Demand trends

At an analyst event last week, Delta said it was seeing strong demand for the holiday season. The company expects its unit revenues over the 15-day holiday period to come between 10% and 12% up on a unit revenue basis. Although the momentum is expected to continue into the beginning part of January, the situation remains fluid.

Most of the domestic demand has been in leisure travel with people either opting to spend their holidays in warm, sunny locations or choosing spots for recreational activities like skiing. Looking at the trends through September and October, travel remained fairly resilient as folks wanted to get back to their lives.

Consumer travel demand is more than 100% restored mainly due to high-value leisure travel. Business travel is about 60% recovered in terms of traffic levels while international business travel is about 25% recovered.

There is some level of choppiness as international travel restrictions evolve but demand is expected to rebound once the restrictions are lifted. Within business travel, the recovery is being led by small and medium businesses with most of it tied to the return to offices. Looking ahead, Delta anticipates a strong growth in demand as it moves into the spring next year.

Network and fleet

Delta is investing significantly in building its network and transforming its fleet. Over the next six months, the company plans to open three new facilities – two in its largest markets, New York and Los Angeles, as well as one in Seattle. The company has also entered into partnerships to expand its network. Its joint venture with Air France-KLM and Virgin Atlantic is the largest one between the US and Europe.

Delta has partnered with Aeromexico for a transborder JV between the US and Mexico and it is awaiting approval on another JV with LATAM which will strengthen its position in South America. Its codesharing partnership with WestJet will help provide better connectivity between the US and Canadian markets and its alliances with Korean Air and China Eastern will help it expand in Asia. Delta expects its global network will drive international growth and margin expansion going forward.

Looking at fleet, Delta accelerated its fleet simplification and removed two fleet families. The company took out 200 airplanes as part of its strategy to retire old planes and bring in new ones. Delta has invested in 350s which it expects will be a long-term asset for the company. It made good progress in up-gauging its 321s and it also acquired some 739s on the used market. These actions helped the company lower its fleet age by two years over the course of the past two years.

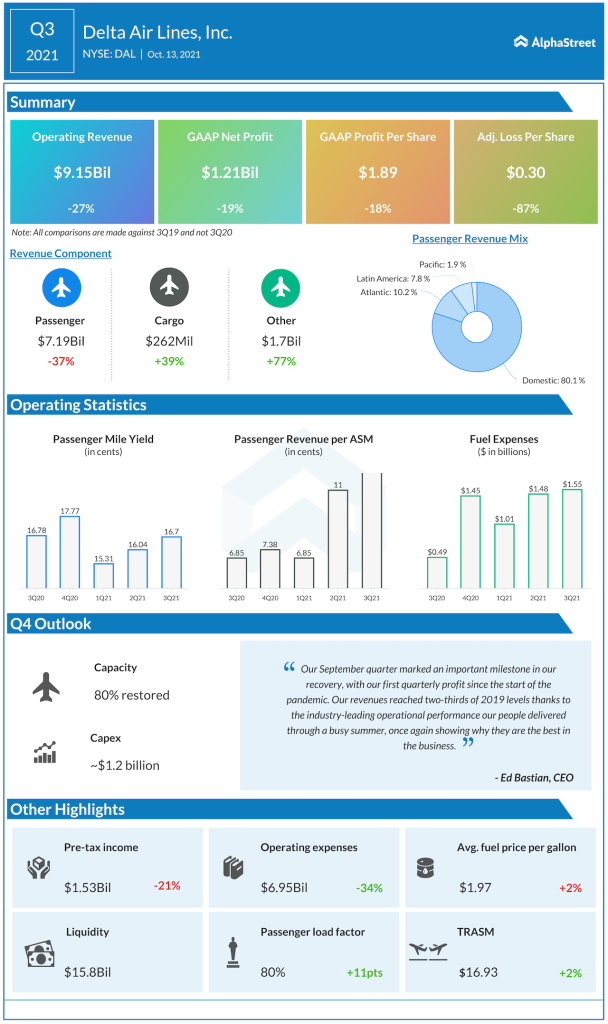

Outlook

Delta expects 2022 to be a profitable recovery year for the company. It anticipates capacity to be around 90% restored by 2022 versus 2019 levels and around 100% by 2023. Capital spending is estimated to amount to $6 billion in 2022 and then drop to $5.0-5.5 billion in 2023.

Looking into 2024, the company aims to generate adjusted revenue of $50 billion or more and adjusted EPS north of $7. It expects to generate free cash flow of $4 billion or more and also reduce its net debt to $15 billion. All in all, Delta remains cautiously optimistic as it looks at its growth path over the near to medium term.

Click here to read the full transcript of Delta Airlines’ Q3 2021 earnings conference call