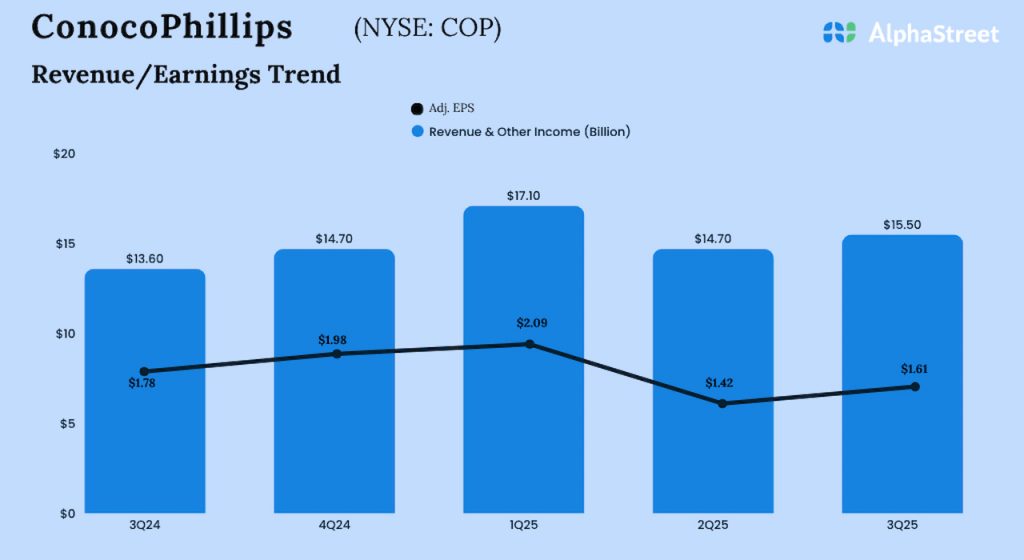

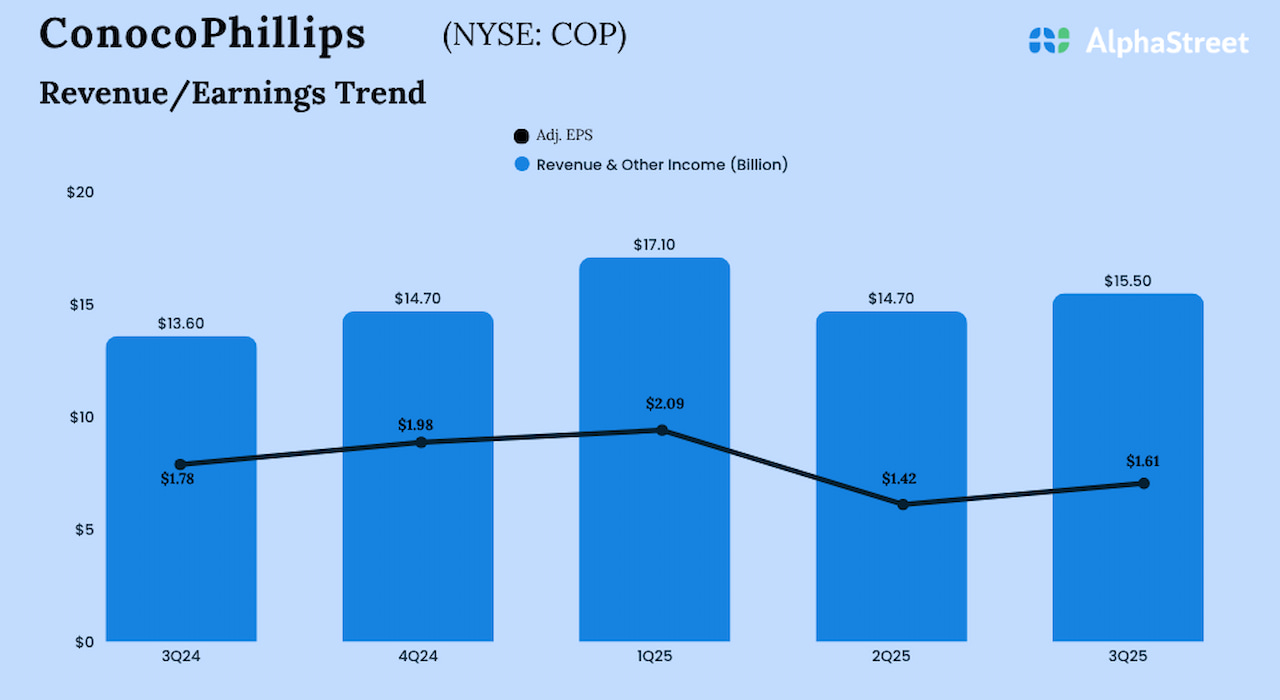

Revenues and other income rose to $15.5 billion in the third quarter from $13.6 billion last year. Total production was 2,399 MBOED in Q3, an increase of 482 MBOED from the same period a year ago. Adjusting for closed acquisitions and dispositions, production increased 4% YoY.

The management raised its full-year 2025 production guidance to 2.375 MMBOED and further reduced operating cost guidance to $10.6 billion. It also issued preliminary 2026 guidance, with $12 billion of capital expenditures, $10.2 billion of adjusted operating costs, and 0-2% underlying production growth.

Ryan Lance, chief executive officer of ConocoPhillips, said, “Looking to 2026, we expect lower capital and operating costs with flat to modest production growth. Willow total project capital is updated to $8.5 to $9 billion, with total LNG project capital reduced to $3.4 billion. Powered by our deep, durable, and diverse portfolio, we remain on track to deliver an expected $7 billion in incremental free cash flow by 2029, including $1 billion each year from 2026 through 2028.”