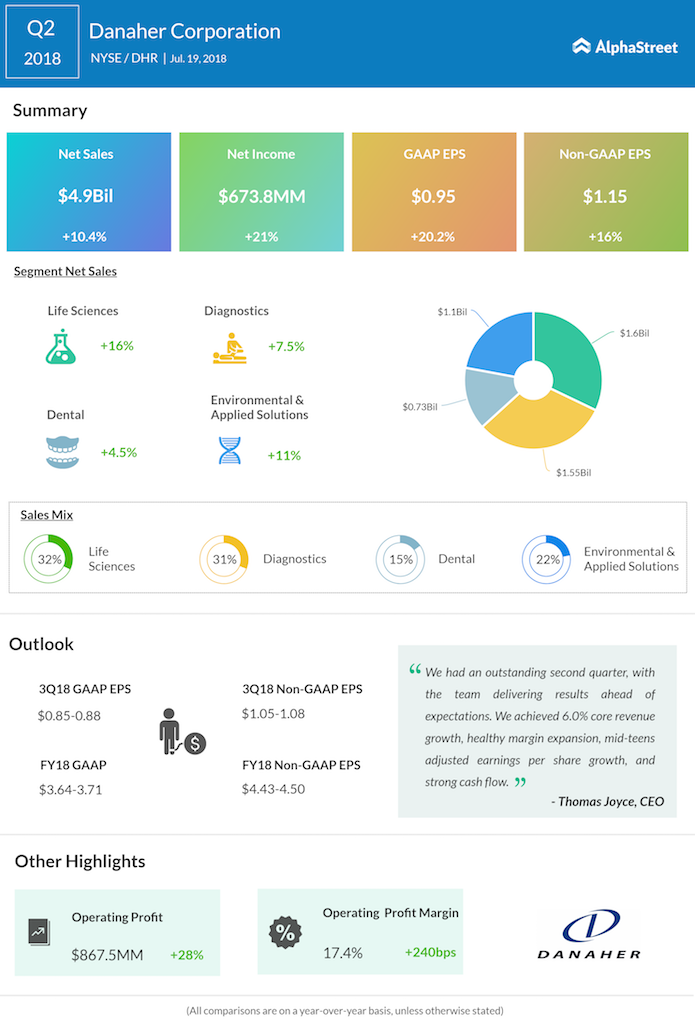

Danaher Corporation (DHR) reported a 10.5% increase in revenues to $5 billion for the second quarter of 2018, while adjusted core revenue grew 6%. Net earnings improved 20% to $673.8 million or $0.95 per share. EPS, on an adjusted basis, saw an improvement of 16% to $1.15. The company beat market estimates on adjusted EPS.

For the third quarter of 2018, the company expects GAAP EPS to be $0.85 to $0.88 and adjusted EPS to be $1.05 to $1.08. For full-year 2018, GAAP diluted EPS is projected to come in between $3.64 to $3.71. Danaher raised its 2018 adjusted diluted EPS outlook to $4.43 to $4.50 from the previous range of $4.38 to $4.45.

Thomas P. Joyce, Jr., President and CEO, said, “Our performance was broad-based, with four of our five platforms delivering mid-single digit or better core revenue growth, and we believe we are taking market share in many of our businesses. These market share gains are being driven by recent growth investments and the team’s strong new product innovation and commercial execution utilizing the Danaher Business System.”

The Washington-based conglomerate also said it is planning to spin-off its Dental segment into an independent, publicly-traded company named DentalCo. DentalCo will comprise the Nobel Biocare, Ormco and KaVo Kerr operations. The transaction is expected to be completed during the second half of 2019 and is intended to be tax-free to shareholders.

Danaher believes its Dental segment, which generated around $3 billion in revenue last year, can function more effectively as a standalone entity and focus more on growth investments. Amir Aghdaei will become President and CEO of DentalCo following the spinoff.

Related: Danaher Corp. Q2 2018 Earnings Call Transcript

Related: Danaher Q1 2018 Earnings Infographic