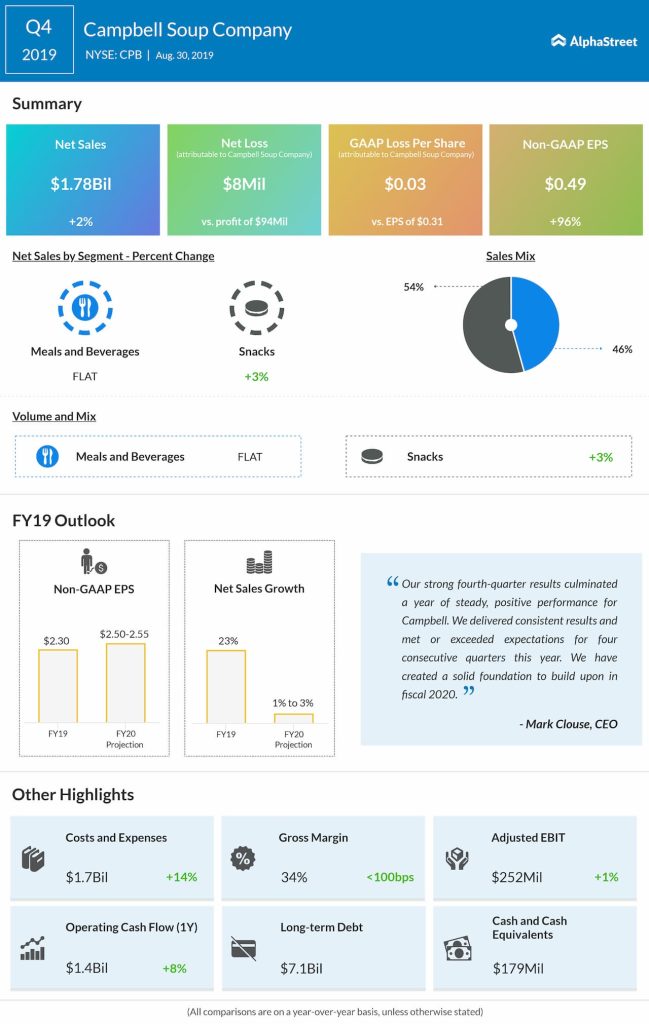

Net sales rose by 2% to $1.78 billion, driven by gains in Snacks, as well as Meals & Beverages. The combined total net sales increased by 2% to $2.02 billion.

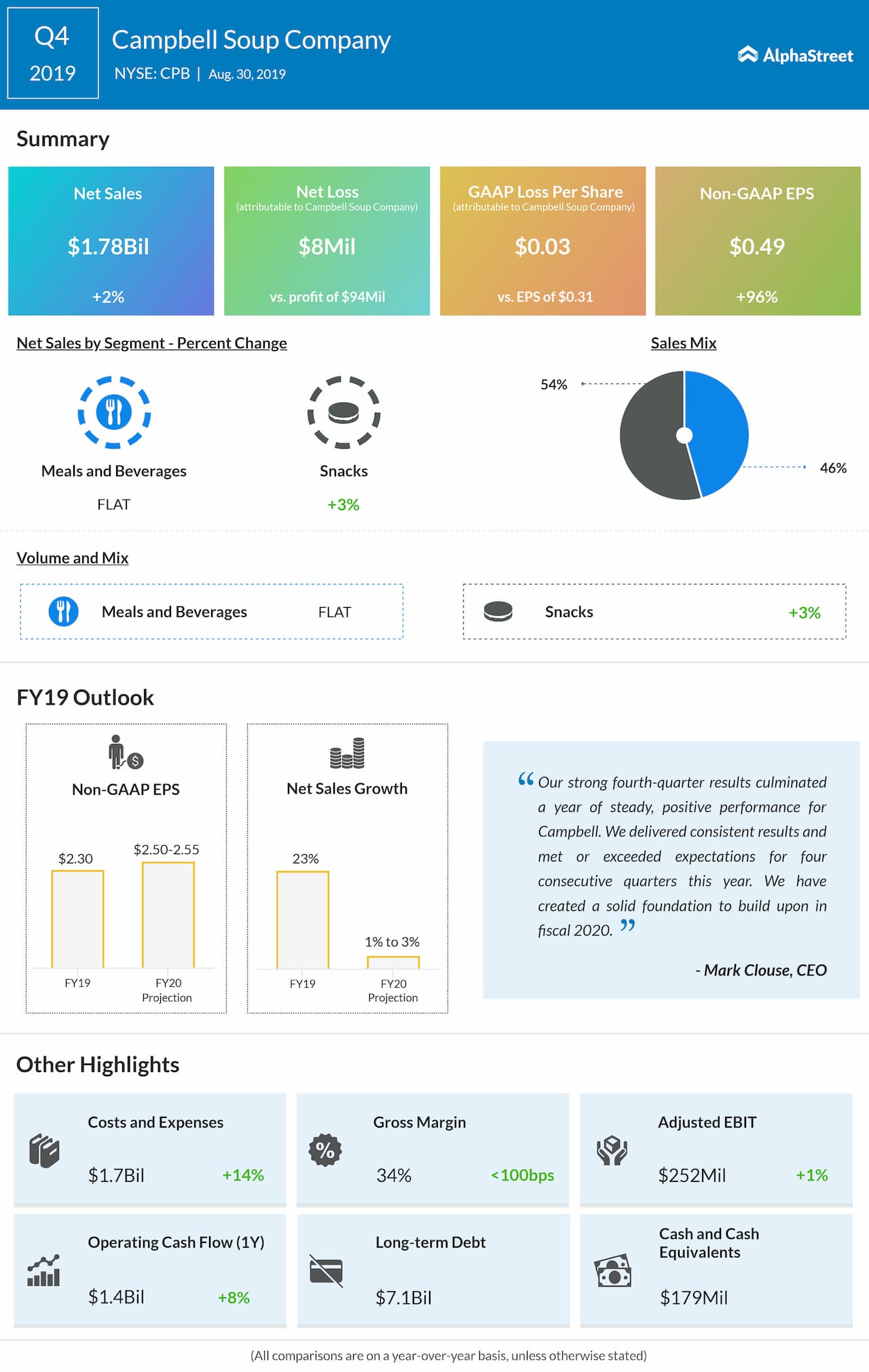

Looking ahead into fiscal 2020, the company expects net sales growth in the range of 1% to 3% and adjusted earnings to increase by 9% to 11% year-over-year to the range of $2.50 to $2.55 per share. Adjusted EBIT is predicted to be in the range of 2% to 4%.

On July 12, 2019, the company agreed to sell the Kelsen Group and on August 2, that it agreed to sell Arnott’s and certain of Campbell’s International operations. These transactions are expected to close in the first half of fiscal 2020. This portfolio of businesses referred to as Campbell International, which was previously included in the Global Biscuits and Snacks segment, is now reported as discontinued operations along with Campbell Fresh.

Effective as of the fourth quarter of fiscal 2019, Campbell is reporting operating results in two segments: Meals & Beverages, and Snacks. The expected net proceeds of about $3 billion from the divestitures of Campbell Fresh and Campbell International are being used to reduce debt.

Read: Will Tesla stock continue to fall on tariff uncertainty

In the fourth quarter, Campbell achieved $45 million in savings under its multi-year cost savings program, inclusive of Snyder’s-Lance synergies, bringing total program-to-date savings to $560 million. As previously announced, Campbell is targeting cumulative annualized savings of $850 million by the end of fiscal 2022.

For the fourth quarter, sales from Meals & Beverages were comparable to the prior year. Organic sales rose 1% reflecting solid performance in US soup, Prego pasta sauces, and Pace Mexican sauces. Sales of US soup increased 3% as gains in ready-to-serve and condensed soups were offset by declines in broth.

Sales from Snacks rose by 3% and organic sales increased by 4%. This performance reflects continued momentum in Pepperidge Farm bakery products, Kettle Brand potato chips, Snack Factory Pretzel Crisps, and Late July snacks, as well as gains in Goldfish crackers, as the company laps the negative impact of the voluntary recall on July 2018.