The restaurant chain, however, faces challenges from weak

customer traffic, particularly in Olive Garden, and the company’s plans on

driving this metric will be worth watching. Another cause of concern is higher

costs which are likely to pressure margins.

Darden has been investing in remodels and culinary

innovation at its Olive Garden and LongHorn divisions. The Brand Renaissance plan

and To Go business are expected to drive momentum at Olive Garden while the menu

innovation could help in driving comp sales growth at LongHorn.

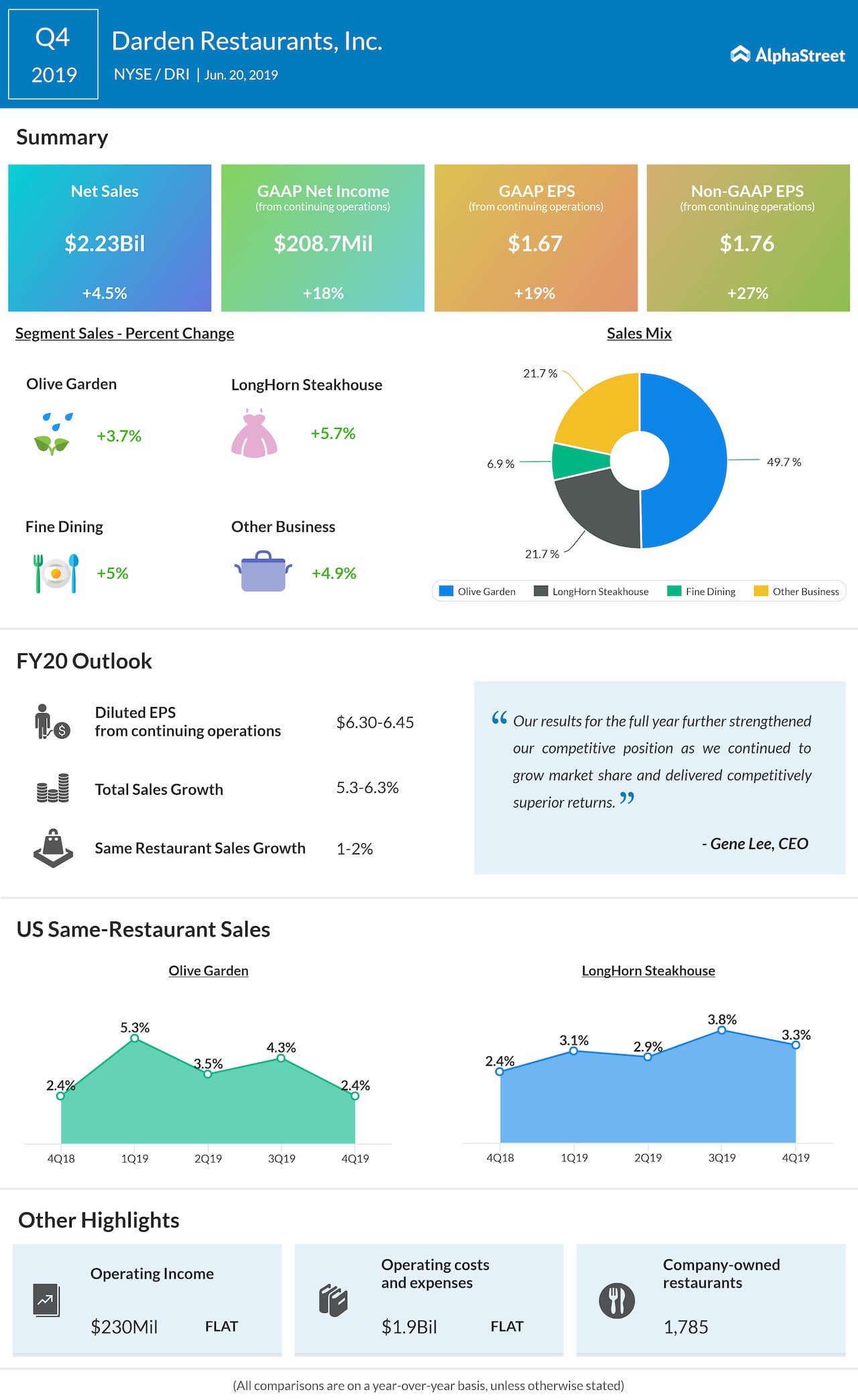

In the fourth quarter of 2019, Darden beat earnings estimates while sales fell short of forecasts. Sales grew 4.5% to $2.23 billion while adjusted EPS jumped 27% to $1.76. Blended same-restaurant sales rose 1.6%.

Also see: Darden Q4 2019 Earnings Conference Call Transcript

For fiscal-year 2020, Darden expects total sales

growth of 5.3-6.3%, including approx. 2% growth related to the 53rd week. Same-restaurant sales is

expected to grow 1-2%. Diluted EPS from continuing operations is expected to be

$6.30-6.45.

Shares of Darden have gained 29% so far this year and 10% in the past one month. The stock has an average price target of $127.92.