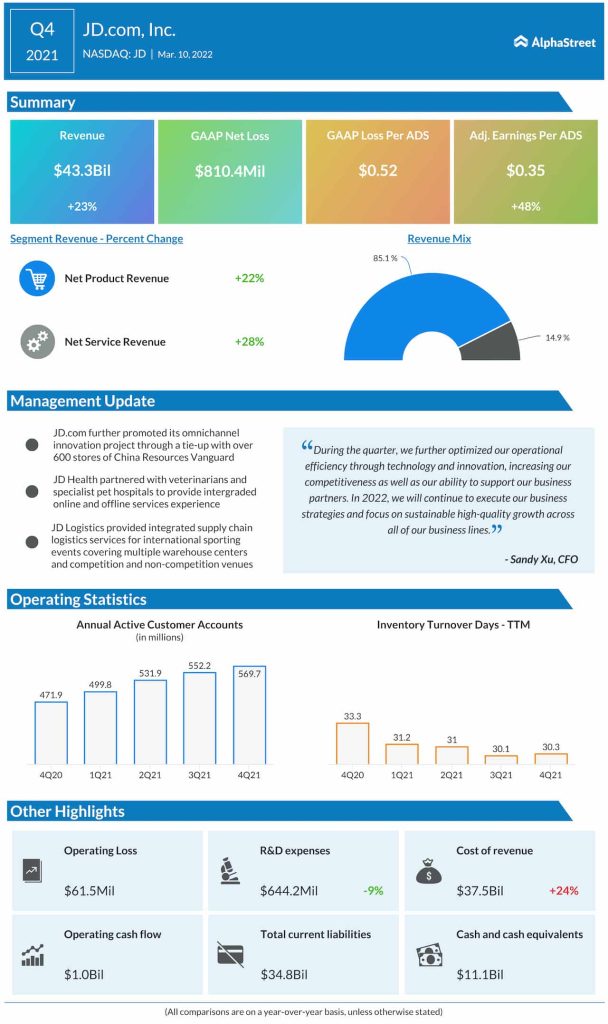

On an adjusted basis, net income increased 48% year-over-year to $0.35 per ADS. on an unadjusted basis, it was a net loss of $810.4 million or $0.52 per ADS, which marked a deterioration from the prior-year period when the company reported net profit.

At $43.3 billion, net revenues were up 23% from the fourth quarter of 2020. At the end of fiscal 2021, JD.com had a total of 569.7 million active customer accounts, up 21% from the previous year.

JD.com Q3 2021 Earnings Call Transcript

“During the quarter, we further optimized our operational efficiency through technology and innovation, increasing our competitiveness as well as our ability to support our business partners. In 2022, we will continue to execute our business strategies and focus on sustainable high-quality growth across all of our business lines,” said Sandy Xu, the chief financial officer of JD.com.