Also, the lingering trade tension and apprehensions of the farming community have weakened investor sentiment. Since the first round of sanctions, customers have delayed their purchases due to the uncertainty surrounding China, which is a key market for many American farmers.

Considering the recent escalation of the trade dispute, the management will likely be cautious in its full-year outlook this time. The options being weighed by the company to override the impact of high costs is to raise product prices and cut expenses, mainly structural costs.

Considering the recent escalation of the trade dispute, the management will likely be cautious in its full-year outlook

However, the stable demand across the board in the key markets, especially for agriculture and turf equipment, points to positive top-line performance in the near term. The market is optimistic about Deere’s bottom line and expects continued earnings growth, both near term and in the future.

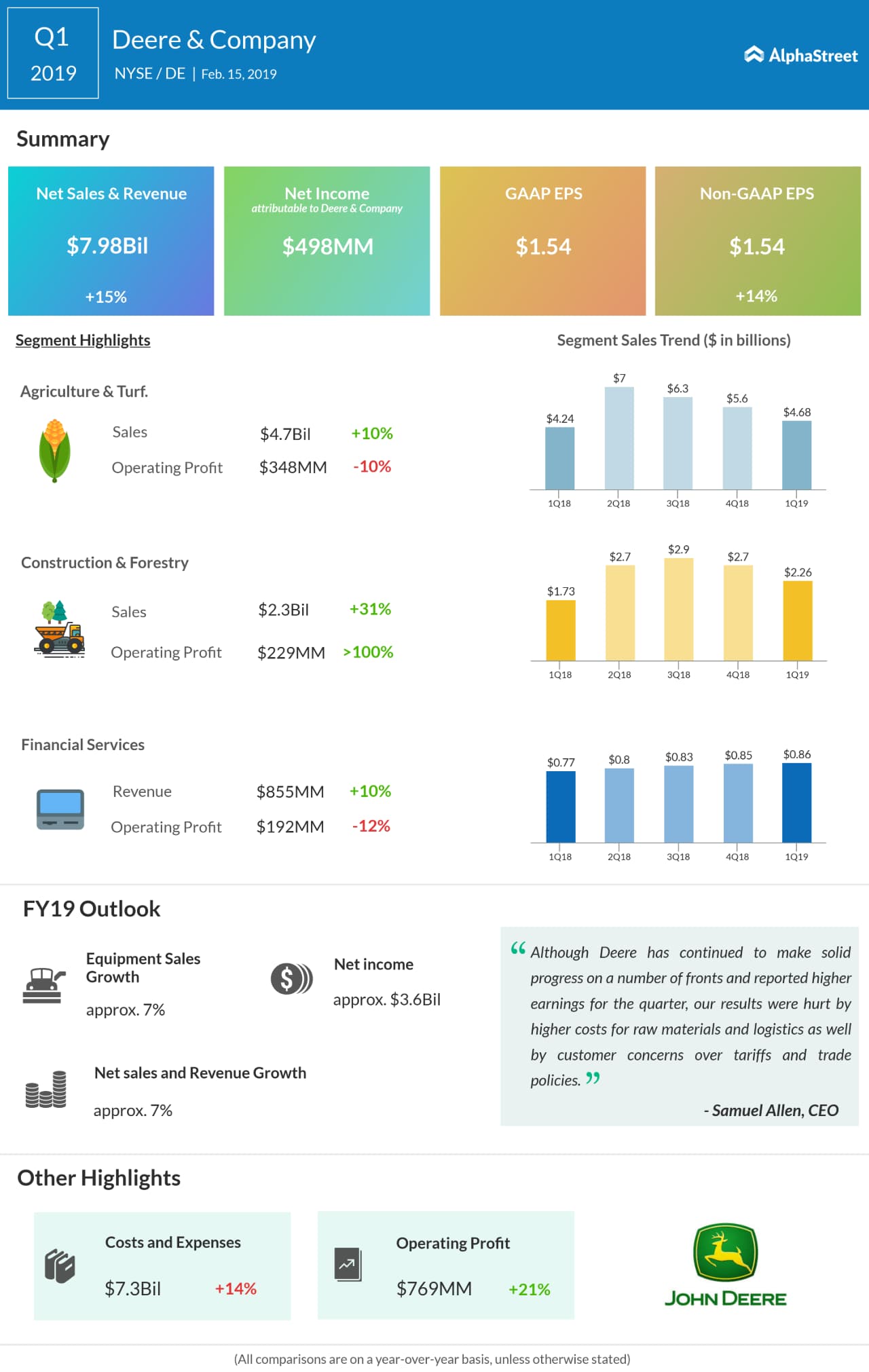

Reflecting the pressure on margins, first-quarter earnings fell short of expectations, while revenues surpassed the forecast. Profit moved up 14% to $1.54 per share and revenues rose 15% to $7.98 billion, supported by broad-based sales growth led by the construction and forestry division.

Among others in the heavy equipment industry, Caterpillar (CAT) last week reported a 4% growth in first-quarter earnings to $2.94 per share. Revenues advanced 5% annually to $13.5 billion during the quarter amid solid demand across all business segments.

Shares of Deere have declined progressively this month, after soaring close to the record highs seen a year ago. The stock lost around 5% in the last twelve months but continued to outperform the industry during the period.