What’s in Store?

The company improved its financial position in the early months of fiscal 2021, after ending the last year on a dismal note. But more recent data shows that demand conditions changed for the worse in the current quarter amid lower IT spending by clients, raising concerns that Oracle is probably headed for a not-so-strong year.

Also read: Tech world on alert after Ciena gives cautious outlook

Oracle’s transformation into a cloud solutions provider from a software company has not been very impressive, as the company still struggles to catch up with leading players like Amazon Web Services (AMZN) and Microsoft’s (MSFT) Azure. While maintaining its dominance in the SaaS segment, the company is continuing its cloud push through measures like linking of on-premises capabilities with the cloud platform.

Pros and Cons

The growth initiatives, combined with innovations like Oracle Autonomous Database, should bear fruit in the long term, supported by the management’s aggressive go-to-market strategy. On the other hand, the muted performance of operating segments like On-premise Consulting will remain a drag on the top-line.

Buoyed by new customer wins — with the most prominent among them being Zoom Video (ZM) — chairman & chief technology officer Lawrence Ellison told analysts this week, “I think Zoom is a great example because it proves that the Oracle Cloud is secure, reliable, high performance and economical. They pick because there is nothing to do with the Oracle Database, it has nothing to do with them doing a SaaS customer, that was just purely an evaluation of our cloud versus Microsoft’s versus Google’s versus Amazon’s.”

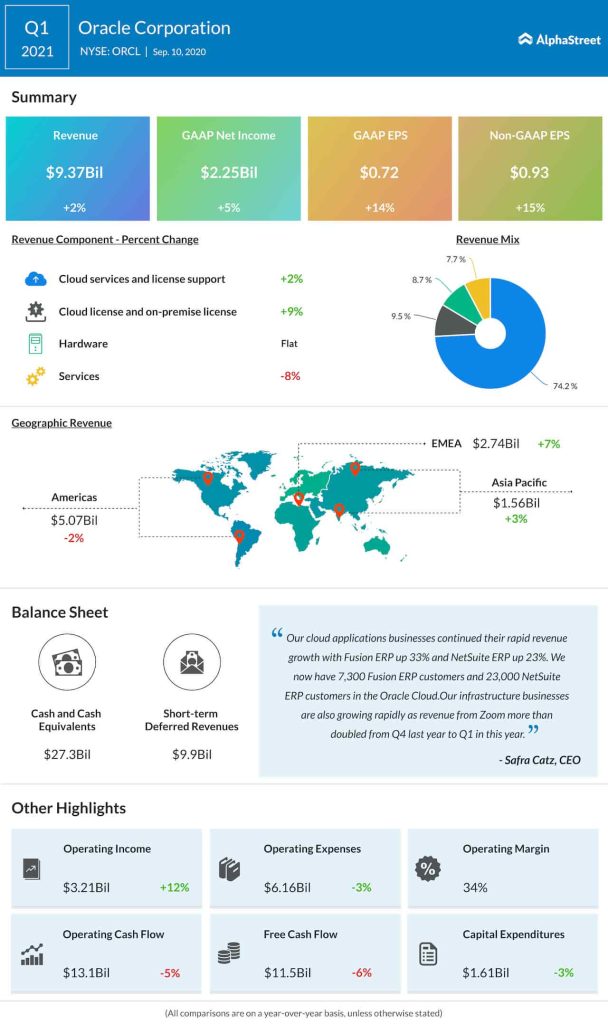

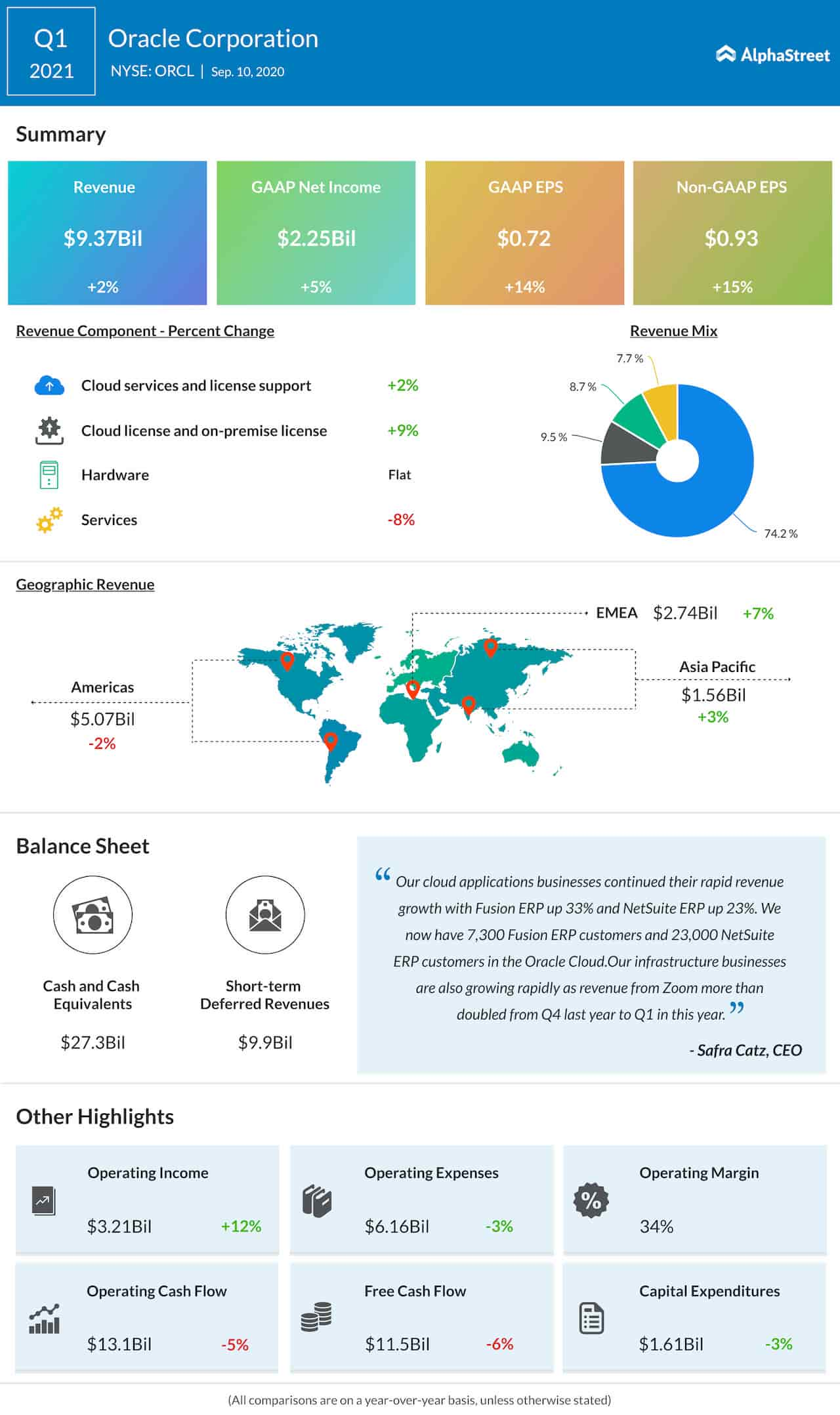

Q1 Numbers Beat

Oracle’s top-line growth was slightly impacted by the reduction in enterprise spending in the August-quarter when revenues edged up 2% to $9.4 billion. Earnings moved up in double digits to $0.93 per share, mainly reflecting a reduction in operating expenses. A further uptick in the licensing business offset weakness in the other areas. The results also came in above the market’s projection. Interestingly, the hardware segment ended its losing streak and stabilized during the quarter.

The hardware growth is entirely dominated by our strategic hardware product, which is really most focused around Exadata. Revenue in Exadata was up 15%. Bookings in our strategic hardware also up very, very high double-digit. And we have actually an enormous Exadata backlog, really the largest — it’s actually double what it was — more than double what it was last year.

Safra Catz, chief executive officer of Oracle

ADVERTISEMENT

TikTok Deal

While there is speculation that Oracle might acquire the US arm of Chinese tech firm TikTok, the former’s executives declined to discuss the matter on the post-earnings conference call. Earlier, President Trump had commented in favor of the company’s rumored deal with TikTok, which was banned in the US recently.

Related: Oracle Corp Q1 2021 Earnings Call Transcript

Over the past twelve months, Oracle’s stock remained almost flat, except for a brief retreat in mid-March when markets witnessed a mass selloff. The shares got a fresh boost Thursday and crossed the $60-mark following the positive earnings report, and continued to hover near the peak.