Q4 Report Due

It is estimated that the Michigan-headquartered restaurant chain generated earnings of $4.38 per share in the December quarter, which is higher than the $3.97 per share it earned in the year-ago quarter. Market watchers are looking for fourth-quarter revenues of $1.42 billion, which represents a 2% year-over-year increase. The results are expected to be released on February 26, at 6:00 a.m. ET.

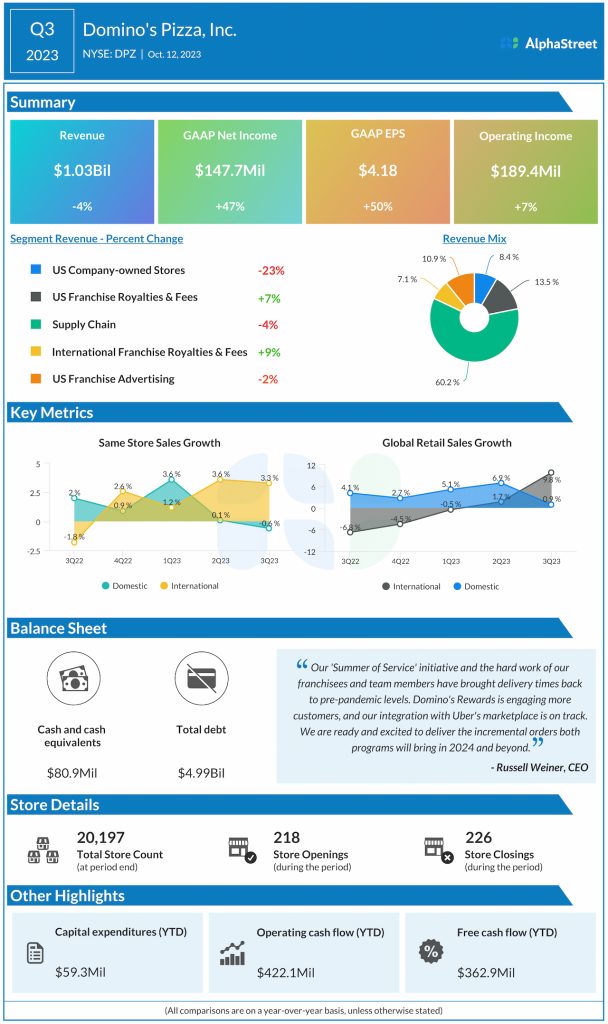

The company’s revenues and earnings beat estimates consistently in the past three quarters. In the most recent quarter, earnings jumped to $147.7 million or $4.18 per share from $100.5 million or $2.79 per share in the comparable period of 2022. Meanwhile, revenues decreased 4% annually to $1.03 billion. US same-store sales decreased 0.6%, as a 2.9% sales growth in company-owned stores was more than offset by a 0.7% dip in franchise store sales.

Commenting on the recent technology partnership with Microsoft, CEO Russell Weiner said during the Q3 earnings call, “Our two companies will collaborate on Generative AI solutions that will create the next generation of pizza ordering and operations technology. Together, our teams are focused on two important goals. First, transforming customer experiences by enhancing the ordering process to personalization and simplification. And then second, streamlining operations and quality control with more predictive tools. I couldn’t be more excited to work with Microsoft on this critical endeavor.”

Partnerships

Last year, Domino’s entered into a partnership with Uber Eats as part of its efforts to enhance customer experience. More recently, it announced a tie-up with Microsoft to develop a generative AI assistant that would simplify store logistics and refine the ordering process.

Shares of Domino’s ended the last trading session lower. In the past three months, the stock has gained around 13%.