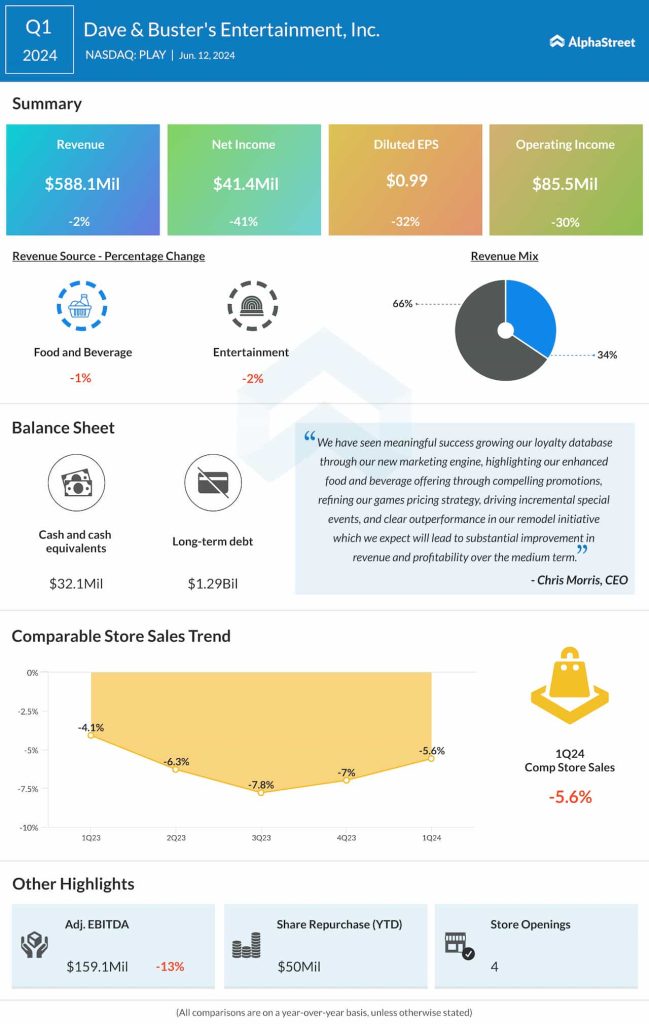

The Dallas-based company reported a net income of $41.4 million or $0.99 per share for the April quarter, down from $70.1 million or $1.45 per share in the prior-year period. Adjusted EBITDA decreased 13% annually to $159.1 million during the three months.

First-quarter revenues dropped 2% year-over-year to $588.1 million, even as comparable store sales declined 5.6%. Revenues decreased in both operating segments — Food and Beverage and Entertainment.

Chris Morris, the company’s CEO, said, “During the quarter, we realized more than $10 million of incremental labor and marketing costs associated with the roll-out of new initiatives and certain marketing tests which we do not expect to repeat going forward. Additionally, we are pleased with the improving top and bottom-line performance we have seen over the last several weeks as we scale some of our more successful organic growth initiatives.”