Q2 Report Due

For the second quarter, analysts’ consensus earnings estimate is $0.09 per share, excluding one-off items, which is lower than the $0.13/share profit the company earned in the prior year quarter. Meanwhile, revenues are expected to stay broadly unchanged at $12.94 billion in the second quarter. The company is expected to unveil the results on Thursday, August 01, at 4:00 pm ET.

Intel issued weak guidance for the June quarter recently, but it is optimistic about delivering a stronger performance in the second half of the year than in the early half. The company continues to face challenges with its manufacturing business, which suffered a substantial loss last year due to the high costs involved in developing the facility.

What’s in Store

While the foundry division is expected to become profitable by 2027, there are concerns that Intel’s traditional businesses are not growing fast enough to drive profit growth. The company launched its multi-billion-dollar factory as a counter to TSMC’s dominance in the semiconductor manufacturing space. Against this backdrop, Intel needs to participate in the AI race more aggressively, considering the cyclical nature of the chip industry.

Intel’s CEO Pat Gelsinger said in a recent interaction with analysts, “We expect to release the 1.0 PDK for Intel 18A this quarter. Furthermore, our lead products, Clearwater Forest and Pampa Lake are already in fab, and we expect to begin production ramp of Intel 18A in these products in the first half of ’25 for product release in the middle of next year. Given this progress, now is the time to turn our focus to matching technology leadership with a competitive cost structure. Establishing a founder relationship between our products group and our manufacturing group was a critical step to achieve better structural cost.”

Q1 Outcome

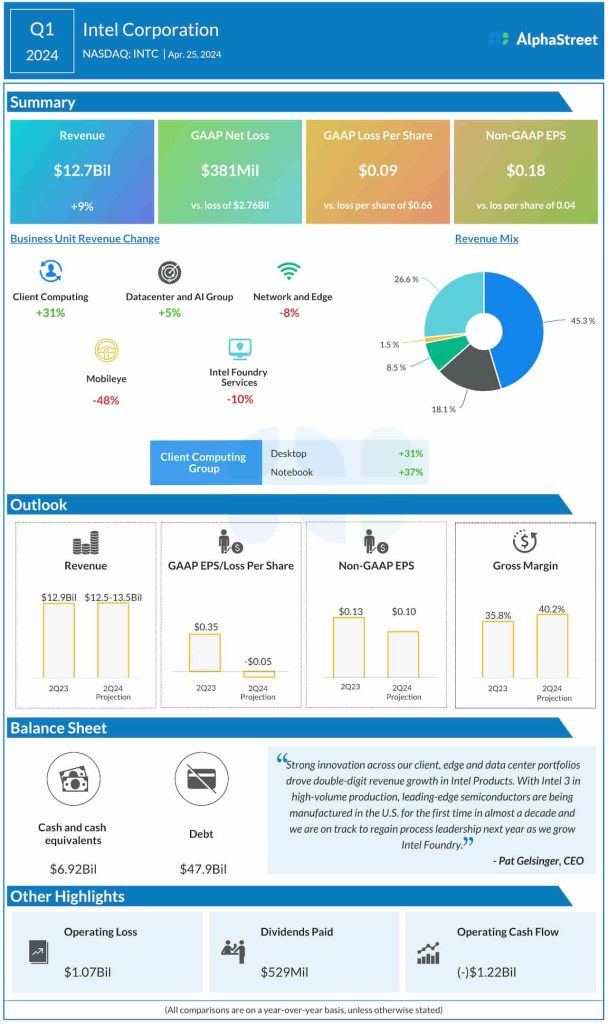

For the March quarter, the tech firm reported adjusted earnings of $0.18 per share, which marked an improvement from the year-ago quarter when it incurred a loss of $0.04 per share. On an unadjusted basis, it was a net loss of $381 million or $0.09 per share in the first quarter, compared to a loss of $2.76 billion or $0.66 per share last year. The bottom line benefitted from a 9% increase in revenues to $12.72 billion. Revenues of Client Computing, the main operating segment, grew in double digits. Earnings topped expectations, marking the fifth beat in a row, while the top line missed.

Extending the downtrend experienced last week, shares of intel traded down 1% on Monday afternoon and stayed below its 12-average value of $38.10.