Health insurer Cigna (CI) reported a surge in its second-quarter profit and revenue, mainly due to strong performance across multiple businesses. The company also raised its full-year 2018 outlook that sent the stock up 2.22%.

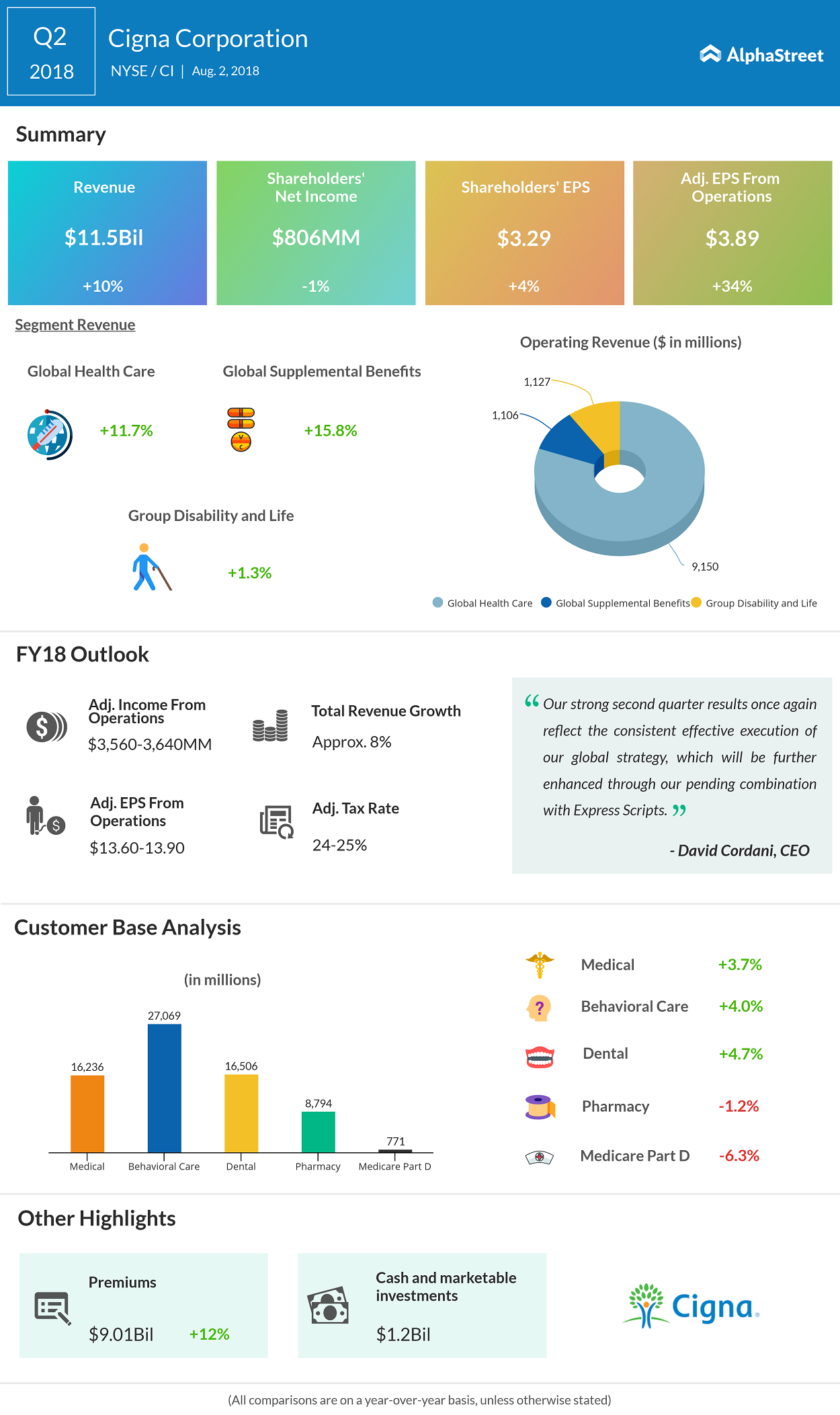

Cigna’s revenue rose 10% to $11.5 billion, topping the consensus estimate of $11.15 billion.

Net income was $806 million, or $3.29 per share, compared to $813 million, or $3.15 per share, for the second quarter of 2017. Excluding items, the health service company earned $3.89 per share, that beat consensus estimate of $3.33 per share.

“Our strong second quarter results once again reflect the consistent effective execution of our global strategy, which will be further enhanced through our pending combination with Express Scripts.” said David M. Cordani, CEO.

Cigna’s medical customer base at the end of Q2 2018 totaled 16.2 million, an increase of 329,000 customers year to date. This increase was driven by continued organic growth in Select, Middle Market, and Individual segments.

The company reported Total Commercial medical care ratio (“MCR”) of 76.3%, reflecting the strong performance Commercial Employer business, the pricing effect of the resumption of the health insurance tax, and favorable prior-year reserve development.

For fiscal 2018, adjusted EPS is projected to grow to $13.60 to 13.90.

Related Infographic