Better-than-expected results

Demand and capacity

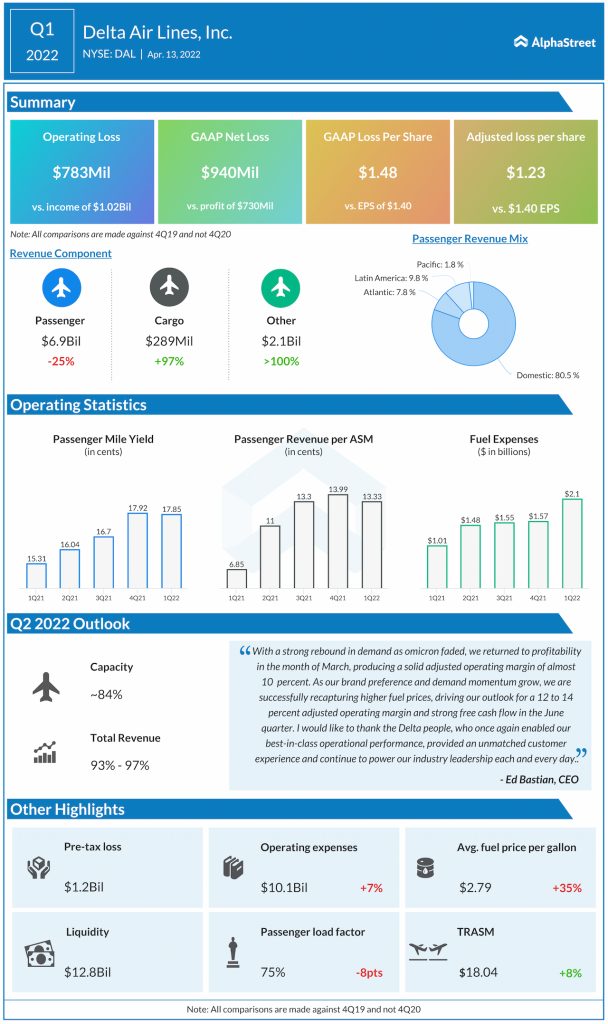

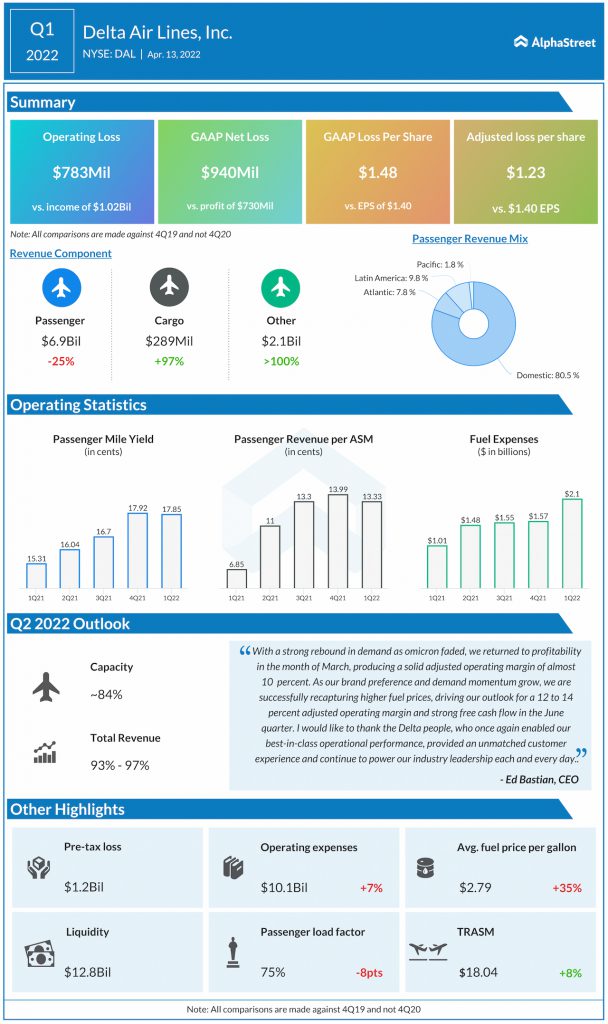

Delta saw a strong rebound in demand as the Omicron variant faded, which helped it return to profitability in the month of March. The airline is also seeing a pickup in business and international travel as offices reopen and travel restrictions are lifted.

The recovery in business travel was fueled by an improvement in corporate. Domestic corporate sales for the quarter were around 50% recovered compared to the same period in 2019, with March improving to around 70% recovered. International corporate sales were around 35% recovered for the quarter, with March improving to around 50%.

On its quarterly conference call, Delta stated that as per its recent survey results, 90% of its corporate accounts anticipate travel volumes to increase in the second quarter as offices continue to reopen.

The company continues to work on keeping capacity in line with demand. In Q1, capacity was 83% restored versus 2019. Demand was suppressed by Omicron in January and early February but witnessed a recovery from the President’s Day weekend onwards.

Delta expects a strong summer in the Transatlantic based on demand trends. In the Pacific, a restoration of demand can be anticipated with the opening of Australia, South Korea and other countries in Southeast Asia. However, regions with heavy restrictions like China and Japan will continue to put pressure on Pacific unit revenues until the pandemic fully wanes.

Outlook

For the second quarter of 2022, Delta expects capacity to be around 84% recovered compared to the same period in 2019. Total revenue is estimated to be 93-97% recovered versus Q1 2019. Non-fuel CASM is expected to be up 17% compared to 2019 while adjusted operating margin is expected to be 12-14%. Adjusted fuel price is estimated to range between $3.20-3.35 per gallon.

Click here to read the full transcript of Delta Air Lines’ Q1 2022 earnings conference call