Quarterly results

Trends

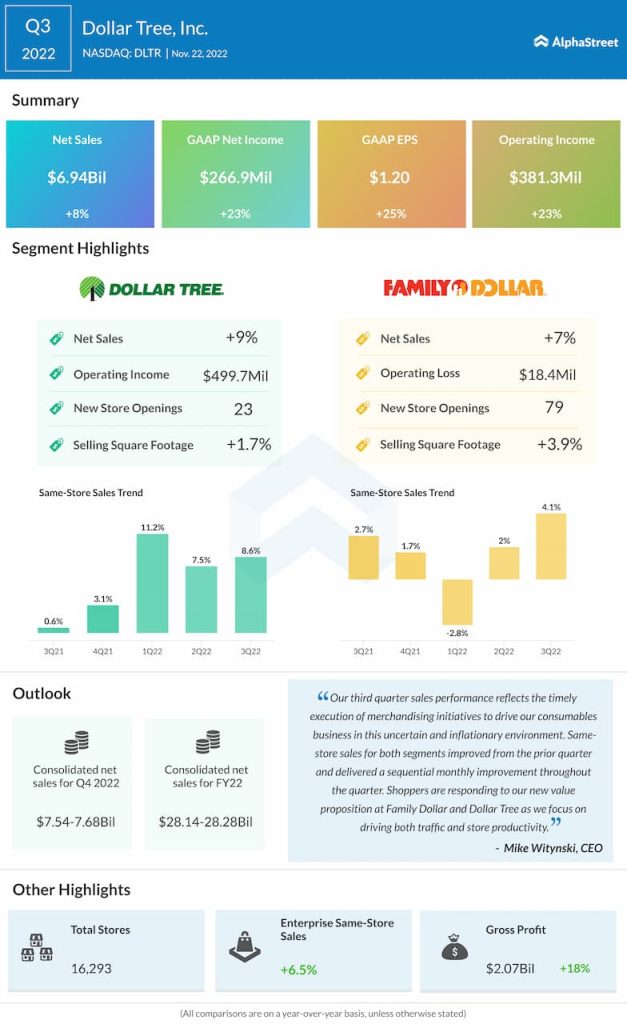

Amid the ongoing inflation, both Dollar Tree and Dollar General saw customers seek value at its stores. In Q3 2022, Dollar Tree’s same-store sales increased 6.5% while Dollar General saw same-store sales growth of 6.8%. Both Dollar Tree and Dollar General saw growth in its consumables category as customers struggle with inflation and focus their spending more on essential items. As a result, discretionary purchases witnessed a slowdown during the quarter.

The shift in product mix towards the lower-margin consumables category had an impact on the gross margins of both retailers and this pressure is expected to continue into the next quarter as well. The $1.25 and $1 price points at Dollar Tree and Dollar General respectively, continue to offer value to shoppers who are also turning to private brands in search of affordable options.

Outlook

Dollar Tree increased its full-year 2022 sales outlook to a range of $28.14-28.28 billion compared to the previous range of $27.85-28.10 billion. The company expects comparable store sales to increase in the mid-single digits for the year. EPS is expected to be in the lower half of the previously provided outlook range of $7.10-7.40. For the fourth quarter of 2022, Dollar Tree expects net sales to be $7.54-7.68 billion and same-store sales to increase in the mid to high single digits.

Dollar General, on the other hand, cut its earnings outlook for the full year of 2022. The company now expects EPS to grow 7-8% versus its prior outlook of 12-14% due to gross margin pressures. Same-store sales growth is expected toward the upper end of the previous range of 4.0-4.5% for the year. Net sales are expected to grow 11% in FY2022. For the fourth quarter, DG expects same-store sales growth of approx. 6-7% and EPS to be $3.15-3.30.