Results beat estimates

Business performance

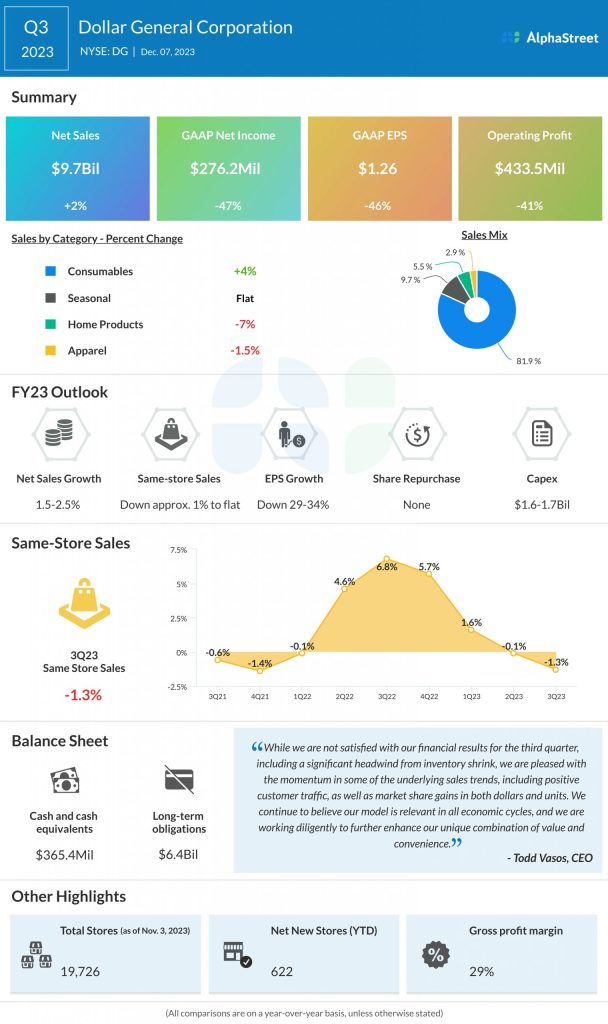

DG’s same-store sales decreased 1.3% in Q3, due to a drop in average transaction amount. This was partly offset by a growth in traffic. The company saw same-store sales decline across all of its categories – home, seasonal, apparel, and consumables – during the quarter.

In Q3, the consumables category alone recorded net sales growth of 4% while sales in the seasonal category remained flat. The apparel and home products categories posted sales declines of 1.5% and 7% respectively during the quarter.

“While we are not satisfied with our financial results for the third quarter, including a significant headwind from inventory shrink, we are pleased with the momentum in some of the underlying sales trends, including positive customer traffic, as well as market share gains in both dollars and units.” – CEO Todd Vasos

The company’s margins during the quarter were impacted by higher shrink, lower inventory mark-ups, and increased markdowns. Gross profit margin in Q3 decreased by 147 basis points to 29%.

Outlook

Dollar General reiterated its guidance for the full year of 2023. It expects net sales to grow 1.5-2.5% for the year. Same-store sales is expected to be down about 1% to flat. EPS is expected to be around $7.10-7.60, representing a decline of 29-34%.

Store growth

DG aims to implement 990 new store openings, 2,000 remodels and 120 store relocations in FY2023. For fiscal year 2024, the company has plans for approx. 800 new store openings, 1,500 remodels, and 85 store relocations. Its new store plans include approx. 30 pOpshelf openings and approx. 15 new stores in Mexico.