Revenues

Dollar General’s sales in Q2 2022 increased 9% to $9.4 billion while same-store sales increased 4.6%. Same-store sales growth was driven by increases in average transaction amount and customer traffic.

Both Dollar Tree and Dollar General saw strong performance within the consumables category as customers spent more on essential items amid the ongoing inflation. The discretionary or non-consumables category took a back seat in general but Dollar Tree managed to post a 6.7% comps growth in discretionary in its namesake banner. Dollar Tree’s Family Dollar banner saw a 4.1% decline in discretionary comps while Dollar General witnessed a decline in its combined non-consumables category.

Profits and margins

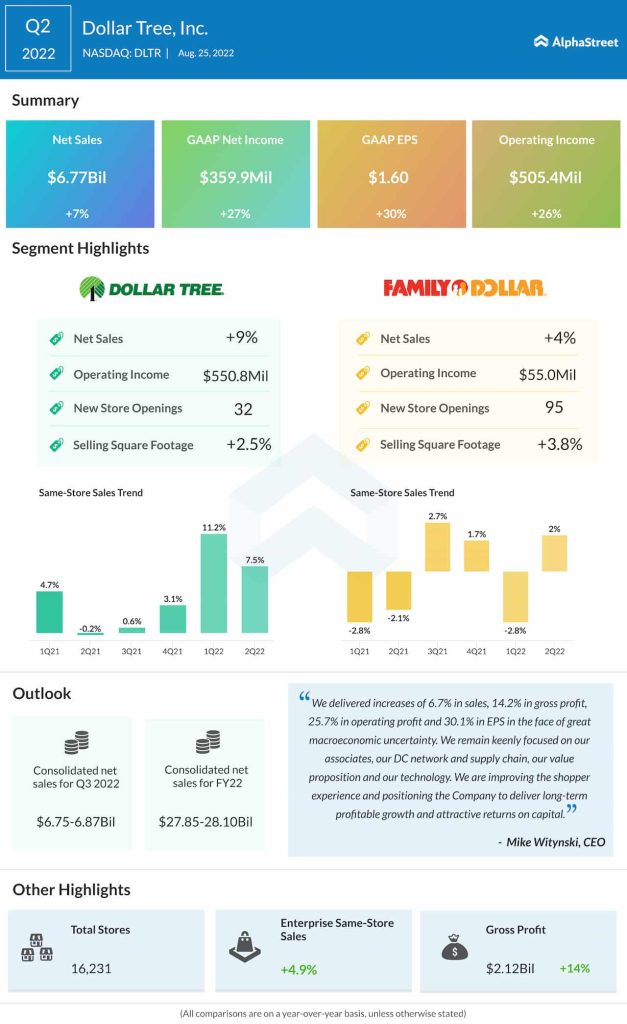

Dollar Tree’s net income increased 27% to nearly $360 million while EPS gained 30% to $1.60 in Q2 versus last year. Gross profit rose 14.2% to $2.12 billion while gross margin improved 200 basis points to 31.4%. Operating income increased 25.7% to $505.4 million while operating margin improved 120 basis points to 7.5%.

Dollar General’s net income increased 6.4% YoY to $678 million while EPS increased 10.8% to $2.98 in Q2. Operating profit increased 7.5% to $913.4 million. Gross margin improved by 69 basis points to 32.3%. Both discount retailers expect to see pressure on margins as a higher portion of sales come from the low-margin consumables category.

Cash position

Dollar Tree had cash, cash equivalents and restricted cash of $742.4 million at the end of the first half of 2022. Operating cash flow amounted to $520.6 million. Dollar General had $326.2 million in cash and cash equivalents at the end of the first half of 2022. Operating cash flow amounted to $948 million.

Outlook

For the full year of 2022, Dollar Tree expects consolidated net sales to range between $27.85-28.10 billion and EPS to range between $7.10-7.40. Comparable store sales are expected to increase in the mid-single digits for the year. Dollar General expects net sales to grow 11% and same-store sales to grow 4-4.5% in FY2022. EPS is expected to grow 12-14% for the year.

Shares of Dollar Tree have gained 56% over the past 12 months while Dollar General’s stock has gained 11% over the same period.

Click here to read the full transcripts of Dollar Tree and Dollar General’s Q2 2022 earnings conference calls