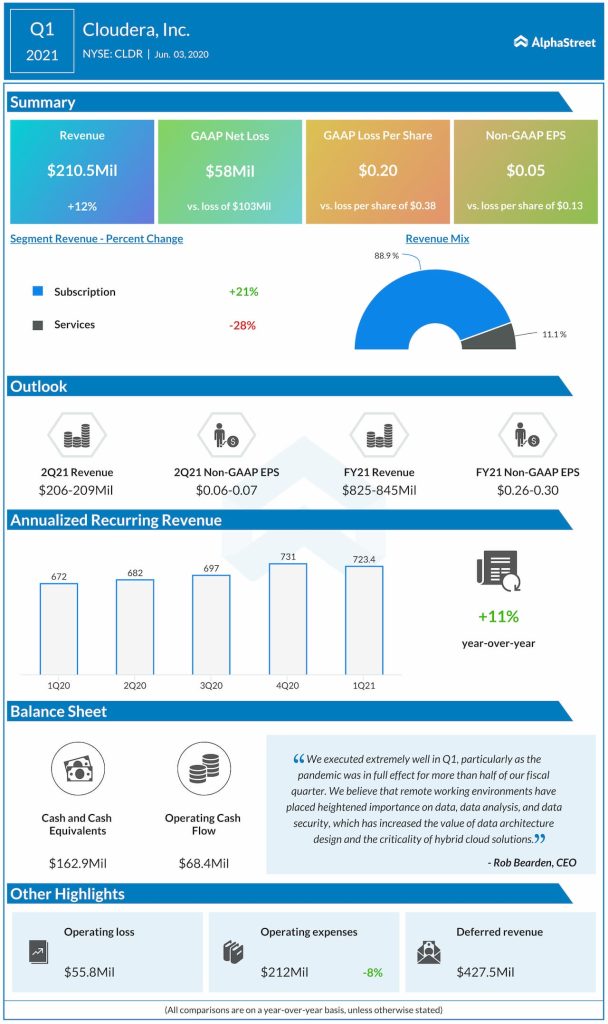

Looking ahead into the second quarter of fiscal 2021, the company expects total revenue in the range of $206-209 million and adjusted earnings in the range of $0.06-0.07 per share. For fiscal 2021, the company predicts total revenue in the range of $825-845 million and adjusted earnings in the range of $0.26-0.30 per share.

The business outlook is based on the assumption that the recessionary impact of the coronavirus pandemic (COVID-19) will peak in Cloudera’s second and third quarters of fiscal 2021 and moderate in the fourth quarter of our fiscal 2021.