Cloudera’s (NASDAQ: CLDR) bottom and topline results for the third-quarter 2020 beat the market estimates. The enterprise data cloud company posted an adjusted loss of $0.03 per share on revenue of $198.3 million. The market had projected Cloudera to post a loss of 6 cents per share on revenue of $189.5 million. CLDR stock was up about 5% during the after-market session.

Cloudera’s GAAP net loss per share for the third quarter of fiscal 2020 was $0.29 per share compared to a GAAP net loss per share of $0.17 per share for the third quarter of fiscal 2019. Subscription revenue grew to $166.9 million in the three months ended October 31, 2019, from $100.8 million in the prior-year quarter.

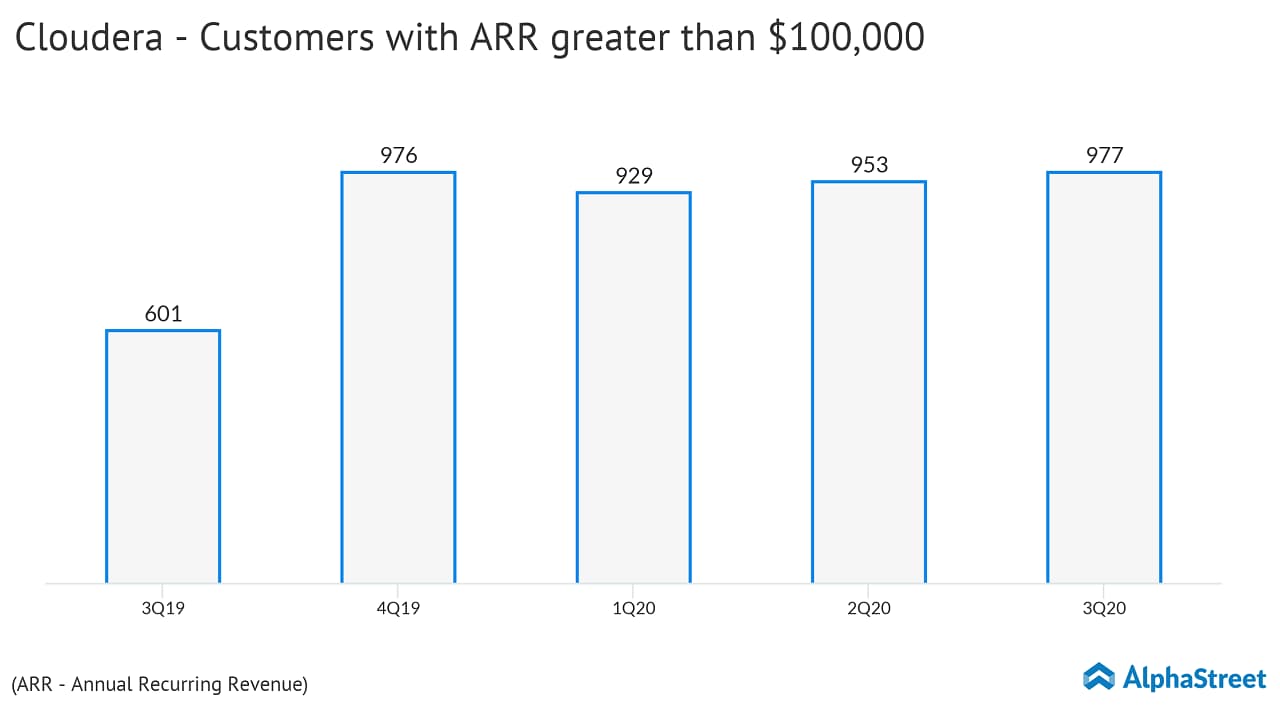

Customers with Annualized Recurring Revenue (ARR) greater than $100,000 were 977, up 24 from the prior quarter. Annualized Recurring Revenue grew 13% year-over-year to $697.4 million in the recently ended quarter.

For the fourth quarter of fiscal 2020, non-GAAP net loss per share is expected to be in the range of $0.04 to $0.02 per share. Total revenue is touted to be in the range of $200 million to $203 million and subscription revenue is expected to be in the range of $173 million to $176 million.

For fiscal 2020 ending January 31, 2020, Cloudera expects non-GAAP net loss per share to be in the range of $0.21 to $0.19 and total revenue in the range of $782 million to $785 million. Subscription revenue is eyed in the range of $659 million to $662 million.

Cloudera stock had lost 10% of its value so far this year, while it advanced 20% in the past three months.