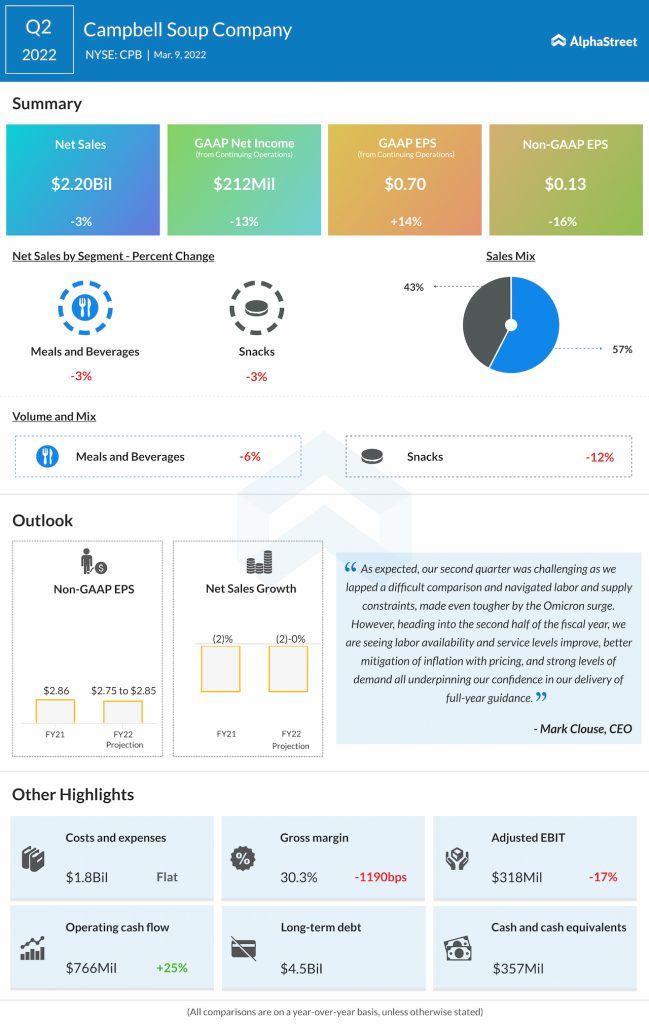

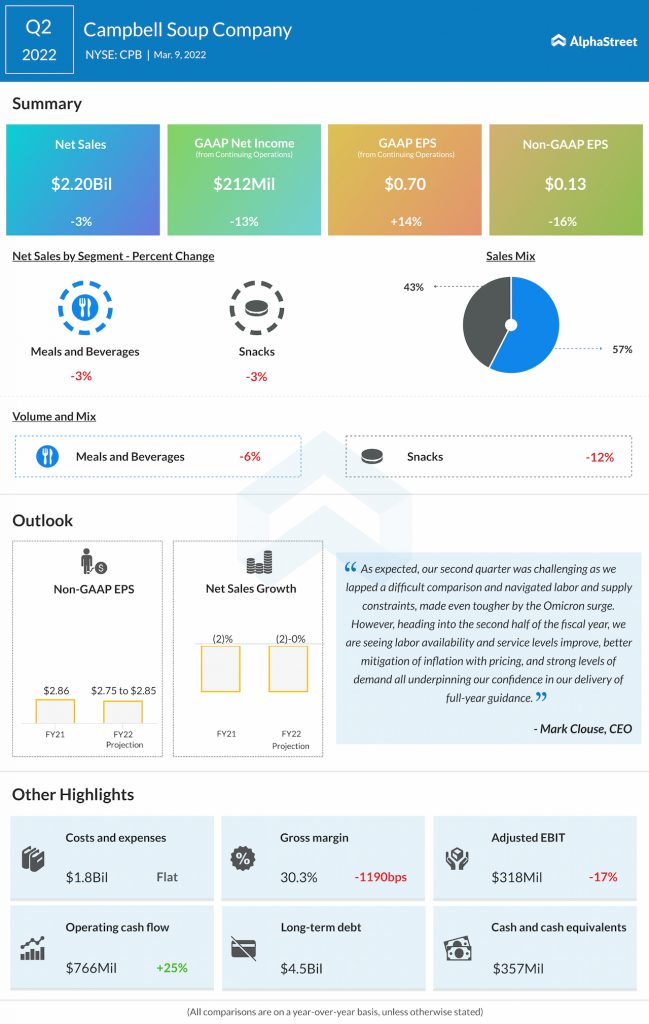

Mixed results

Headwinds

The biggest headwind that Campbell faced during the quarter was inflation. Rising inflation, along with lower volume, led to double-digit declines in margins and earnings during the second quarter. Adjusted EBIT declined 17% YoY due to higher costs on ingredients and packaging, transportation, and labor. Volumes declined due to industry-wide labor and supply challenges and this offset the positive impacts of net pricing during the quarter.

Campbell faced tough sales comparisons to the year-ago period when at-home food consumption saw a significant spike amid the pandemic. Supply constraints also impacted the company’s ability to meet demand during the quarter. Campbell faced short-term market pressure on certain brands, particularly where distribution levels were down. Both the Meals & Beverages and Snacks divisions reported declines in organic sales during the quarter.

Despite this, the company saw strong performance for its key brands in both segments. It has also seen a rise in household penetration for its soup category as more consumers are purchasing its soup brands compared to pre-pandemic levels. In the ready-to-serve category, the Chunky brand is seeing good momentum as people are eating more low-prep lunches than last year.

Outlook

Looking ahead, Campbell expects to see strong demand for the rest of the year with a steady pickup in supply and service levels, especially in the fourth quarter as labor recovers. The company expects to mitigate the pressures of inflation through pricing, supply chain productivity improvements, and cost savings initiatives. The full effects of wave two pricing will be reflected in the third quarter.

Core inflation is now expected to be low double digits for the full year. Campbell expects these efforts, coupled with an improved labor outlook and easier prior-year comparisons, to drive progress and recovery in margins and earnings during the second half of the year.

For FY2022, organic net sales are expected to range between minus 1% to plus 1% while adjusted EPS is estimated to range between minus 4% to flat compared to FY2021. Adjusted EBIT is expected to be minus 4.5% to minus 1.5%.

Click here to read the full transcript of Campbell Soup Company’s Q2 2022 earnings conference call