The Stock

As AI adoption gathers steam, Coca-Cola looks determined not to miss the bus – it has launched an AI-supported flavor named Y3000 Zero Sugar. The post-pandemic reopening and resumption of outdoor events enabled the company to beat economic uncertainties, since the away-from-home business accounts for about 50% of its sales.

What’s in Cards

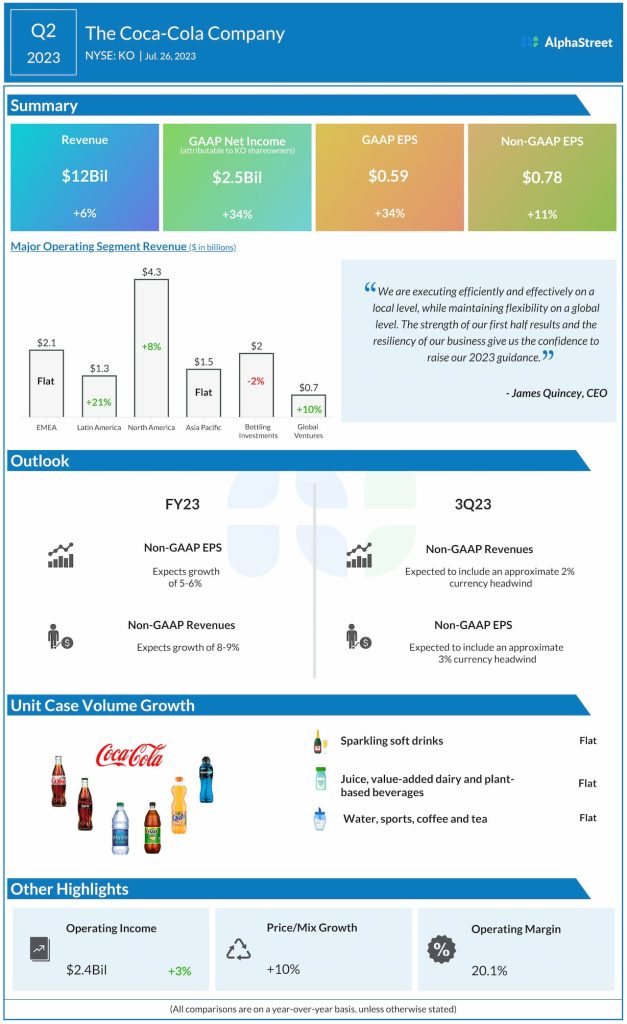

While Coca-Cola has a relatively high debt to equity ratio, investors will likely overlook that and focus on the company’s operating efficiency and scale. Meanwhile, the challenging macro environment remains a concern though supply chain issues eased significantly since the pandemic era. In the near term, the company is likely to experience softness in some overseas markets due to geopolitical tensions and elevated global inflation. The slowdown in China, which is an important market for the company, will be a drag on sales in that region. The Coca-Cola leadership recently cautioned that third-quarter revenues would include around 2% currency headwinds and 1% headwinds from acquisitions, divestitures, and structural changes.

From Coca-Cola’s Q2 2023 earnings call:

“Inflationary pressures are beginning to moderate in some ways, including freight rates that are favorable compared to last year. That said, several commodities that are prevalent in our basket, like sugar and juice, remain elevated. And we have some hedges that we’ll be rolling off to less favorable rates. Based on current rates and hedge positions, we continue to expect per case commodity price inflation in the range of a mid-single-digit impact on comparable cost of goods sold in 2023.”

Coca-Cola’s organic revenue growth – a metric that is important for consumer companies since it is considered an indicator of the underlying strength of the business — was 11% in Q2. Total revenues came in at $12 billion, which is up 6% year-over-year. North America accounted for more than one-third of the total business. At $0.78 per share, adjusted profit was higher by 11% compared to the year-ago period.

Impressive EPS Beat

Earnings beat estimates constantly for more than five years. Buoyed by the strong performance in the first half and the continued resilience of the business, the management raised full-year guidance. Now it expects adjusted earnings to grow between 5% and 6% in FY23. The forecast for full-year revenue growth is 8-9%. Interestingly, shipments remained broadly unchanged across all business categories in Q2

Recently, the stock dropped to the lowest level in nearly two years, before paring a part of the losses this week. The shares traded slightly higher in early trading on Tuesday.