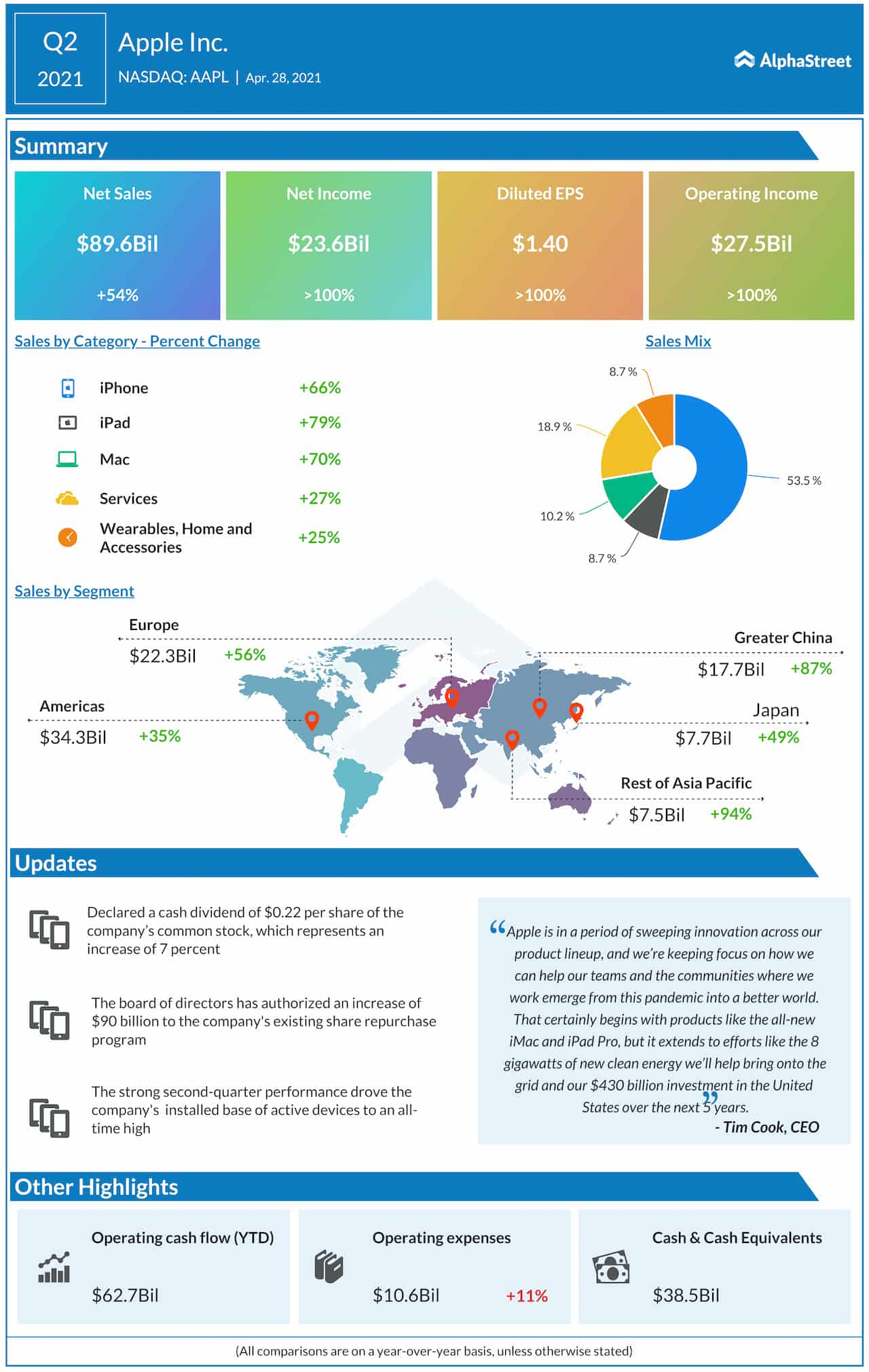

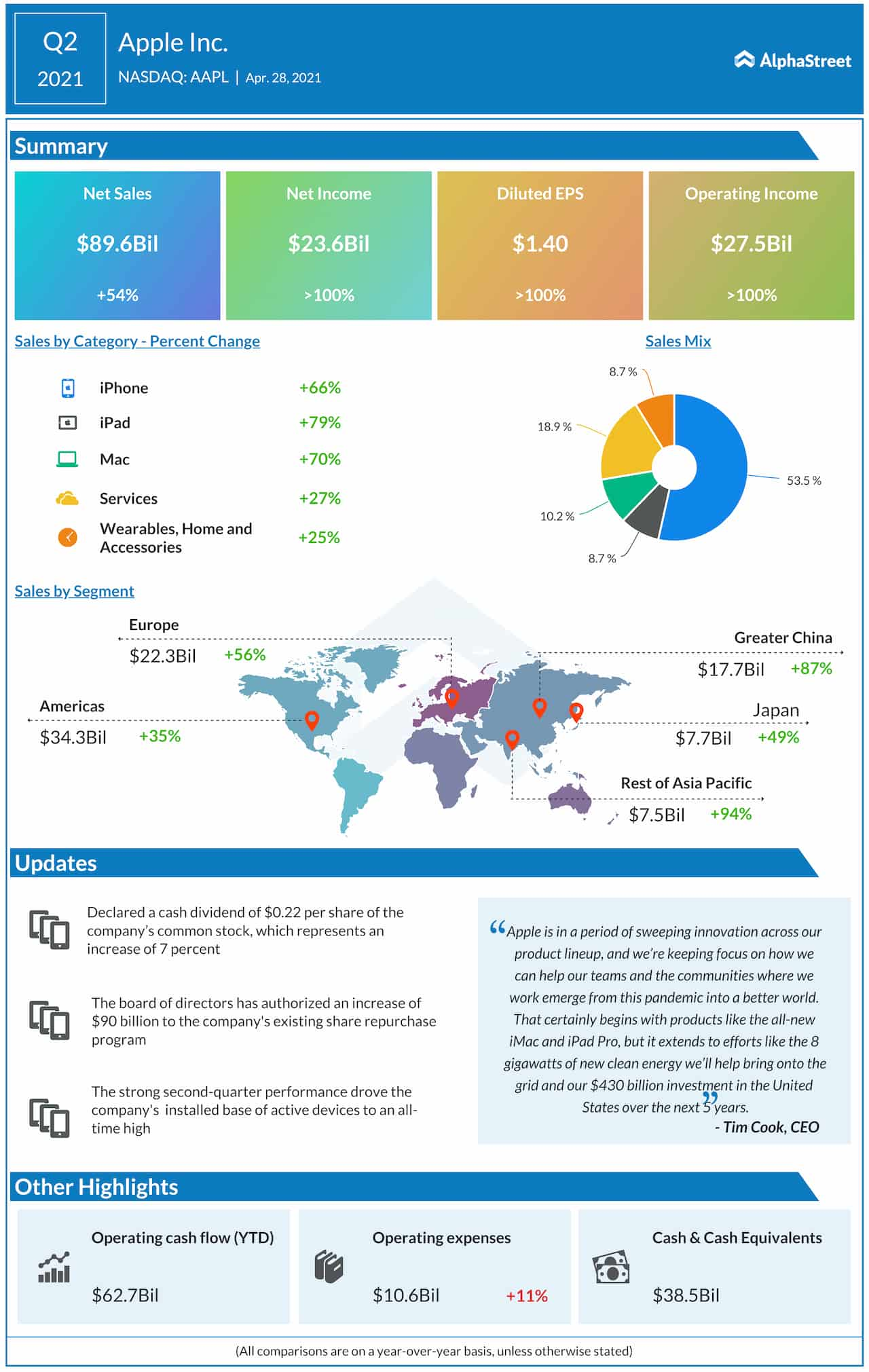

Apple Inc. (NASDAQ: AAPL) shrugged off the COVID-induced slowdown pretty quickly and entered fiscal 2021on a high note, powered by its 5G-compatible iPhone and thriving services business. After a record-breaking holiday season, the gadget giant this week once again impressed the market with blowout earnings results.

Buy AAPL?

Shares of the Cupertino-based tech titan made strong gains Wednesday evening as the market responded favorably to its impressive second-quarter results, and rose above the $135-mark. Compared to its FAANG peers the stock is more affordable, which makes it an investors’ favorite. It is estimated that the stock would recoup the recent losses this year and bounce back to the January peak. Currently, AAPL is a safe bet that can add value to your investment portfolio.

Read managemnt/analysts’ comments on Apple’s Q1 report

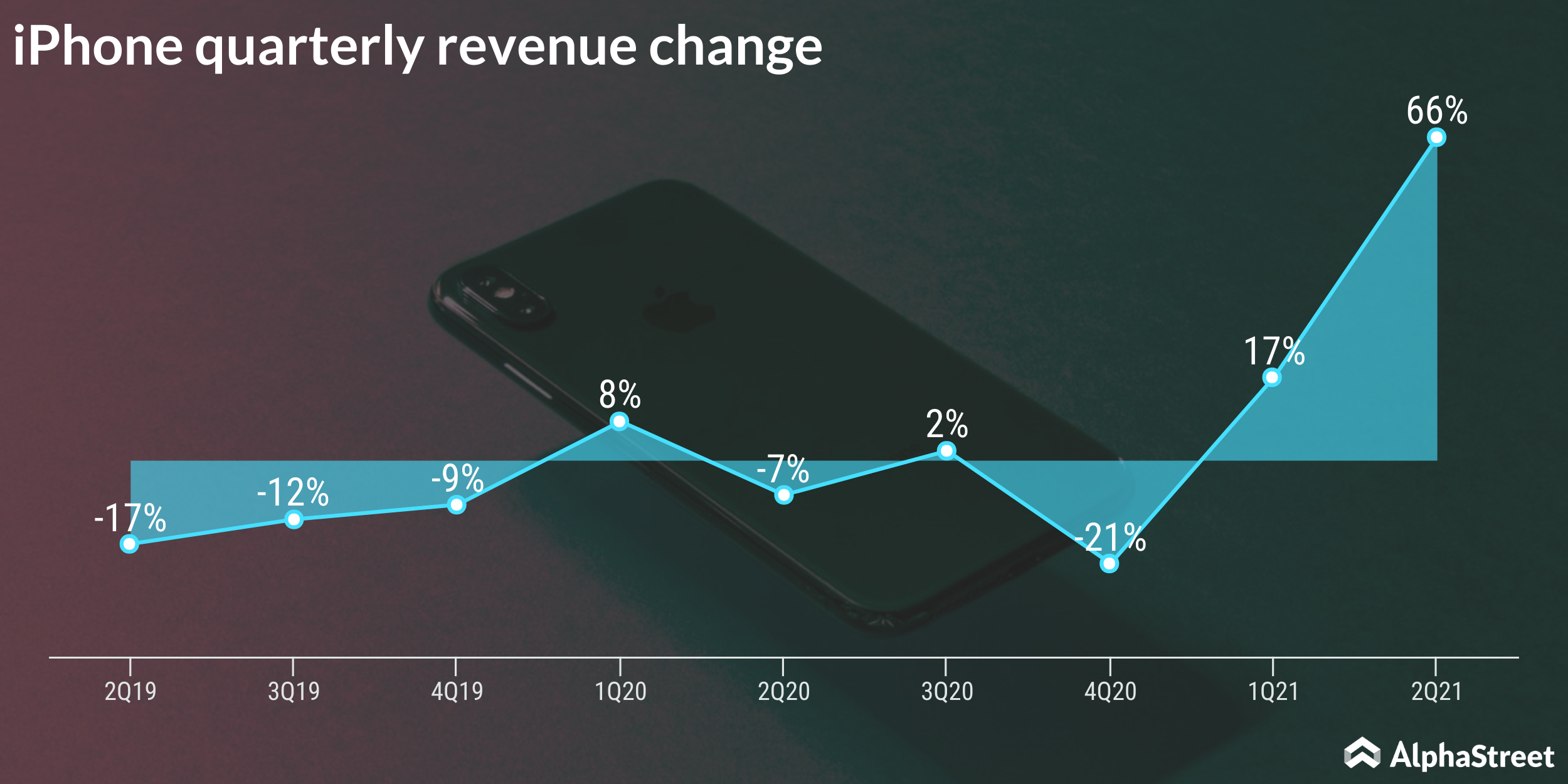

When markets fell into the grip of coronavirus early last year, Apple’s revenues suffered as iPhone sales faltered, extending the slowdown experienced in the trailing quarters. Though challenges like the severe chip shortage persisted, things changed for the better in the early months of fiscal 2021 when sales bounced back and stayed in the positive territory. Underscoring the company’s strong financial position, the management has announced an additional $90 billion of stock buyback and a 7% dividend hike.

Focus on Services

The stable growth of the services segment, which includes the Apple TV streaming service and the Apple Store, indicates the company has transitioned from a gadget maker into a diversified technology provider. While the current momentum is mainly attributable to the shelter-in-place orders that lifted the demand for digital services, the uptrend will likely continue even after the economy reopens. As part of streamlining the portfolio, the management has decided to reduce the production of AirPods amid weak demand.

We achieved growth of 27% year-over-year and set new records for services in each of our geographic segments. We continue to enhance and improve our current service offerings from Apple Music to Apple News, while continuing to launch new services that enhance our customers’ lives. Just last week, we introduced Apple Card Family, which reinvents how you can share credit cards and build credit together.

Tim Cook, CEO of Apple

iPhone Sales Surge

In the second quarter, iPhone sales increased a whopping 66% aided by the COVID-driven spike in smartphone demand, thanks to the widespread adoption of digital services. As a result, total sales climbed 54% to about $90 billion and earnings more than doubled to $1.40 per share. The upbeat sales trend – double-digit annual growth – was reflected across all the operating segments and geographical regions.

The top-line performance also got a boost from the rapidly growing services business which has emerged as the second-largest division, generating relatively stronger margins. The second-quarter numbers far exceeded the market’s projection. The company expects June-quarter revenue to grow strong double-digits annually but sees a sequential decline from the March quarter.

Stock Movement

Apple’s market value more than doubled in the past twelve months making it the first Wall Street firm to cross the $2-trillion mark. The stock, which outperformed the broad market consistently this year, traded slightly higher in Thursday’s early session, extending the post-earnings momentum.