Quarterly performance

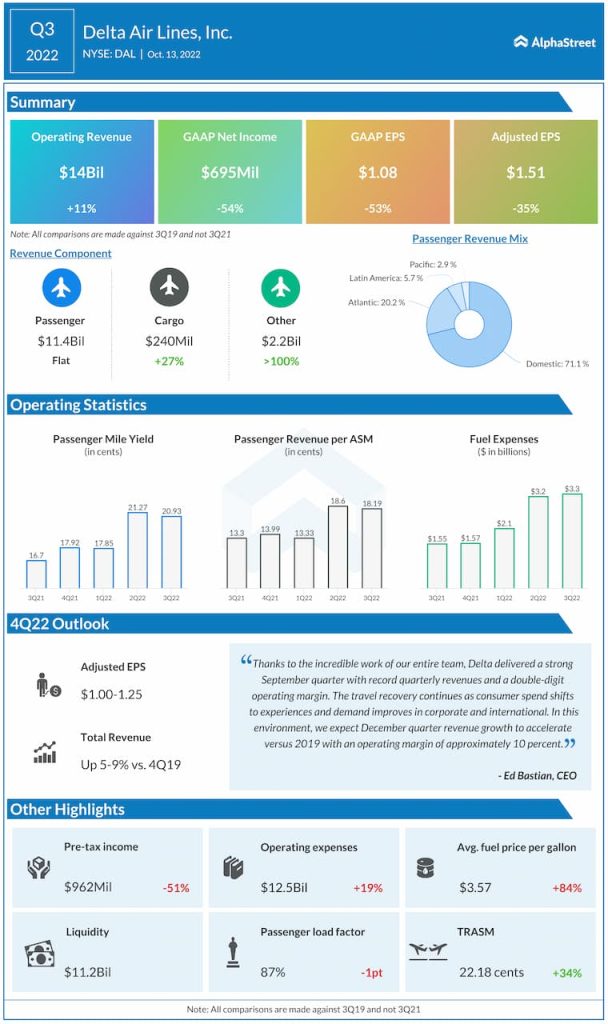

GAAP net income decreased 54% to $695 million, or $1.08 per share, compared to Q3 2019. Adjusted EPS fell 35% to $1.51, missing projections of $1.53. The quarterly results included a $35 million impact on the top line and a $0.03 impact on the bottom line from Hurricane Ian.

Trends

Delta continues to see strong demand for travel as consumers spend on experiences. Domestic passenger revenue in Q3 was 2% higher than the same quarter in 2019. The airline is also seeing improvement in international and business travel. International passenger revenue was 97% recovered compared to 2019 levels and international unit revenue growth surpassed domestic for the first time since the pandemic.

Transatlantic revenue rose 12% compared to 2019 on strong demand for travel to locations like Italy, Spain and Greece. Delta saw corporate travel pick up after Labor Day. At quarter-end, business travel was 80% recovered compared to 2019 levels.

In its earnings report, the company said that recent corporate survey results display an optimistic outlook for business travel as nearly 90% of accounts expect their travel to stay the same or increase during the fourth quarter compared to the third quarter.

Operating expenses totaled $12.5 billion in Q3, up 19% from the same period in 2019. Non-fuel CASM was 22.5% higher than the 2019 levels on 17% less capacity. Adjusted fuel expense amounted to $3.3 billion, up 45% versus Q3 2019.

Outlook

Based on the strong demand for domestic and international travel and the improvement in business travel, Delta expects revenue for the fourth quarter of 2022 to be up 5-9% compared to the same period in 2019. The company expects capacity for the December quarter to be 91-92% restored to 2019. Non-fuel unit costs are expected to be 12-13% higher than the Q4 2019 levels. Delta expects operating margin of 9-11% and adjusted EPS of $1.00-1.25 for Q4 2022.

Click here to access the full transcripts of the latest earnings conference calls