Heavy machinery maker Deere & Company (DE) swung to a profit in the first quarter from a loss last year, which included charges to the provision for income taxes due to tax reform. The top line exceeded analysts’ expectations while the bottom line missed consensus estimates.

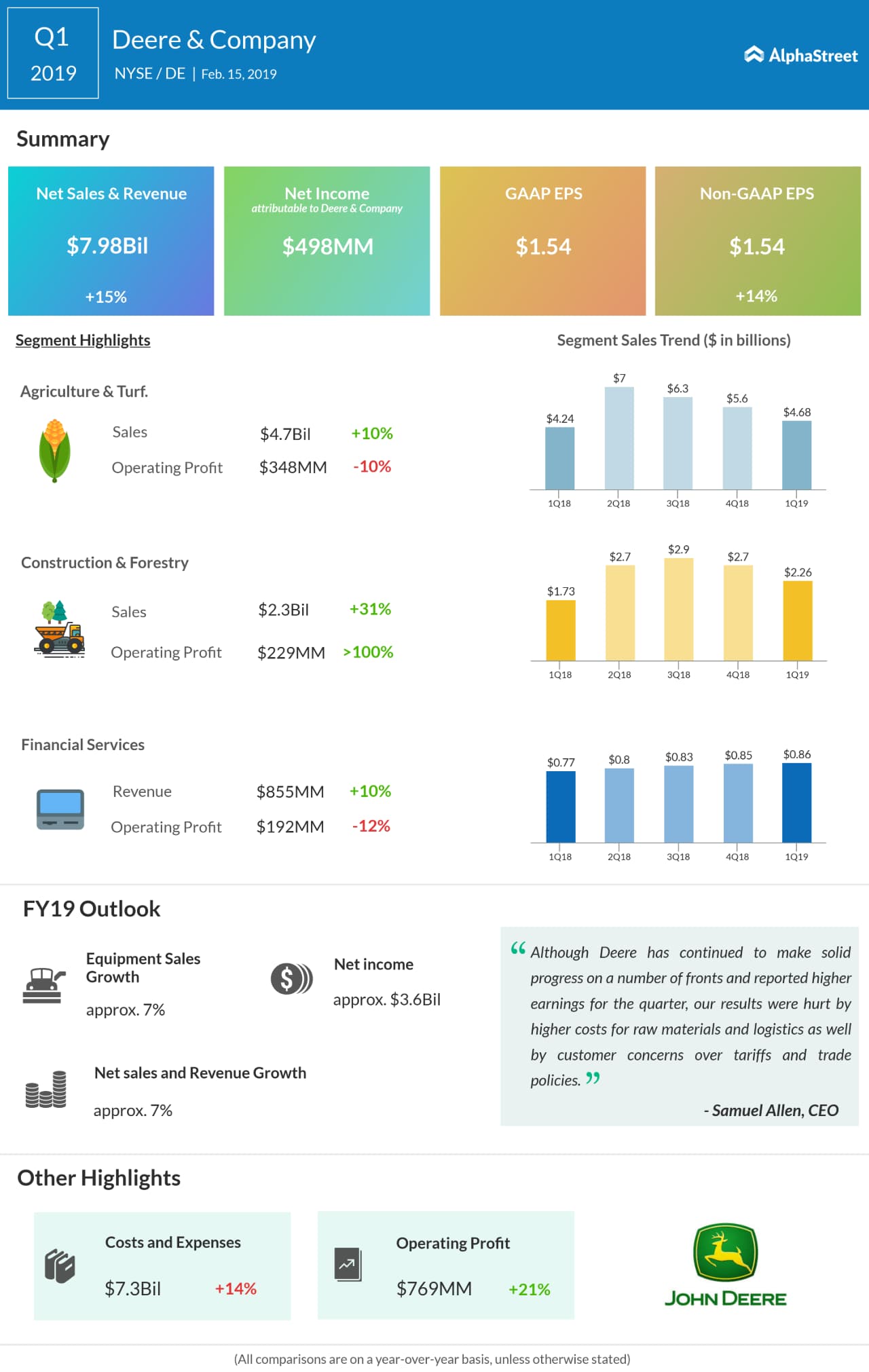

Net income was $498.5 million or $1.54 per share compared to a loss of $535.1 million or $1.66 per share in the previous year quarter. Excluding tax reform charges, first-quarter 2018 net income results would have been $442.1 million or $1.35 per share.

Total revenues grew by 15% to $7.98 billion. Net sales from Equipment Operations increased by 16% to $6.94 billion. Construction & Forestry sales climbed 31% to $2.26 billion, due to the inclusion of Wirtgen for the full period. The Construction & Forestry sales increased due to price realization and higher shipment volumes, partially offset by the unfavorable effects of currency translation.

In the first quarter, sales from Agriculture & Turf increased by 10% to $4.68 billion, helped by higher shipment volumes and price realization. This was partially offset by the unfavorable effects of currency translation and higher warranty-related expenses.

For fiscal 2019, company equipment sales are anticipated to increase by about 7% due to the inclusion of Wirtgen results. Total revenues are predicted to rise by about 7% and net income is forecast to be about $3.6 billion.

Although Deere has continued to make solid progress on a number of fronts and reported higher earnings for the quarter, the results were hurt by higher costs for raw materials and logistics as well by customer concerns over tariffs and trade policies. These latter issues have weighed on market sentiment and caused farmers to become more cautious about making major purchases.

The company believes cost pressures should abate as the year progresses and is hopeful it will soon have more clarity around trade issues. As a result, the company remained cautiously optimistic about its prospects for the year ahead.

Looking ahead, industry sales of agricultural equipment in the US and Canada are forecast to be flat to up 5%, helped by continued demand for both large and small equipment. Industry sales of turf and utility equipment in the US and Canada are expected to be flat to up 5% for 2019.

The Construction & Forestry forecast includes a full year of Wirtgen sales, versus 10 months in fiscal 2018, with the two additional months adding about 4% to division sales for the year. The outlook reflects generally positive fundamentals and economic growth worldwide. In forestry, global industry sales are expected to be up 5% to 10% mainly as a result of improved demand in EU28 countries and Russia.

Shares of Deere ended Thursday’s regular session down 0.17% at $162.42 on the NYSE. Following the earnings release, the stock inched down over 3% in the premarket session.