Dave & Buster’s Entertainment, Inc. (NASDAQ: PLAY), which operates a chain of casual dining and leisure facilities, reported stronger-than-expected earnings and revenues for the first quarter of 2022 as comparable-store sales recovered from the recent slump.

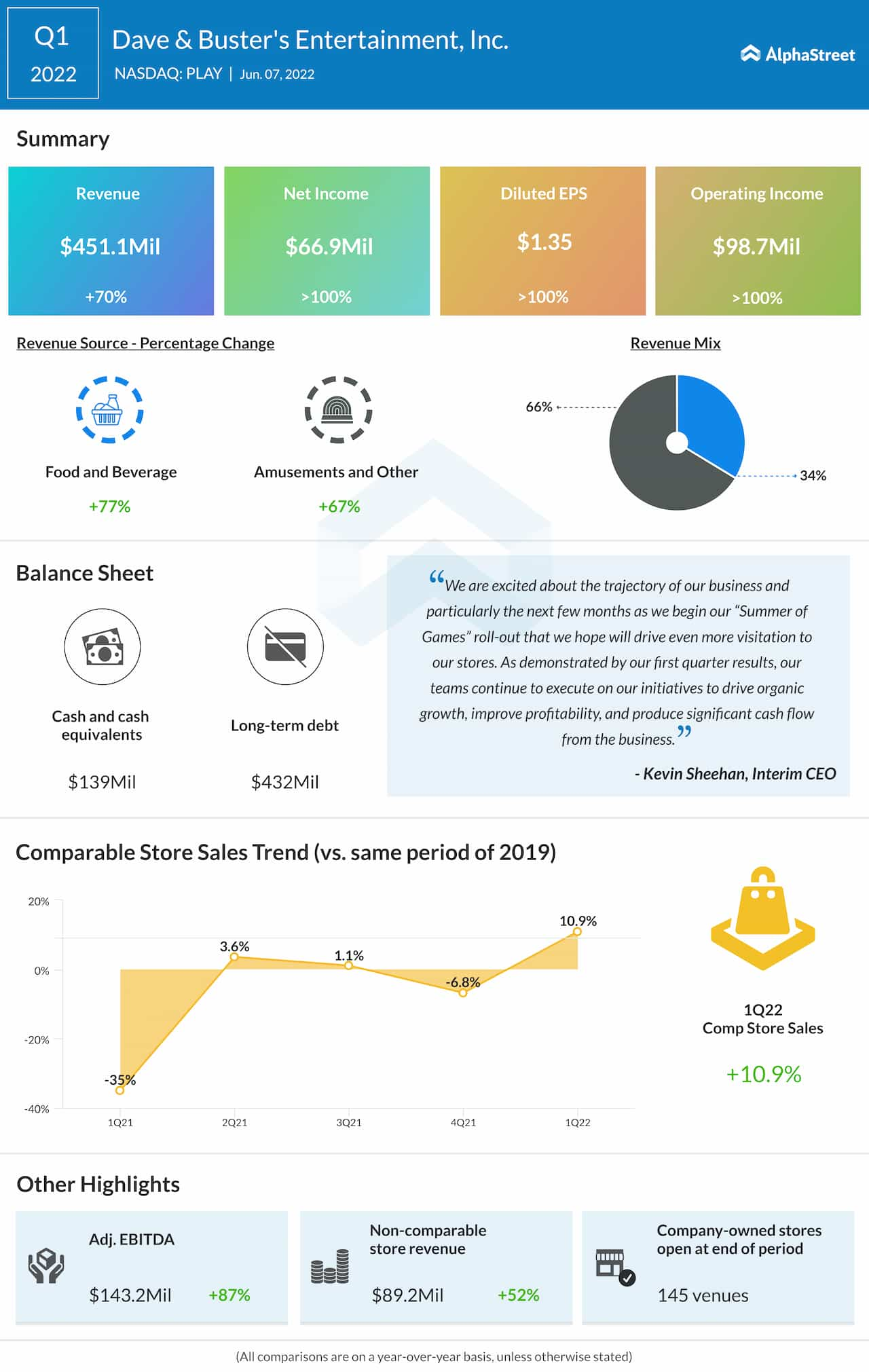

The Dallas-based company reported a net income of $66.9 million or $1.35 per share for the April quarter, compared to $19.6 million or $0.40 per share in the same period of 2021. The latest number also came in above the consensus forecast.

The positive bottom-line performance reflects a 70% surge in revenues to $451.1 million amid strong performance by both the operating segments. Comparable store sales moved up 10.9% compared with the first quarter of 2019.

“As demonstrated by our first-quarter results, our teams continue to execute on our initiatives to drive organic growth, improve profitability, and produce significant cash flow from the business. We have significant upside potential and with our continued focus on innovation, growth, and value creation, we are determined to deliver on that potential,” said Kevin Sheehan, interim chief executive officer of Dave & Buster’s Entertainment.

Read management/analysts’ comments on Dave & Buster’s Q1 results

Shares of Dave & Buster’s have gained around 13% in the past six months. The stock traded higher in early trading on Tuesday after closing the previous session higher.