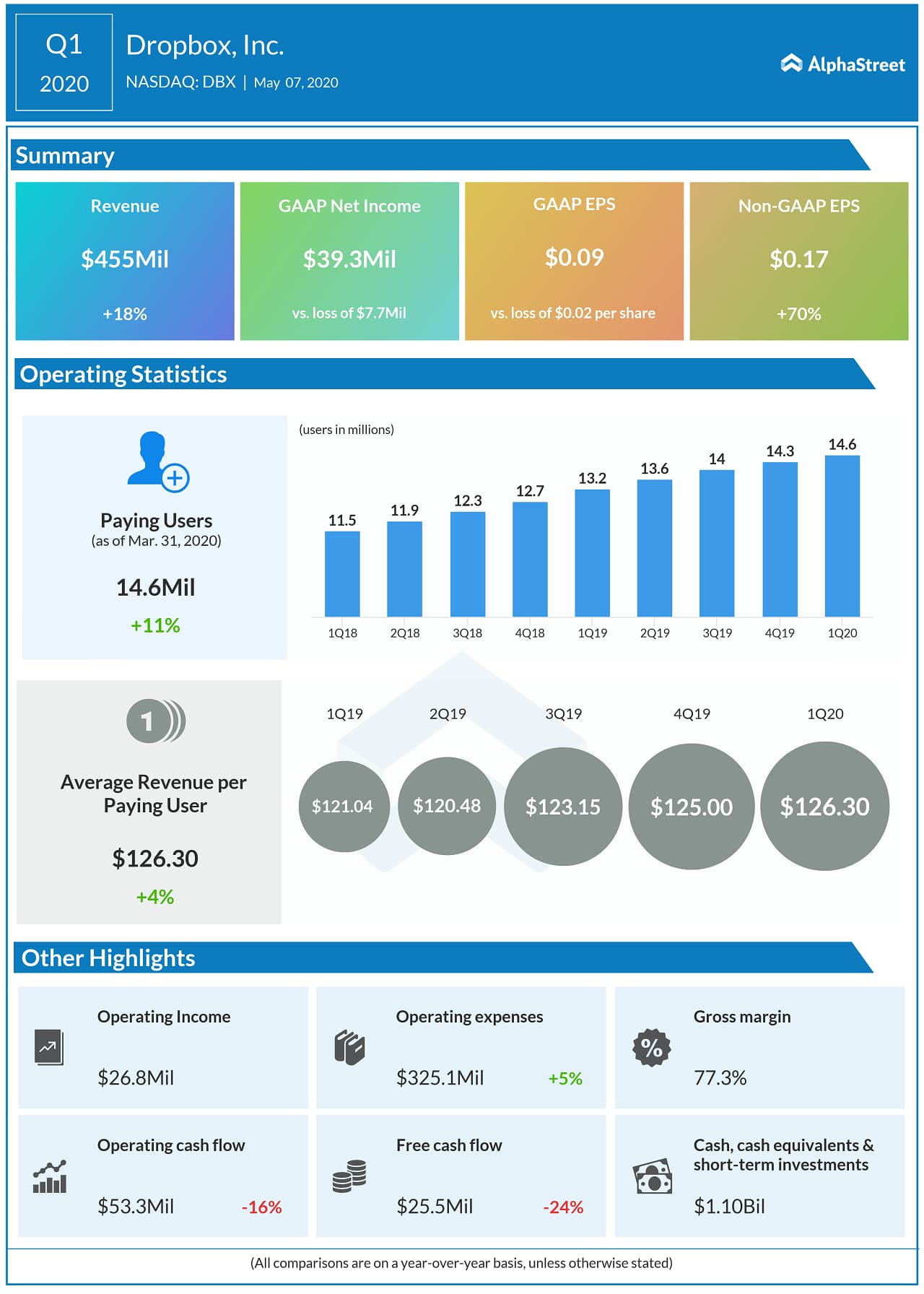

Dropbox Inc. (NASDAQ: DBX) benefited from

the restrictions put in place due to the coronavirus outbreak as more companies

shifted their employees to a work-from-home setting. The company reported an

18% increase in revenue and a 70% jump in adjusted EPS for the first quarter of

2020.

On its quarterly conference call, Dropbox stated that over

the past couple of months, it saw a rise in the number of free trial starts for

both its individual as well as team plans. The company’s business team trials

saw a growth of around 40% and individual plans climbed over 25% from mid-March

compared to the pre-COVID period.

Dropbox also benefited from the increasing adoption of its products which are seen as easy to integrate and use. Weekly active users of its desktop app increased by around 60% over the past few months. UK-based Usborne Publishing, which became a Dropbox Business customer recently, cited the integrations with Adobe products being a key reason for adopting the platform.

During the quarter, Dropbox added new features to its deep

integration with Zoom and with the shift to remote work, the company saw a 20

times increase in Zoom integration usage heading into April versus February

levels.

The company’s solutions are gaining popularity not only among

corporate users looking to manage their work flow through employees working

remotely, but also with educational institutions adopting a remote learning model.

Solutions such as HelloWorks and Dropbox Paper saw increased demand during the

pandemic period.

Dropbox believes that this shift to a remote working model will

continue going forward, driving demand for its products and benefiting the

company in the long term. A survey

by Gartner reveals that 74% of companies plan to shift to more remote work

on a permanent basis post COVID-19.

As part of its strategy to drive higher levels of engagement

and conversion in order to enable monetization and retention, the company

improved its mobile on-boarding flows for users signing up for a Dropbox Plus

trial. These efforts are driving improvements in the mobile trial conversion

rate.

During the first quarter, Dropbox saw an improvement in margins

driven by unit cost efficiency gains and a decrease in sales and marketing

expenses helped by efficiencies in marketing spend. On the flip side, R&D

expenses rose due to new product development and testing.

These factors helped the company achieve GAAP profitability

for the first time in Q1 and despite some possible fluctuations from quarter to

quarter, Dropbox expects to be GAAP profitable for fiscal year 2020.

Looking ahead, Dropbox believes its product portfolio makes it well-positioned to support the growing shift towards remote work and remote learning that is taking place worldwide. Although still early, the company is seeing encouraging trends in terms of team and individual trial volumes.

Dropbox has guided for revenue of $463-466 million for the second quarter of 2020. For the full year, the company revised its revenue outlook to $1.88-1.90 billion from the previous range of $1.89-1.90 billion.