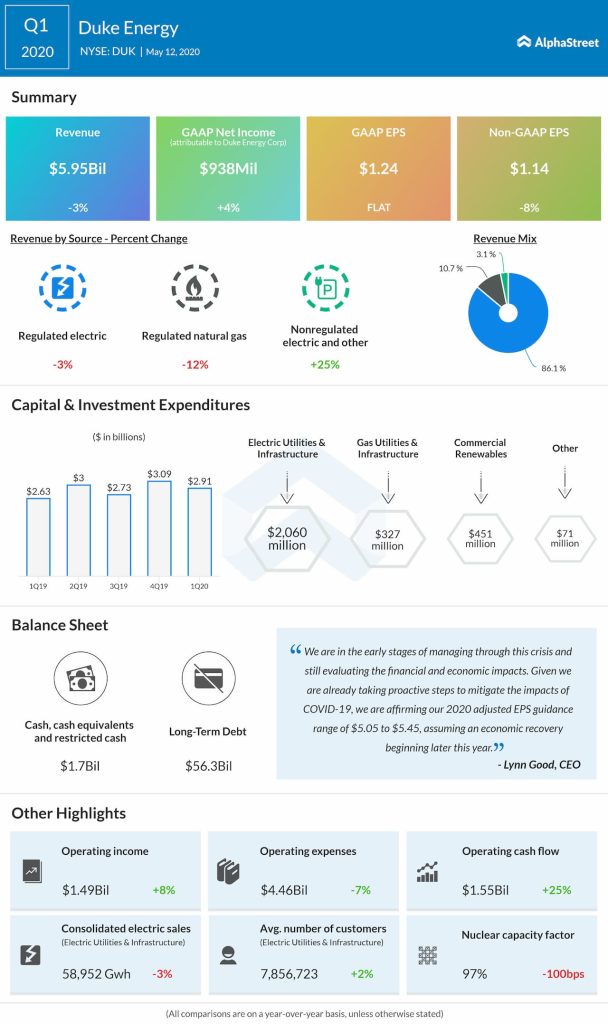

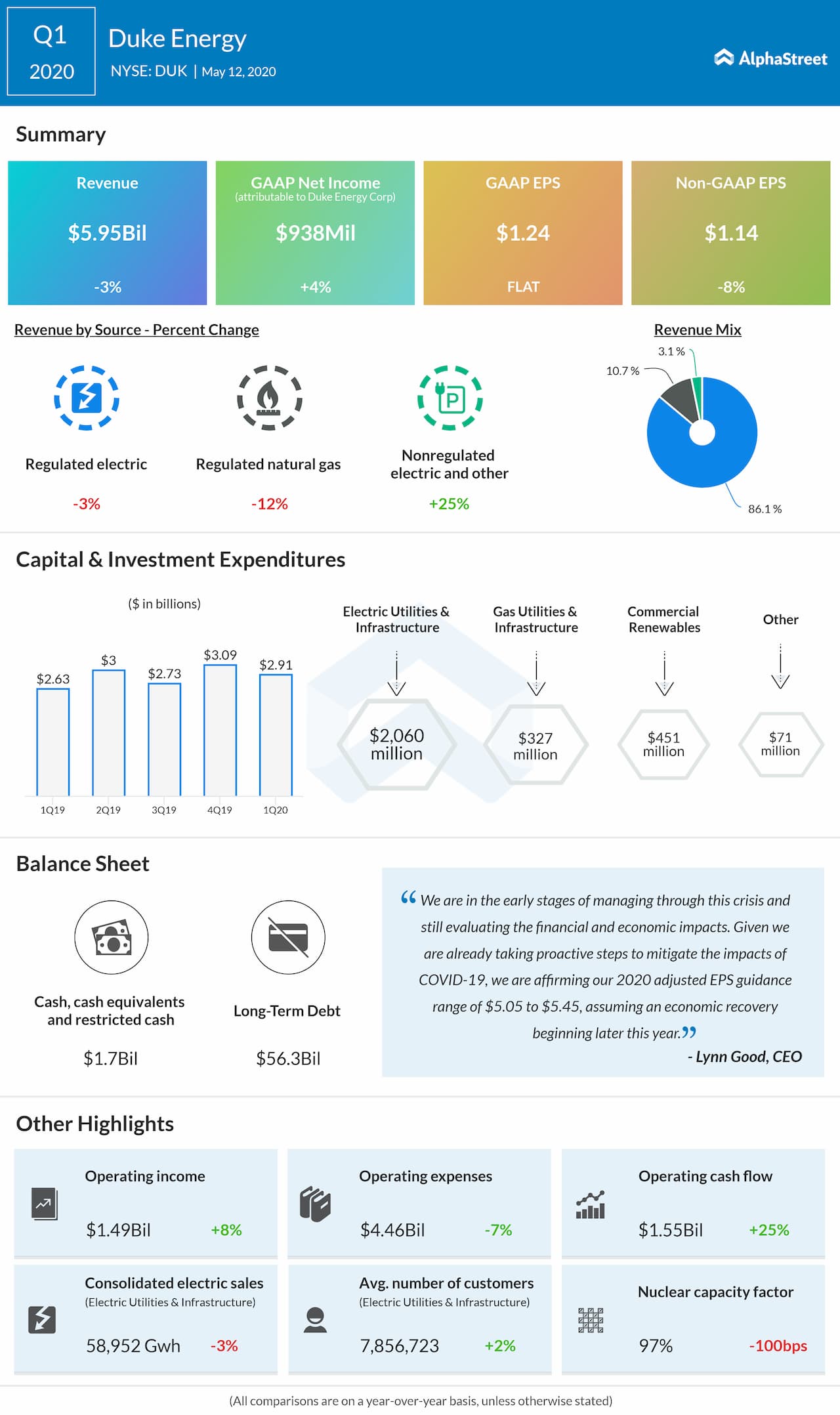

For the quarter, the company saw improved results in the Gas Utilities and Infrastructure segment from the Piedmont North Carolina rate case and Commercial Renewables experienced growth from new projects. Electric Utilities and Infrastructure was positively impacted by electric base rate case increases in South Carolina and Florida, and higher rider revenues in the Midwest, net of forecasted higher depreciation and amortization.

Given the already taken proactive steps to mitigate the impacts of COVID-19, the company reaffirmed its 2020 adjusted EPS guidance in the range of $5.05-5.45, assuming an economic recovery beginning later this year. The company is in the early stages of managing through this crisis and still evaluating the financial and economic impacts.