Challenging Q2

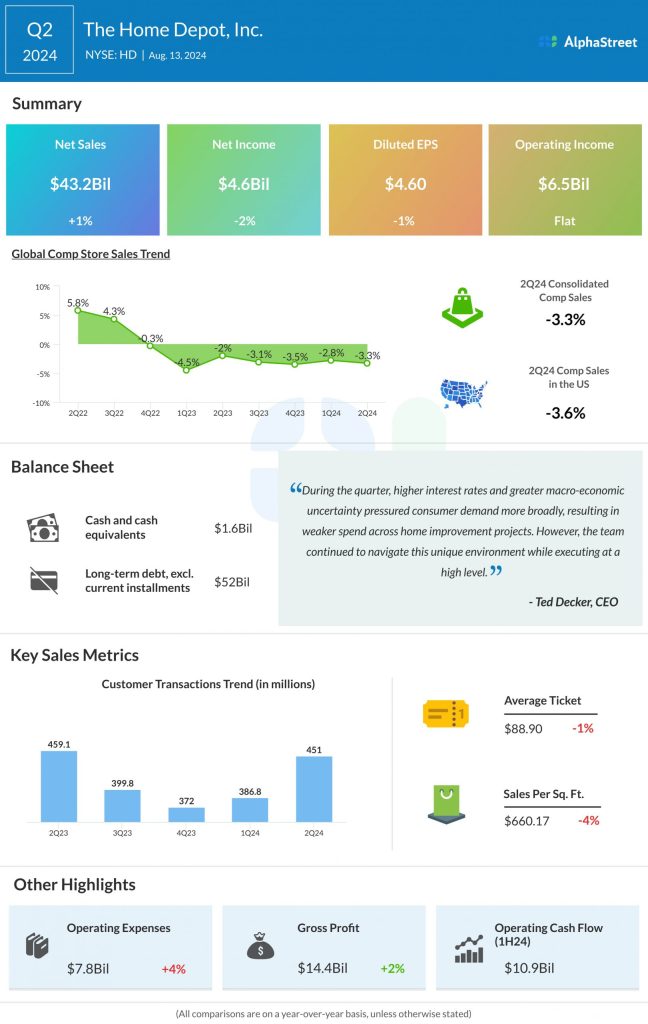

In Q2, customer demand was impacted by higher interest rates and macroeconomic uncertainty which led to weaker spend on home improvement projects. Spring projects witnessed a general softness and were also impacted by extreme weather changes during the quarter.

The company saw a 2.2% decrease in comp transactions and a 1.3% drop in average ticket during the quarter. Big-ticket comp transactions, or those over $1,000, were down 5.8% YoY, with larger discretionary projects, like kitchen and bath remodels, experiencing softness.

Cautious outlook

Due to the weak performance in the first half of the year and the continued uncertainty around consumer demand, Home Depot remains cautious in its outlook for fiscal year 2024. The retailer now expects comparable sales for the 52-week period to be down 3-4% versus its prior expectation of a decline of around 1%.

GAAP EPS for the 53-week period is now expected to decline 2-4% versus the previous forecast for growth of approx. 1%. Adjusted EPS for the 53-week period is expected to decline 1-3%. The 53rd week is expected to contribute EPS of approx. $0.30 on both a reported and adjusted basis.

Bright spots

Despite these near-term challenges, Home Depot is focused on growing its share in the highly fragmented, approx. $1 trillion home improvement market over the long term.

“Remember, we operate in one of the largest asset classes, which is estimated at approximately $45 trillion, representing the installed base of homes in the United States. Today, we have roughly 17% market share, with tremendous growth potential. That is why we have been investing and executing on our strategy to create the best interconnected experience, grow our Pro wallet share through a differentiated set of capabilities, and build new stores.” – Ted Decker, CEO

Another area of opportunity is the SRS Distribution acquisition. The SRS acquisition contributed $1.3 billion in sales to HD’s top line in Q2. On its conference call, Home Depot said for the six-month period matching its first half, SRS generated high-single-digit top line growth, while growing operating income largely in line with sales, compared to the previous year.

This acquisition provides HD with the chance to drive growth through several sales and cross synergy opportunities. It allows Home Depot to expand its product portfolio with a range of offerings in roofing, pool, and landscape from SRS. HD plans to make purchases more convenient for SRS customers at its stores by offering a form of credit tied to their account. The combined assets and capabilities from this acquisition are expected to prove beneficial to HD over the long term.

Home Depot updated its full-year 2024 guidance to reflect the SRS acquisition. It now expects total sales to increase 2.5-3.5%, including the 53rd week, compared to the previous expectation for a growth of approx. 1%. The 53rd week is projected to add approx. $2.3 billion to total sales while the SRS acquisition is expected to contribute approx. $6.4 billion in incremental sales.