffirming its long-term financial targets, the company said the revised FY25 guidance does not include potential impacts from new tariffs.

Conagra Brands’ stock is maintaining a downtrend ahead of next week’s earnings. On Tuesday, the shares traded lower throughout the session.