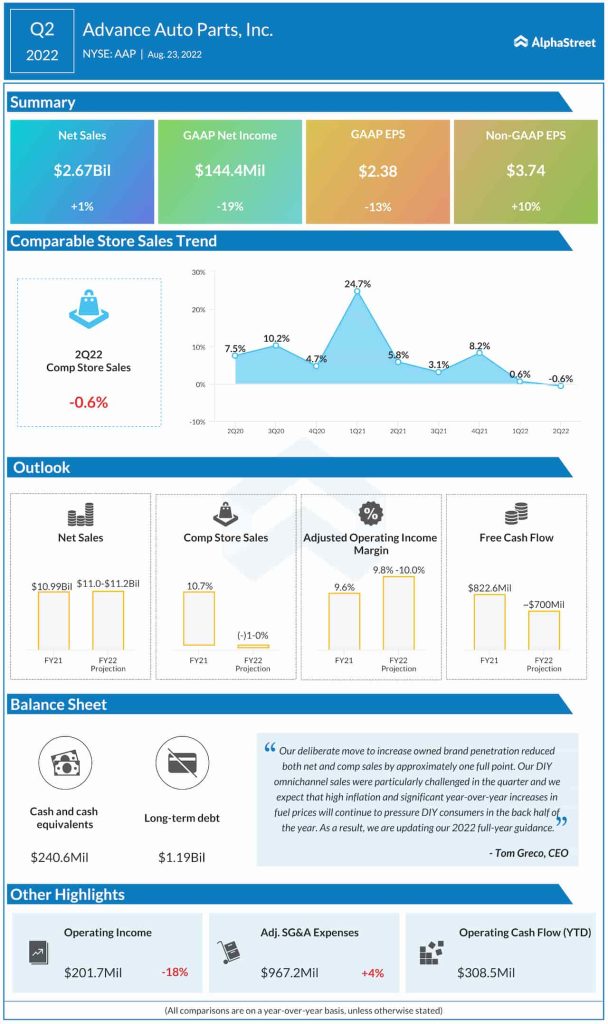

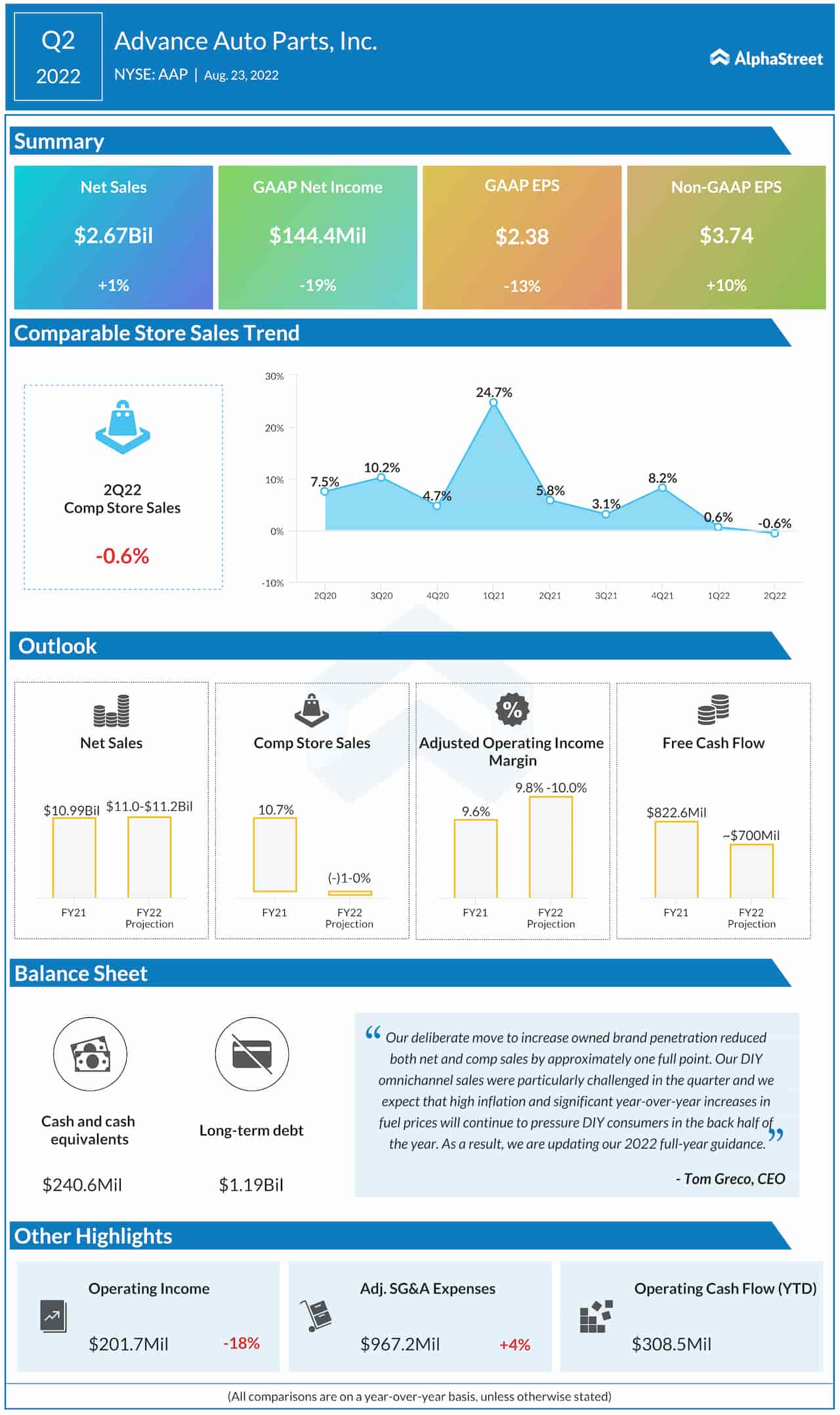

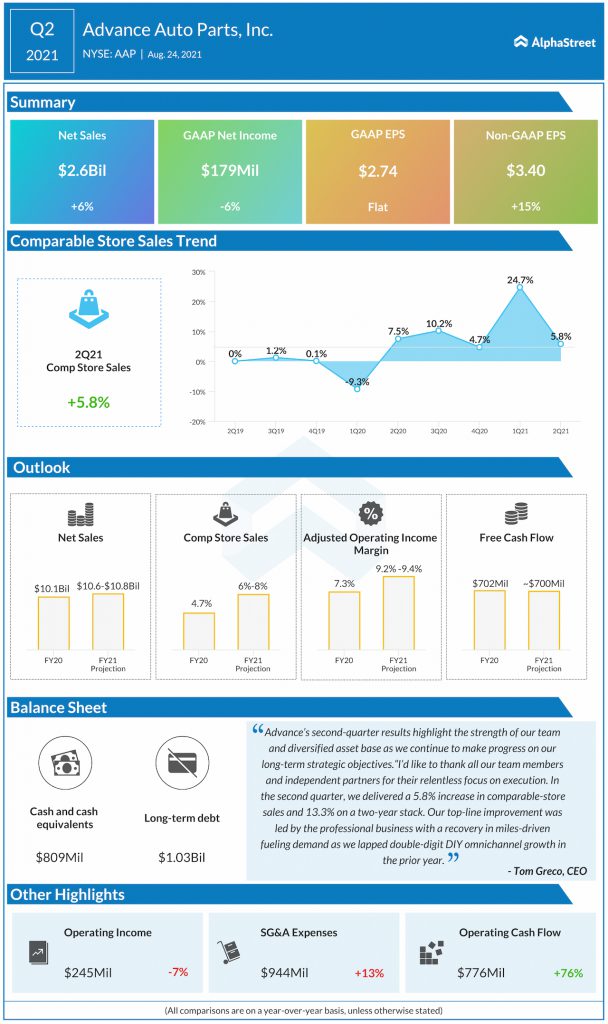

Net income, excluding one-off items, increased 10% annually to $3.74 per share during the three-month period. Meanwhile, second-quarter unadjusted net income decreased to $144.4 million or $2.38 per share from $178.7 million or $2.74 per share in the same period of 2021.

At $2.67 billion, second-quarter revenues were up 1% from the corresponding period of the prior year. Comparable store sales decreased by 0.6%, after increasing regularly in the trailing quarters.

Check this space to read management/analysts’ comments on Advance Auto Parts’ Q2 report

“Our adjusted operating income margin rate of 11.7% was the highest-level AAP has achieved in seven years. This helped enable a quarterly record for adjusted diluted earnings per share of $3.74, which increased 10.0% compared with Q2 2021 and 72% compared with Q2 2019. Additionally, we returned $291 million dollars to our shareholders through a combination of share repurchases and our quarterly cash dividend,” said Tom Greco, chief executive officer of Advance Auto Parts.