Sales

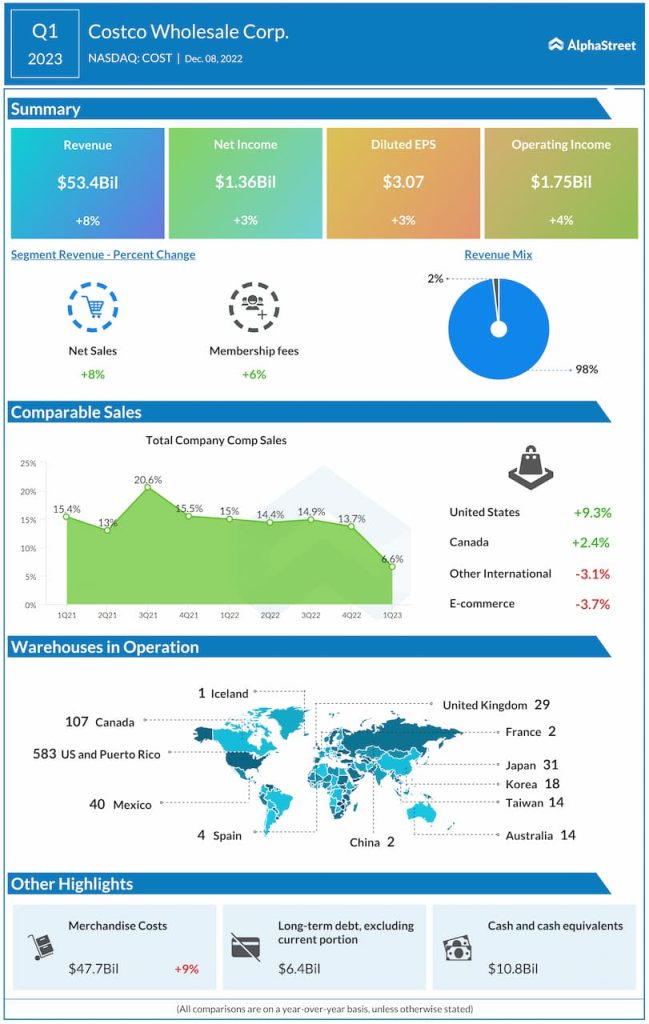

During the quarter, Costco saw a 3.9% increase in traffic worldwide with a 2.6% growth in average transaction size. In the US, traffic was up 2.2% while average transaction size increased 6.9%. Ecommerce sales were down 3.7% in Q1.

On its quarterly conference call, Costco said that ecommerce growth had benefited mainly from big-ticket items like electronics and furniture earlier but these categories are now seeing some weakness which is in turn impacting ecommerce. The company still sees long-term growth opportunity in ecommerce.

Membership income

Membership fees comprise a significant part of Costco’s income. In Q1, membership fee income rose 5.7% year-over-year to $1 billion. Renewal rates in the US and Canada stood at 92.5% at the end of the quarter while the worldwide rate stood at 90.4%.

Costco ended the quarter with 66.9 million paying household members and 120.9 million cardholders, both up 7% versus last year. Paid executive memberships stood at 30 million at the end of Q1. Executive members currently make up 45% of paid memberships and just under 73% of worldwide sales.

Warehouse expansion plan

Costco plans to open 24 units in fiscal year 2023. In Q1, the company opened seven new warehouses. Of these, four were in the US and the remaining three were in Korea, New Zealand, and Sweden. The company plans to open three units in Q2, four in Q3, and 10 in Q4. Of the planned 24 units, 15 will be in the US.