Q2 results

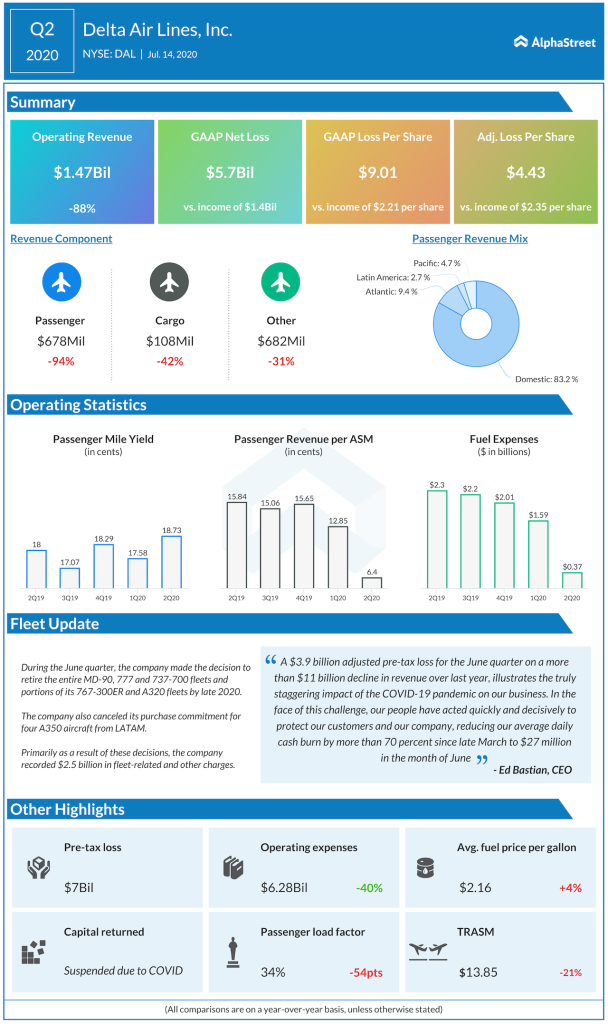

While loss of $4.33 per share in the second quarter didn’t meet the market’s expectations, revenue of $1.47 billion was slightly better than the Street’s view. On an adjusted basis, Delta’s pre-tax loss totaled $3.9 billion in the June quarter.

Response to COVID-19

To combat the staggering effects of the pandemic, Delta has been taking several steps. As of now, over 17,000 employees have voluntarily signed up to depart the company. The company plans to end the voluntary departure and early retirement programs this month. Delta believes that it could minimize the vast majority of the headcount changes, if not eliminating the need for involuntary furloughs.

Operating expenses declined $5.5 billion or 53% in the June quarter, better than the company’s original expectation. This was partly due to the contributions of more than 40,000 employees who have elected to take voluntary unpaid leaves.

Q3 outlook

Delta expects revenue for the September quarter to be only 20% to 25% of what it saw last summer due to the flattening demand growth, which was caused by the increasing COVID-19 cases. Delta said that it had pared back capacity plans for August. For the September quarter, Delta expects seats available-for-sale, which accounts for 60% load factor cap, to be 20% to 25% of last year’s level, up from 10% in the June quarter.

[irp posts=”52976″]

Recovery

Business travel, which accounts for 50% of Delta’s revenue, has not recovered so far. There is no clear timeline when international borders will open for the US travelers. When discussing on the business traffic, CEO Ed Sebastian said that the company would ever get back entirely to the business traffic volume achieved in 2019.

CEO Ed Sebastian added,

“As we go through the summer and into the fall, we’ll continue to move quickly to balance what we’re seeing in the revenue environment with our ability to get cost out of the business and keep us on the path to achieve our goal of breakeven cash burn by the end of the year. Given the combined effects of the pandemic and associated financial impact on the global economy we continue to believe it could be two years or more before we see a sustainable recovery.”

ADVERTISEMENT