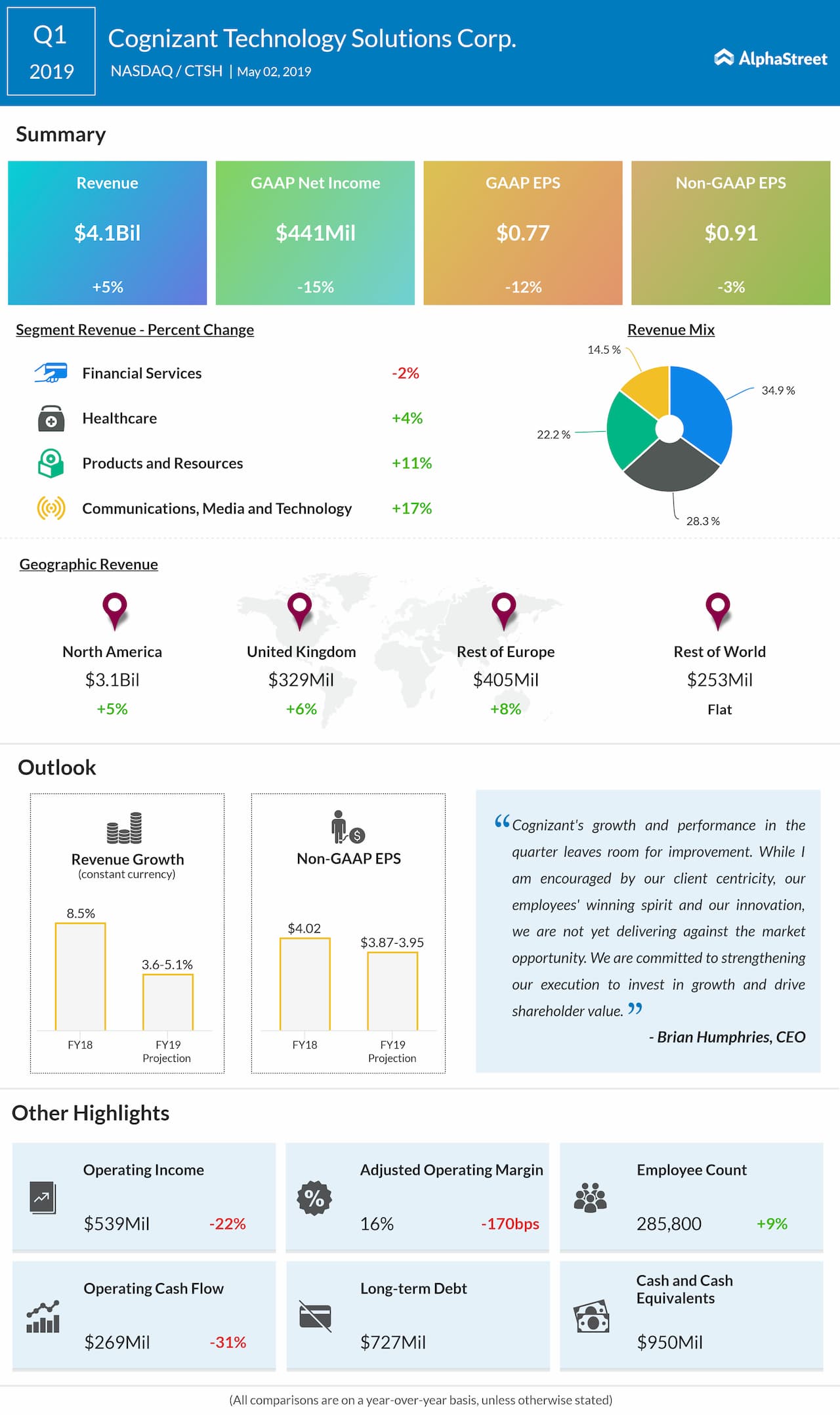

For the first quarter of 2019, Cognizant’s bottom line and top line missed Street’s predictions. The Teaneck, New Jersey-firm had guided second quarter revenue to be in the range of $4.11 billion to $4.15 billion, reflecting growth of 2.6% to 3.6%. The company slashed FY19 outlook citing the disappointing Q1 performance and sluggish growth predictions in Financial Services and Healthcare segments for the remainder of 2019. After the earnings report, shares of Cognizant plunged 11% the next day.

During the three months ended March 31, 2019, Cognizant registered double-digit growth in Products and Resources, as well as Communications, Media and Technology segments. However, Financial Services segment, which accounted for 35% of total revenue in Q1, dropped 2% hurt by the softness in banking and insurance clients. Healthcare, which accounted for 28% of total revenue, had a growth of 4%. As the company announced in May, this sluggishness is expected to continue in the Financial Services and Healthcare segments for the June quarter.

The learning curve for Brian Humphries, the new CEO who joined the company on April 1 this year, should be over by now. During the second quarter earnings conference call, investors will look out for his plans to overcome the headwinds that Cognizant is facing now.

With regards to a question on its banking clients, the company stated during the last earnings call that it neither expects a significant recovery nor deterioration with the three of big five banking clients moving into the second half of the year. The company added that the four healthcare companies involved in two large mergers resulted in some pullbacks during the first quarter, and this deterioration will continue in Q2 and prolong in the rest of the year also.

Related: Cognizant (CTSH) Q1 2019 earnings conference call transcript

Cognizant stock, which plummeted to a new 52-week low ($56.73) in May, had advanced 4% since the beginning of this year and slumped 19% in the trailing 12 months.